Hello, I’m Jose Morales!

From Jose’s Tax Service In New Haven.

I’m here to offer you Virtual & in-person tax Preparation in New Haven. At Jose’s Tax Service, we pride ourselves on providing exceptional service at competitive rates. You’ll experience the personalized care and attention that large tax chains simply can’t match.

Our services include comprehensive preparation of your federal and state tax returns, with Virtual & in-person tax Preparation in New Haven. as well as e-filing to expedite your refund process. Best of all, you can start with us today and pay $0 upfront for professional tax preparation. For a detailed estimate, please feel free to call, text, or email us at Jose’s Tax Service. Let us take the stress out of tax season for you!

MISSION STATEMENT

We strive to provide a quality Service at a reasonable price, accompanied by superior customer service and to deliver the highest levels of professionalism and experience. Our number one priority and commitment is a world class service to our clients.

Our Reviews

Definitely recommend Jose's tax service very professional highly educated in the field of financial services and accounting.

This is my second year working with Jose. He is a diligent, hard working, professional gentleman who knows his way around a spreadsheet and has a strong knowledge of the tax system. I live in PA and Jose handles my tax return from CT. He is very reasonably priced and takes care of just about everything for you. I was really lucky to find him and couldn’t be more pleased with the outcome.

Jose’s Tax Service saved me a ton of money and time when others either didn’t, couldn’t or wouldn’t. Jose got me filed on time even though I didn’t realize I needed him until very late in the game. Definitely going to him again next year.

didn't use your service.so can't give review. stop sending emails

Jose made it really easy and stress free to file me and my boyfriend’s taxes this year!! So glad we have him!!

Our Services

Tax Preparation & Filing

Tax Preparation & Filing

We provide accurate and hassle-free tax preparation for individuals and small businesses. From W-2s to self-employment income, we ensure every deduction and credit is applied to maximize your refund or minimize your liability. Federal and state e-filing included.

Tax Planning & Consultations

Tax Planning & Consultations

Take control of your financial future with proactive tax planning. We help you reduce your tax liability, strategize for upcoming life or business changes, and stay ahead of new tax laws. Schedule a personalized consultation to build a year-round tax strategy that works for you.

Bookkeeping & Business Support

Bookkeeping & Business Support

Stay organized and compliant with our professional bookkeeping services. We track income, expenses, and financial records, giving you clear insights to make smart business decisions. Plus, we offer ongoing support for tax compliance, invoicing, and payroll setup.

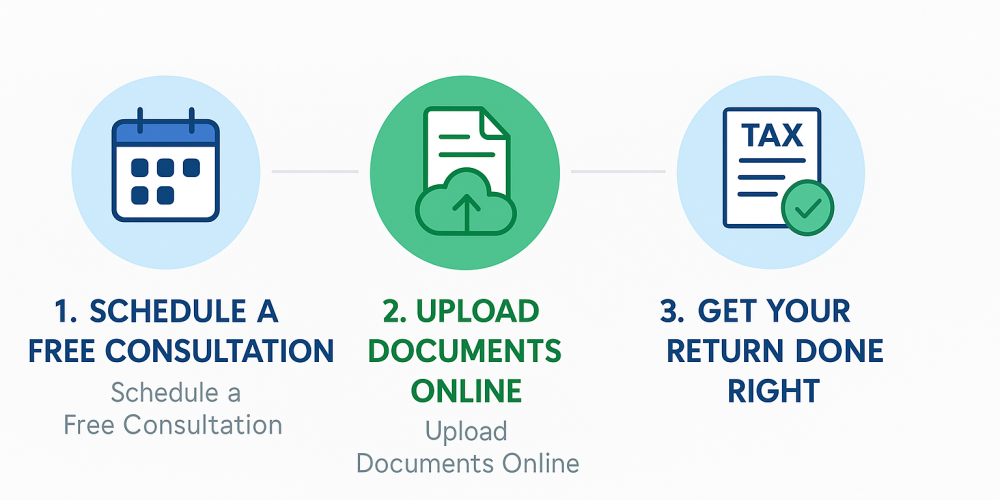

How It Works!