7 Self-Employed Tax Mistakes You're Making (And How to Fix Them Before Filing Season)

December 2025 brings more than holiday festivities: it signals the final weeks to address critical tax preparation issues before the 2026 filing season begins. Self-employed individuals face unique challenges that traditional employees never encounter, and making these seven common mistakes can cost you thousands in penalties, missed deductions, and unnecessary stress.

The Internal Revenue Service (IRS) processes over 160 million individual tax returns annually, with self-employed taxpayers representing a significant portion requiring additional scrutiny. Understanding these pitfalls now gives you time to implement corrective measures before April 15, 2026.

Mistake #1: Mixing Personal and Business Finances

The Problem: Using a single checking account for both personal groceries and client payments creates an accounting nightmare that undermines your credibility with the IRS.

Co-mingling funds represents the most prevalent error among self-employed taxpayers. When you deposit client checks into your personal account and pay business expenses with your personal credit card, you eliminate the clear financial boundaries the IRS expects to see during audits.

This practice complicates expense tracking, increases the likelihood of claiming personal expenses as business deductions, and makes legitimate business expenses harder to identify and substantiate.

The Fix: Open dedicated business banking accounts immediately.

Establish a business checking account and business credit card exclusively for commercial transactions. Transfer personal funds to business accounts only as documented owner draws or capital contributions. Maintain separate monthly statements and never use business accounts for personal purchases.

Document all transfers between accounts with clear notations indicating the purpose. This separation demonstrates to the IRS that you maintain organized financial boundaries and take your business operations seriously.

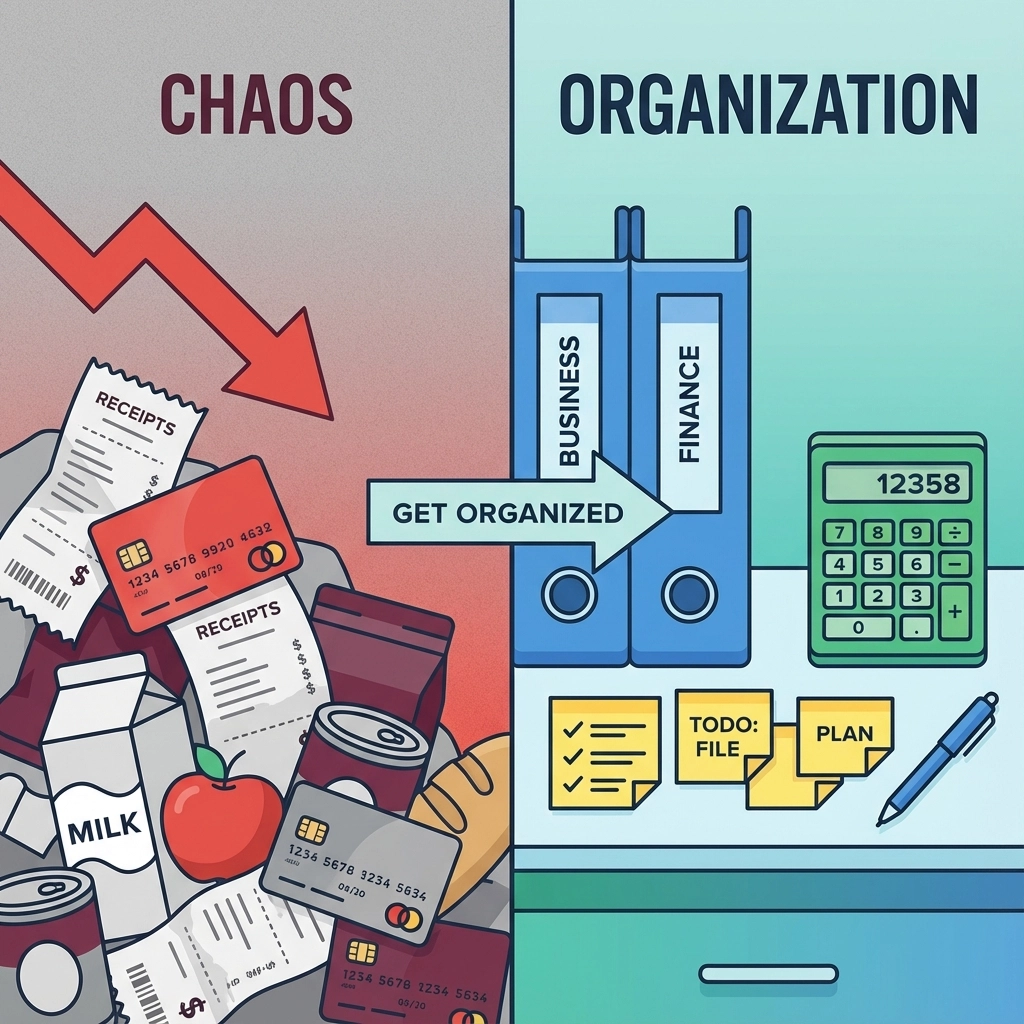

Mistake #2: Neglecting Year-Round Record Keeping

The Problem: Attempting to reconstruct twelve months of financial activity during tax season leads to missed deductions and reporting errors.

Many self-employed individuals collect receipts in shoe boxes or rely on memory to categorize expenses months after transactions occur. This approach virtually guarantees incomplete records and overlooked legitimate business deductions.

Poor record-keeping also increases audit risk, as the IRS views disorganized financial records as indicators of potential underreporting or overclaiming deductions.

The Fix: Implement systematic bookkeeping procedures throughout the tax year.

Use accounting software like QuickBooks Online or Wave to automatically categorize transactions as they occur. Connect your business bank accounts to sync transactions daily, eliminating manual data entry errors.

Photograph receipts immediately using mobile apps that integrate with your accounting system. Record the business purpose on each receipt before filing or scanning.

Reconcile your accounting records monthly against bank statements and credit card statements. Address discrepancies immediately rather than allowing them to compound over time.

Mistake #3: Misclassifying Workers as Independent Contractors

The Problem: Incorrectly treating employees as contractors triggers substantial penalties including unpaid payroll taxes, interest charges, and potential criminal liability.

The IRS uses strict criteria to distinguish between employees and independent contractors, focusing on behavioral control, financial control, and relationship characteristics. Misclassification can result in owing the employer portion of Social Security and Medicare taxes, plus penalties reaching 100% of the unpaid amounts.

State agencies often impose additional penalties and may require payment of unemployment insurance premiums and workers’ compensation coverage retroactively.

The Fix: Apply the IRS three-factor test to evaluate worker relationships correctly.

Behavioral Control: Determine whether you control how, when, and where the worker performs tasks. Employees typically work set schedules using company equipment and following detailed instructions.

Financial Control: Evaluate who provides tools, covers expenses, and determines payment methods. Contractors usually invoice for services, provide their own equipment, and may work for multiple clients simultaneously.

Relationship Type: Consider whether written contracts exist, whether you provide benefits, and the expected duration of the working relationship.

When classification remains unclear, file Form SS-8 with the IRS requesting an official determination before the relationship begins.

Mistake #4: Skipping Quarterly Estimated Tax Payments

The Problem: Failing to make quarterly payments results in underpayment penalties even if you pay the full amount owed by the filing deadline.

Self-employed individuals must pay taxes throughout the year rather than waiting until April 15. The IRS requires quarterly payments when you expect to owe $1,000 or more in taxes for the current year.

Underpayment penalties accrue from the due dates of missed quarterly payments, not from the annual filing deadline. These penalties compound quarterly and cannot be avoided by paying the full amount with your tax return.

The Fix: Calculate and submit quarterly payments using Form 1040-ES by these deadlines:

- First Quarter: April 15, 2025 (for January-March income)

- Second Quarter: June 16, 2025 (for April-May income)

- Third Quarter: September 16, 2025 (for June-August income)

- Fourth Quarter: January 15, 2026 (for September-December income)

Set aside 25-30% of net self-employment income each month in a separate tax savings account. Use the previous year’s tax liability as a safe harbor: pay 100% of last year’s total tax (110% if your prior year adjusted gross income exceeded $150,000) to avoid penalties regardless of current year income fluctuations.

Make payments electronically through the Electronic Federal Tax Payment System (EFTPS) or by phone to ensure timely processing and obtain confirmation numbers.

Mistake #5: Inaccurate Income Reporting

The Problem: Underreporting income triggers automatic IRS matching programs that generate correspondence and potential audit selections.

The IRS receives copies of all 1099-NEC and 1099-MISC forms issued to you and matches this information against your tax return using automated systems. Discrepancies generate computer-selected examinations that require you to explain and document the differences.

Overreporting income unnecessarily increases your tax liability and reduces available cash flow for business operations and personal needs.

The Fix: Reconcile all income sources against 1099 forms and bank deposits systematically.

Request 1099 forms from clients who paid you $600 or more during the tax year if you haven’t received them by January 31. Follow up with non-responsive clients to ensure complete reporting.

Compare total reported income against business bank account deposits, accounting for non-taxable deposits like loan proceeds or capital contributions. Investigate and document any discrepancies before filing your return.

Use accounting software that automatically tracks income by client or project to ensure complete capture of all revenue sources throughout the year.

Mistake #6: Claiming Non-Deductible Personal Expenses

The Problem: Deducting personal expenses as business costs inflates deductions illegally and increases audit risk substantially.

Common errors include claiming personal clothing purchases, family vacation expenses, and regular commuting costs between home and your primary place of business. These personal expenses never qualify as legitimate business deductions regardless of how you structure the claims.

The IRS applies the “ordinary and necessary” test to all business deductions, requiring expenses to be both common in your industry and helpful for your specific business operations.

The Fix: Apply strict criteria to every claimed business expense and maintain detailed documentation.

Ordinary Test: Determine whether similar businesses in your industry commonly incur this type of expense. Personal grooming, regular commuting, and family entertainment fail this test.

Necessary Test: Evaluate whether the expense directly supports your business operations or income generation. The expense need not be essential, but it must be helpful and appropriate.

Document the business purpose for every expense immediately when incurred. Write the business reason, date, participants, and business benefit directly on receipts or in your expense tracking system.

Maintain separate personal and business expense categories in your accounting system to prevent accidental misclassification during tax preparation.

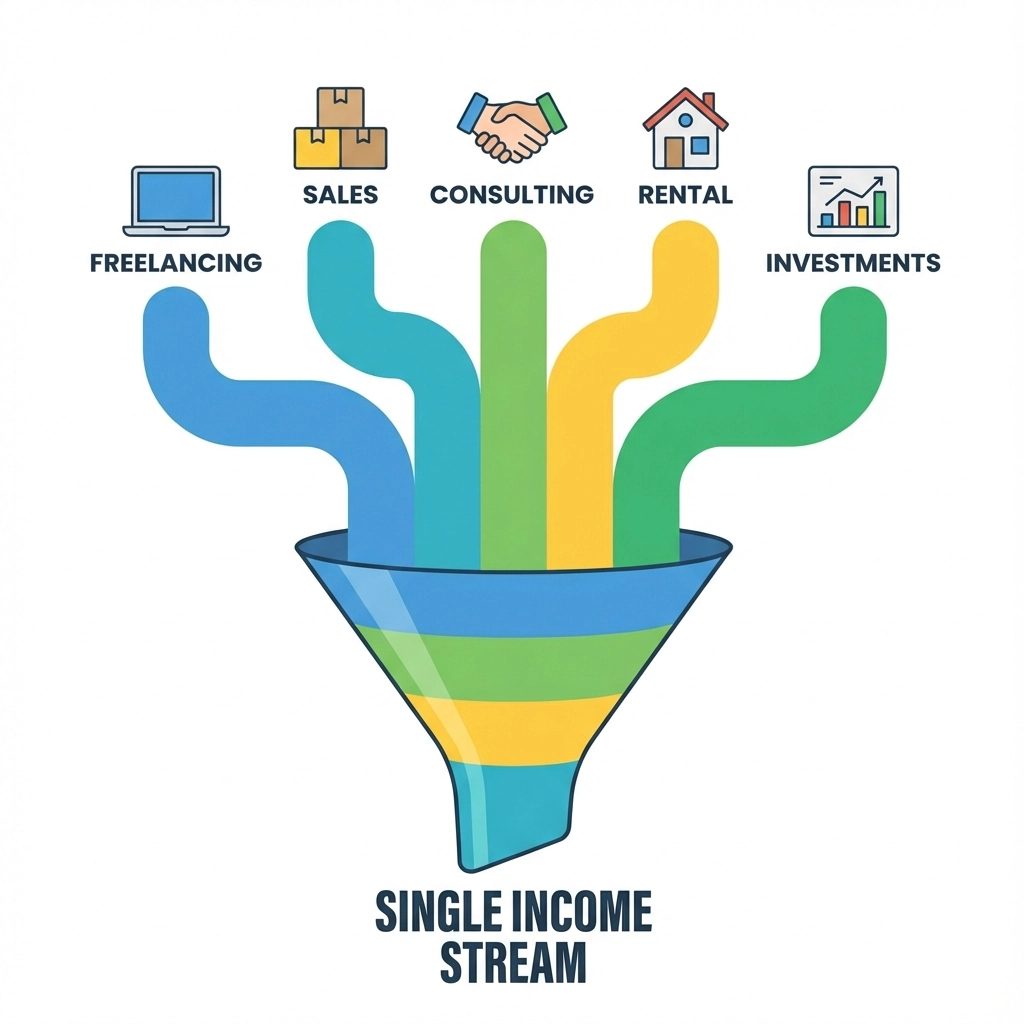

Mistake #7: Losing Track of Multiple Income Sources

The Problem: Self-employed individuals often receive payments from various clients, projects, and income streams, making complete income reporting challenging without systematic tracking.

Freelancers, consultants, and small business owners may have dozens of different payment sources throughout the year, including client payments, affiliate commissions, product sales, and service fees. Failing to track all sources leads to underreporting and potential IRS inquiries.

Side businesses and occasional consulting work still require quarterly estimated tax payments and complete reporting, even when the amounts seem small or the activities are infrequent.

The Fix: Establish comprehensive income tracking systems that capture every payment source throughout the tax year.

Create separate income categories in your accounting software for each type of revenue stream: consulting fees, product sales, affiliate commissions, and rental income. This categorization helps identify trends and ensures complete reporting.

Reconcile monthly income totals against bank deposits and 1099 forms to identify any missing income sources. Set up automatic alerts for unusual deposit patterns that might indicate forgotten income streams.

Review prior year tax returns to identify recurring income sources and create checklists to ensure current year completeness. Include seasonal income that may occur only during specific months.

Taking Immediate Action Before Filing Season

Address these seven mistakes now while you still have time to implement corrective procedures. December 2025 provides the final opportunity to establish proper systems, gather missing documentation, and calculate accurate quarterly payments for the January 15 deadline.

Review your current practices against each mistake category and prioritize corrections based on your specific situation. Consider engaging a qualified tax professional to evaluate your setup and identify additional opportunities for improvement.

The investment in proper tax preparation procedures pays dividends through reduced penalties, maximized deductions, and decreased audit risk. Self-employed taxpayers who maintain organized records and follow IRS guidelines experience significantly fewer problems during filing season and throughout the year.

Start implementing these corrections immediately: your future self will appreciate the reduced stress and improved financial outcomes when April 15, 2026 arrives.

Tags: Business taxes, Joses Tax service, New Haven Tax Preparation, New Haven tax preparer, Refund, Self-employed, Tax advisor, Tax Audit, Tax help, Tax planning, Year-End Tax Planning

Leave a Reply

You must be logged in to post a comment.