The Smart Vault Advantage: Simplified Document Storage for Your 2025 Tax Season

Stop Losing Tax Documents in Email Chains and File Cabinets!

The 2025 tax season brings new compliance requirements and increased documentation demands. Traditional document storage methods: email attachments, physical file folders, and local computer drives: create security risks, accessibility issues, and workflow delays that can cost you time and money.

SmartVault cloud document storage eliminates these problems by centralizing your tax documents in a secure, accessible platform that integrates directly with professional tax preparation workflows. At Jose's Tax Service, we use SmartVault to streamline client document collection, ensure data security, and accelerate tax preparation timelines.

What Is SmartVault and How Does It Work?

SmartVault operates as a comprehensive cloud-based document management system designed specifically for tax professionals and their clients. The platform automates document collection workflows, maintains SOC 2 Type 2 compliance standards, and integrates with leading tax software platforms including Lacerte, ProConnect, ProSeries, UltraTax CS, and Drake.

The system functions through three primary components: automated client intake, secure document storage, and seamless software integration. Clients upload documents through mobile-friendly scanning tools that convert smartphone photos into high-quality PDFs. The platform then routes these documents automatically into appropriate folders based on document type and client information.

Security Features That Protect Your Sensitive Financial Data!

SmartVault maintains enterprise-level security protocols that exceed standard cloud storage solutions. The platform implements SOC 2 Type 2 compliance and aligns with IRS Publication 4557 requirements and FTC Safeguards Rule standards for financial data protection.

Key security measures include:

• End-to-end encryption for all document transfers and storage

• Identity verification through Knowledge-Based Authentication (KBA) for document access

• Role-based access controls that limit document visibility to authorized users

• Audit logs that track all document access, modifications, and sharing activities

• Secure client portals that eliminate email attachment risks

The platform maintains 100% uptime during tax season and provides 24/7 remote access without compromising security protocols. This ensures your tax documents remain accessible when needed while protecting against data breaches and unauthorized access.

Streamlined Document Collection Eliminates Client Follow-Up!

Traditional tax preparation requires extensive client communication to collect missing documents. SmartVault automates this process through structured digital intake forms and automated tracking systems that monitor document completion status.

The platform generates custom document request lists based on client tax situations and prior year returns. Clients receive automated reminders for missing documents, and tax preparers can track collection progress in real-time without manual follow-up calls or emails.

Document collection features include:

• Mobile scanning capabilities that convert photos to professional-quality PDFs

• Automated document categorization based on tax form requirements

• Progress tracking dashboards for both clients and tax preparers

• Digital signature collection for Form 8879 and other required authorizations

• Version control that maintains document history and prevents overwrites

Integration With Professional Tax Software Accelerates Preparation!

SmartVault connects directly with major tax software platforms, eliminating manual file transfers and reducing preparation time. Documents route automatically into appropriate software folders and workpapers, maintaining organization throughout the preparation process.

The integration supports automated workpaper filing, team collaboration tools, and approval workflows that scale operations during peak tax season without requiring additional staff. Tax preparers can access all client documents from within their existing software environment.

Software integration benefits:

• Direct document routing to tax software workpapers

• Automated file organization by tax form and schedule requirements

• Collaborative preparation tools for multi-preparer assignments

• Real-time document updates that sync across all platforms

• Backup and recovery systems that prevent data loss

How Jose's Tax Service Uses SmartVault for Client Success!

At Jose's Tax Service, we implement SmartVault to enhance our tax preparation efficiency and client communication. The platform allows us to provide secure document collection, faster turnaround times, and improved accuracy in tax return preparation.

Our clients benefit from simplified document submission through mobile apps, secure access to completed returns, and organized document retention for future reference. The system maintains all historical tax documents in searchable, audit-ready formats that support multi-year comparisons and amendment processes.

Our SmartVault implementation includes:

• Custom client portals branded with Jose's Tax Service information

• Automated document request workflows based on individual tax situations

• Secure return delivery with digital signature capabilities

• Year-round document storage for ongoing financial planning support

• Multi-language support to serve our diverse New Haven client base

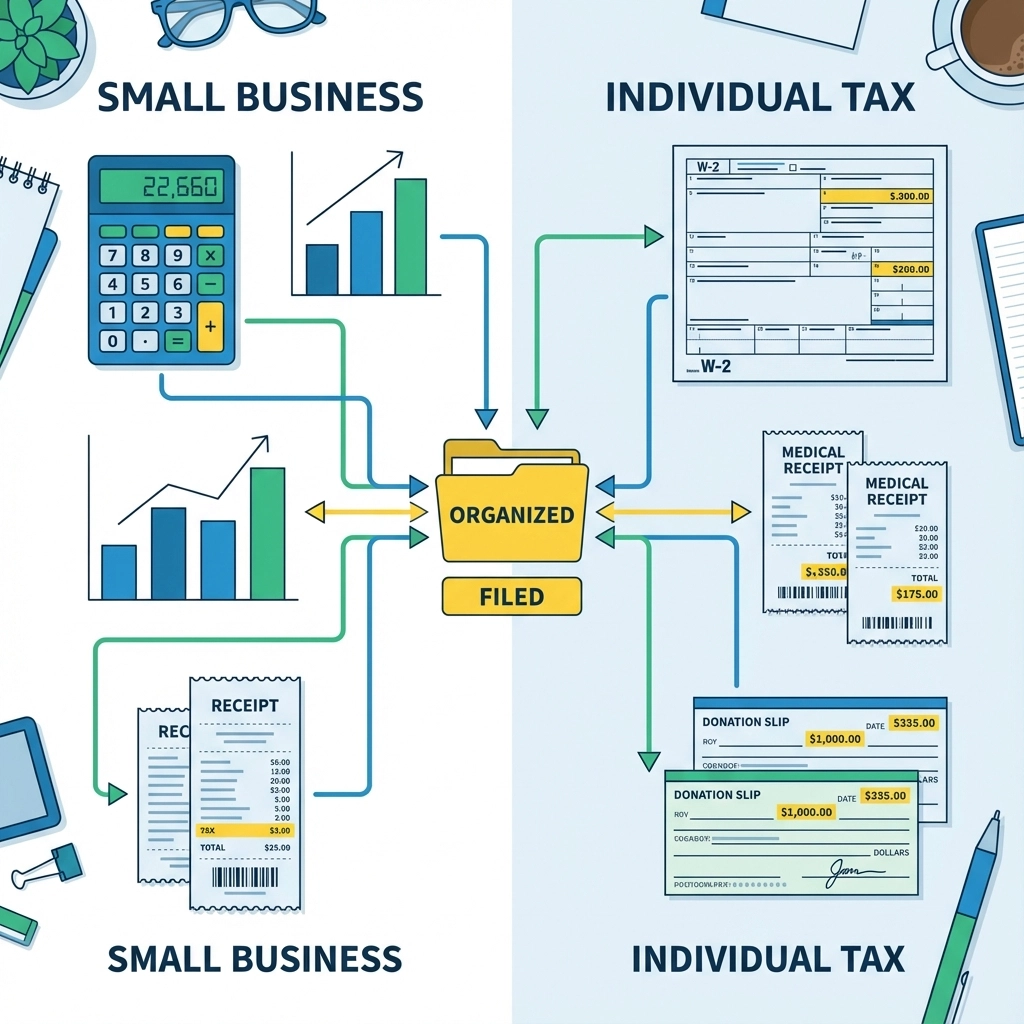

Benefits for Small Business Owners and Individual Taxpayers!

Small business owners face complex documentation requirements including income statements, expense receipts, payroll records, and asset purchase documentation. SmartVault organizes these documents automatically and maintains them in formats that support both tax preparation and business planning activities.

Individual taxpayers benefit from simplified document submission and organized storage of tax-related materials. The platform accommodates various document types including W-2 forms, 1099 statements, charitable donation receipts, and medical expense documentation.

Specific benefits for small businesses:

• Automated expense categorization for business deduction optimization

• Quarterly document organization for estimated tax payment support

• Asset tracking capabilities for depreciation and disposal calculations

• Payroll document management for employment tax compliance

• Financial statement preparation support for loan and credit applications

Individual taxpayer advantages:

• Receipt organization for itemized deduction tracking

• Investment document management for capital gains calculations

• Healthcare expense tracking for medical deduction optimization

• Education document storage for credit and deduction claims

• Charitable contribution organization for accurate reporting

Implementation and Getting Started With SmartVault!

Setting up SmartVault for your 2025 tax preparation begins with account creation and initial document upload. The platform guides users through setup procedures and provides tutorial resources for optimal system utilization.

Jose's Tax Service provides SmartVault access to all tax preparation clients at no additional charge. We configure your account settings, establish document categories relevant to your tax situation, and provide training on mobile scanning and document submission procedures.

Getting started steps:

- Contact Jose's Tax Service to activate your SmartVault account access

- Download the mobile application for document scanning capabilities

- Complete the initial setup by uploading current year tax documents

- Establish document categories based on your individual or business tax needs

- Begin regular document uploads throughout the tax year for organized preparation

The platform supports both current year tax preparation and long-term document retention strategies. Users can maintain historical tax records, organize supporting documentation, and prepare for future tax planning activities through year-round system access.

SmartVault represents a significant advancement in tax preparation technology that benefits both tax professionals and their clients. The combination of security, accessibility, and integration capabilities creates a comprehensive solution for modern tax document management challenges.

For more information about SmartVault implementation at Jose's Tax Service, contact our office to discuss your specific document management needs and schedule your 2025 tax preparation consultation.

Tags: Business taxes, Joses Tax service, New Haven Tax Preparation, New Haven tax preparer, Refund, Self-employed, Smart vault, Tax advisor, Tax Audit, Tax help, Tax planning, Year-End Tax Planning

Leave a Reply

You must be logged in to post a comment.