Why Year-Round Tax Planning Will Change the Way You Handle Business Finances

category: News

Most business owners approach tax planning the same way they handle emergencies: waiting until the last possible moment, then scrambling to piece together a year's worth of financial decisions in a matter of weeks. This reactive approach costs businesses thousands of dollars annually and creates unnecessary stress that disrupts operations during critical growth periods.

Year-round tax planning fundamentally transforms how you manage business finances by shifting from crisis management to strategic financial stewardship. Instead of treating taxes as an annual burden, continuous tax planning integrates seamlessly into your ongoing business operations, enabling informed decision-making and optimizing your financial position throughout the entire year.

Transform Your Financial Decision-Making Process!

The most significant change year-round tax planning brings is immediate clarity during critical business decisions. When you maintain visibility into your tax situation continuously, major choices like equipment purchases, facility expansions, or hiring decisions become informed by their actual tax implications rather than guesswork.

Consider this scenario: You need new manufacturing equipment costing $50,000. Without ongoing tax planning, you make this purchase based solely on operational needs. With year-round planning, you evaluate whether timing this purchase in the current year qualifies for Section 179 deductions or if deferring it to the next tax year provides better overall tax advantages.

This strategic approach prevents costly mistakes that occur when businesses discover tax consequences after committing resources. You can evaluate each significant decision based on:

- Current year tax bracket projections

- Available deduction opportunities

- Cash flow impact timing

- Multi-year tax strategy alignment

File your equipment purchase decisions through your ongoing tax analysis rather than making isolated choices. Enter each major expenditure into your year-round planning framework to determine optimal timing and structure.

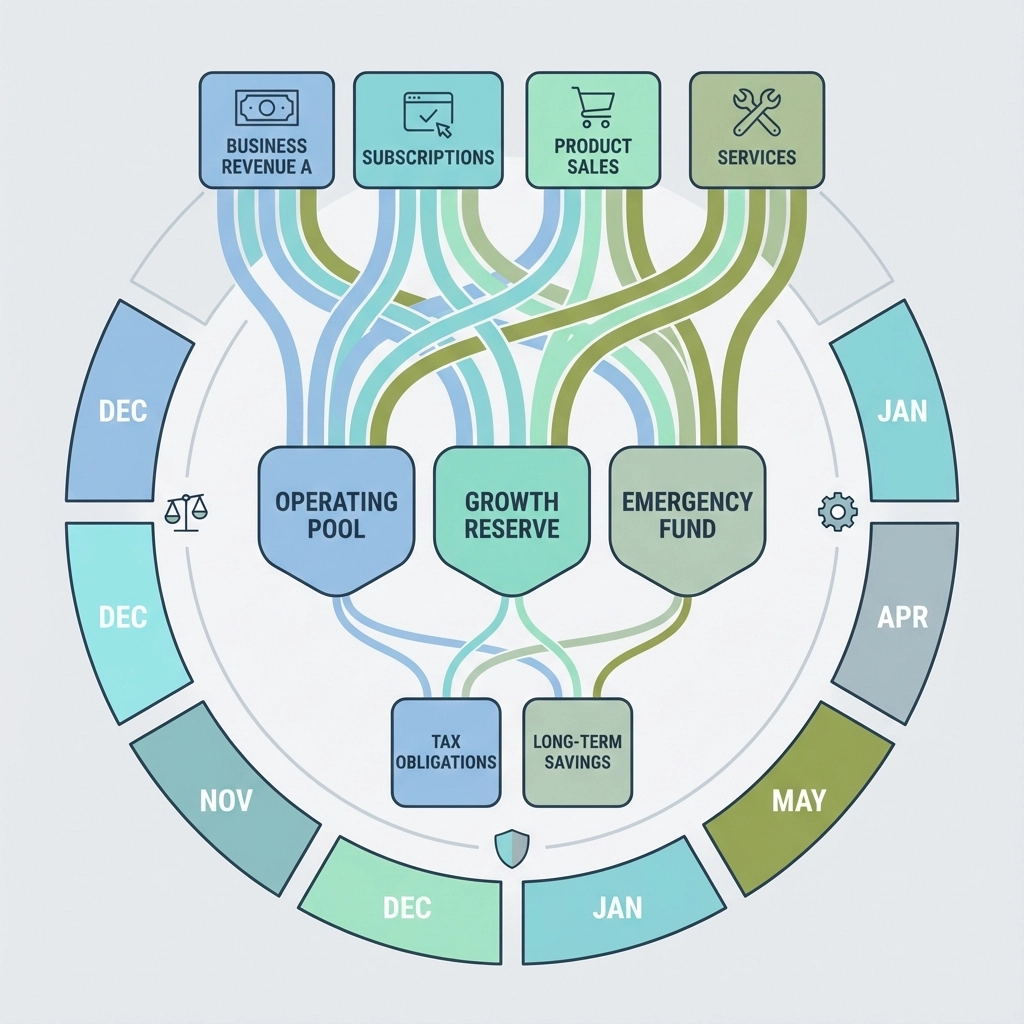

Revolutionize Cash Flow Management Through Strategic Planning!

Traditional last-minute tax planning creates financial chaos through sudden, large tax bills that disrupt business operations. Year-round planning eliminates this volatility by allowing you to forecast tax obligations and establish consistent reserve funds throughout the year.

Use these specific cash flow management strategies:

Quarterly Tax Estimation Process:

- Calculate estimated tax payments based on current year projections

- Adjust withholdings monthly as revenue patterns emerge

- Set aside 25-30% of net profits for tax obligations

- Review cash flow impact of tax payments quarterly

Monthly Reserve Funding:

- Establish dedicated tax savings accounts

- Transfer fixed percentages of monthly revenue to tax reserves

- Track actual versus projected tax obligations

- Adjust reserve contributions based on quarterly reviews

This systematic approach prevents the financial strain of unexpected tax payments and removes the need to scramble for emergency loans or deplete operational reserves when tax bills arrive. Instead of providing the government an interest-free loan through excessive withholding or facing dangerous cash shortfalls, you achieve balanced cash flow that supports growth initiatives and maintains operational stability.

Capture Maximum Tax Savings Through Continuous Monitoring!

Businesses operating on reactive schedules inevitably miss valuable deductions and credits that could significantly reduce their tax burden. Year-round tax planning ensures you maintain accurate expense records continuously and identify opportunities before critical deadlines pass.

Essential Year-Round Documentation Practices:

- Track business expenses in real-time using cloud-based accounting systems

- Photograph and digitize receipts immediately upon purchase

- Categorize expenses monthly rather than annually

- Review deduction opportunities quarterly with tax professionals

Critical Tax-Saving Opportunities to Monitor:

- Retirement plan contribution deadlines (varies by plan type)

- Healthcare benefit implementations (ACA compliance requirements)

- Business equipment purchases (Section 179 and bonus depreciation limits)

- Research and development credit documentation (Form 6765 requirements)

- Work Opportunity Tax Credit eligibility (Form 5884 filings)

Double-check deduction eligibility monthly rather than discovering missed opportunities during year-end reviews. Enter expense categories into your tracking system immediately to ensure proper classification and documentation.

Maintain Compliance and Strategic Adaptability!

Tax regulations evolve continuously, but year-round engagement with tax planning keeps your business informed about changes as they occur rather than facing compliance surprises during filing season. Working regularly with accounting professionals allows you to adjust strategies proactively, avoiding penalties while maximizing new tax advantages.

Quarterly Compliance Review Process:

- Review current tax law changes with qualified professionals

- Assess impact of new regulations on existing business structures

- Update documentation requirements for new compliance standards

- Modify business practices to align with regulatory changes

Strategic Adaptation Framework:

- Monitor proposed tax legislation that may affect future planning

- Evaluate business structure optimization opportunities

- Review state and local tax obligation changes

- Assess multi-state compliance requirements for expanding businesses

Use official IRS publications and qualified tax professionals to stay current with regulatory changes. File necessary forms and documentation updates promptly to avoid penalties that can reach thousands of dollars annually.

Eliminate Operational and Emotional Burden!

The most tangible change year-round tax planning provides is complete elimination of tax season stress and operational disruption. By distributing tax-related work across twelve months instead of concentrating it during a few frantic weeks, business owners avoid the pressure that leads to costly errors and decision-making paralysis.

Monthly Task Distribution Strategy:

- January: Review prior year results and establish current year projections

- February-March: Implement tax-saving strategies identified during annual review

- April-June: Complete quarterly filings and adjust mid-year projections

- July-September: Evaluate tax implications of major business decisions

- October-December: Execute year-end tax strategies and prepare documentation

Stress Reduction Benefits:

- Organized documentation ready for professional review

- Informed decision-making throughout the year

- Predictable cash flow without tax-related surprises

- Professional relationships maintained through regular communication

Everything remains organized and accessible when deadlines arrive, allowing you to focus on growing your business rather than managing tax crises that drain resources and attention from core operations.

Implementation Timeline for Maximum Results!

Begin your transition to year-round tax planning immediately, regardless of your current fiscal year position. Start with these foundational steps:

Week 1-2: Establish Systems

- Set up dedicated business accounting software

- Create digital filing systems for expense documentation

- Schedule monthly reviews with qualified tax professionals

Month 1: Baseline Assessment

- Review current year tax position with professional guidance

- Identify immediate tax-saving opportunities

- Establish quarterly estimated payment schedules

Months 2-3: Process Integration

- Implement monthly expense tracking and categorization

- Begin quarterly business decision tax impact analysis

- Establish cash flow forecasting including tax obligations

The transition to year-round tax planning represents moving from reactive survival mode to strategic financial stewardship: a transformation that enhances profitability, reduces operational stress, and enables confident business decision-making throughout the entire year.

File your commitment to year-round tax planning by scheduling your initial consultation with qualified tax professionals. Enter this strategic approach into your business operations to achieve the financial clarity and tax optimization your business deserves.

Tags: Business taxes, Joses Tax service, New Haven Tax Preparation, New Haven tax preparer, Refund, Self-employed, Tax advisor, Tax Audit, Tax help, Tax planning, Year-End Tax Planning

Leave a Reply

You must be logged in to post a comment.