Why Your 2026 Refund Could Be Bigger (or Smaller) Than Expected: The Standard Deduction Changes Explained in 3 Minutes

NEW HAVEN, CT : February 22, 2026 : The 2026 standard deduction increased substantially from last year, and this change will directly impact your tax refund: whether you realize it or not. Many New Haven taxpayers are about to discover their refunds look different than expected, and it all comes down to these deduction adjustments.

The standard deduction serves as a flat amount the IRS allows you to subtract from your income before calculating what you owe. Higher deduction means lower taxable income. Lower taxable income typically means lower tax liability. But the relationship between deductions and refunds is more complex than it appears.

What Changed for 2026: The Numbers You Need to Know

The IRS adjusted the standard deduction amounts for tax year 2026, reflecting both inflation and legislative changes from the "One Big Beautiful Bill" that passed earlier this year.

Standard Deduction Amounts for 2026:

- Single filers and married filing separately: $16,100 (increased from $15,750)

- Married filing jointly: $32,200 (increased from $31,500)

- Head of household: $24,150 (increased from $23,625)

These increases represent approximately a 2.2% adjustment across filing statuses. For a single filer, that's an additional $350 reduction in taxable income. For married couples filing jointly, it's an extra $700.

Additional deductions for those 65 and older:

- Single or head of household: Additional $2,050

- Married (per qualifying spouse): Additional $1,650 each

The compounding effect means a married couple where both spouses are 65 or older can claim a total standard deduction of $35,500 in 2026.

Why Your Refund Could Be BIGGER Than Expected

A larger refund occurs when your employer withheld taxes based on outdated calculations, but your actual tax liability decreased. Three scenarios can trigger this outcome for New Haven taxpayers:

Scenario 1: Withholding Based on 2025 Rates

Your employer's payroll system likely calculated your withholding using the 2025 standard deduction amounts throughout most of 2025 and early 2026. If you didn't update your W-4, taxes were withheld assuming you'd claim $15,750 (single) or $31,500 (married filing jointly). But when you file your 2026 return, you'll claim the higher amounts: $16,100 or $32,200: resulting in lower actual tax owed and a larger refund.

Scenario 2: New Deductions You Didn't Anticipate

Several new or expanded deductions became available for 2026:

- Tip income deduction: If you work in New Haven's restaurant or hospitality industry, qualifying tip income may now be deductible

- Overtime pay deduction: Certain overtime compensation can be excluded from taxable income under new provisions

- Charitable donation deduction for non-itemizers: Up to $1,000 in charitable contributions can be deducted even if you take the standard deduction instead of itemizing

- Senior taxpayer deduction: An additional $6,000 deduction for taxpayers age 65 and older (available through 2028)

If you qualify for any of these and your withholding didn't account for them, expect a larger refund.

Scenario 3: You Previously Itemized, Now You Don't

The higher standard deduction may push some taxpayers who previously itemized back to claiming the standard deduction. If your state and local tax (SALT) deductions, mortgage interest, and charitable contributions total less than the new standard deduction threshold, you'll claim the standard deduction instead. This could lower your tax liability if your withholding assumed you'd itemize again.

Why Your Refund Could Be SMALLER Than Expected

Smaller refunds don't necessarily mean you paid more in taxes. Often, it means your withholding more accurately matched your actual tax liability. Here's when this occurs:

Your Employer Adjusted Withholding Mid-Year

Some payroll systems automatically updated withholding tables when the new standard deduction amounts were announced. If your employer implemented these adjustments, you've been taking home slightly more in each paycheck throughout the year: meaning less was withheld for taxes. Your annual tax liability decreased, but so did your withholding, resulting in a smaller refund at filing time.

You Updated Your W-4

If you submitted a new W-4 form in 2025 or early 2026 to account for the increased standard deduction, your withholding decreased accordingly. You essentially gave yourself a "raise" throughout the year instead of waiting for a lump sum refund.

You Switched From Itemizing to Standard Deduction

While the higher standard deduction reduces your taxable income, the mechanics of withholding don't always align perfectly. If you were itemizing in previous years and claiming additional withholding allowances based on those deductions, switching to the standard deduction: even though it's higher: can sometimes result in different refund amounts depending on your specific situation.

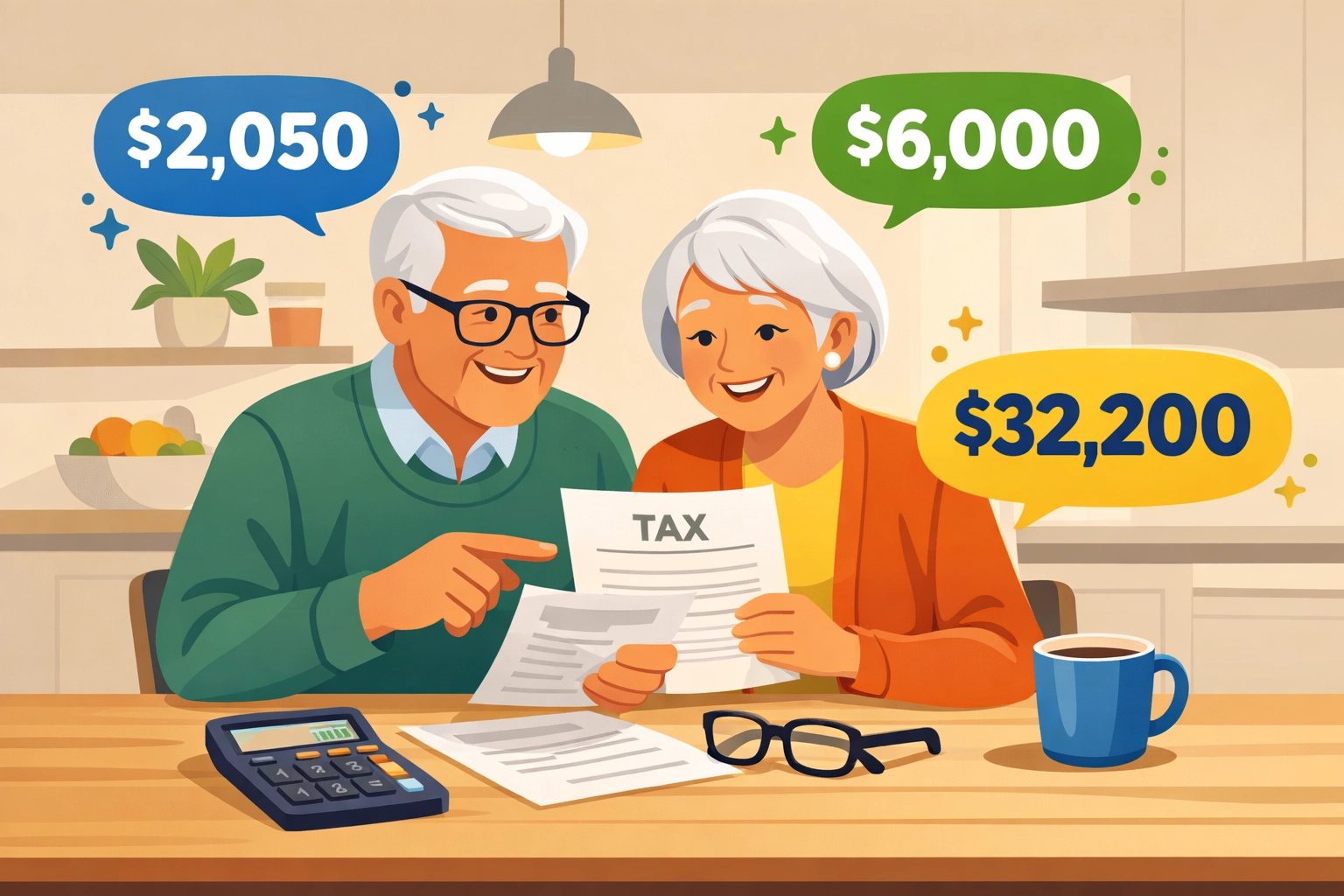

Special Considerations for New Haven Seniors!

If you're 65 or older and live in New Haven, pay close attention to these provisions:

Standard Additional Amount

You can claim an additional $2,050 if you're single or head of household, or $1,650 per qualifying spouse if married. This applies on top of the regular standard deduction.

New $6,000 Senior Deduction (2026-2028)

The "One Big Beautiful Bill" includes a temporary additional deduction of $6,000 for taxpayers age 65 and older. This deduction is available for tax years 2026, 2027, and 2028.

Combined Impact Example:

A married couple, both age 68, living in New Haven can claim:

- Base standard deduction: $32,200

- Additional amounts for age 65+: $3,300 ($1,650 × 2)

- New senior deduction: $12,000 ($6,000 × 2)

- Total: $47,500

If their combined income is $50,000, their taxable income drops to just $2,500 before any other deductions or credits apply.

What You Need to Do NOW

Review your final 2025 paychecks immediately. Check how much federal tax was withheld. Compare this to your expected 2026 tax liability using the new standard deduction amounts.

Update your W-4 if necessary. If you want to adjust your withholding for the remainder of 2026, submit a new W-4 to your employer. This can help you avoid overpaying throughout the year.

Gather documentation for new deductions. If you qualify for the tip income deduction, overtime deduction, or charitable donation deduction for non-itemizers, collect all necessary documentation now.

Calculate your estimated refund or amount owed. Use the IRS Tax Withholding Estimator or consult with a tax professional to understand your specific situation.

File accurately and on time. The April 15, 2026 deadline applies regardless of whether you expect a refund or owe taxes.

Don't Navigate These Changes Alone

The standard deduction changes for 2026 create both opportunities and complications. One mistake in calculating your deduction or misunderstanding which category you fall into can cost you hundreds: or even thousands: of dollars.

At Jose's Tax Service, we specialize in helping New Haven taxpayers maximize their refunds while staying fully compliant with current tax law. Our team stays updated on every deduction, credit, and rule change that affects Connecticut residents.

We offer personalized service at competitive rates, and we'll sit down with you to review your specific situation: including income sources, family status, age-related deductions, and any new provisions you might qualify for.

Schedule your appointment today. Visit josestaxservice.com or call us directly. Don't leave money on the table because you didn't understand how the 2026 standard deduction changes apply to your return.

The difference between a smaller and larger refund often comes down to knowledge and preparation. Get both at Jose's Tax Service.

Categories: News, Tax Planning

Leave a Reply

You must be logged in to post a comment.