Tax Preparation New Haven: 7 Ways Your Concierge Tax Pro Saves You Money (That H&R Block Won’t Tell You)

New Haven, CT : February 16, 2026 : The difference between a rushed tax appointment at a national chain and a concierge tax preparation experience isn't just about customer service. It's about money: your money: and how much of it you get to keep.

Big-box tax preparers operate on volume. Get you in, get you out, collect the fee. But when you're working with a concierge tax pro who knows New Haven businesses, Connecticut tax law, and actually has time to review your financial situation? That's when the real tax planning begins.

Here are seven ways a concierge tax preparer saves you money that the major chains won't mention during your 45-minute appointment.

1. They Actually Review Your Prior Returns (And Find Money You Left Behind!)

National chains treat each tax season like a fresh start. Last year's return? Ancient history. But a concierge tax pro in New Haven reviews your previous filings to identify patterns, missed opportunities, and carryover deductions you may have forgotten.

Did you claim that home office deduction last year but skip the depreciation? A concierge preparer catches that. Charitable contributions from 2024 that exceeded the limit and can carry forward to 2025? They're already calculating it before you sit down.

The Big-Box Difference: H&R Block preparers change locations and staff constantly. Your 2025 preparer probably hasn't seen your 2024 return and won't ask about it unless you volunteer the information.

2. Year-Round Tax Planning (Not Just April Panic Mode)

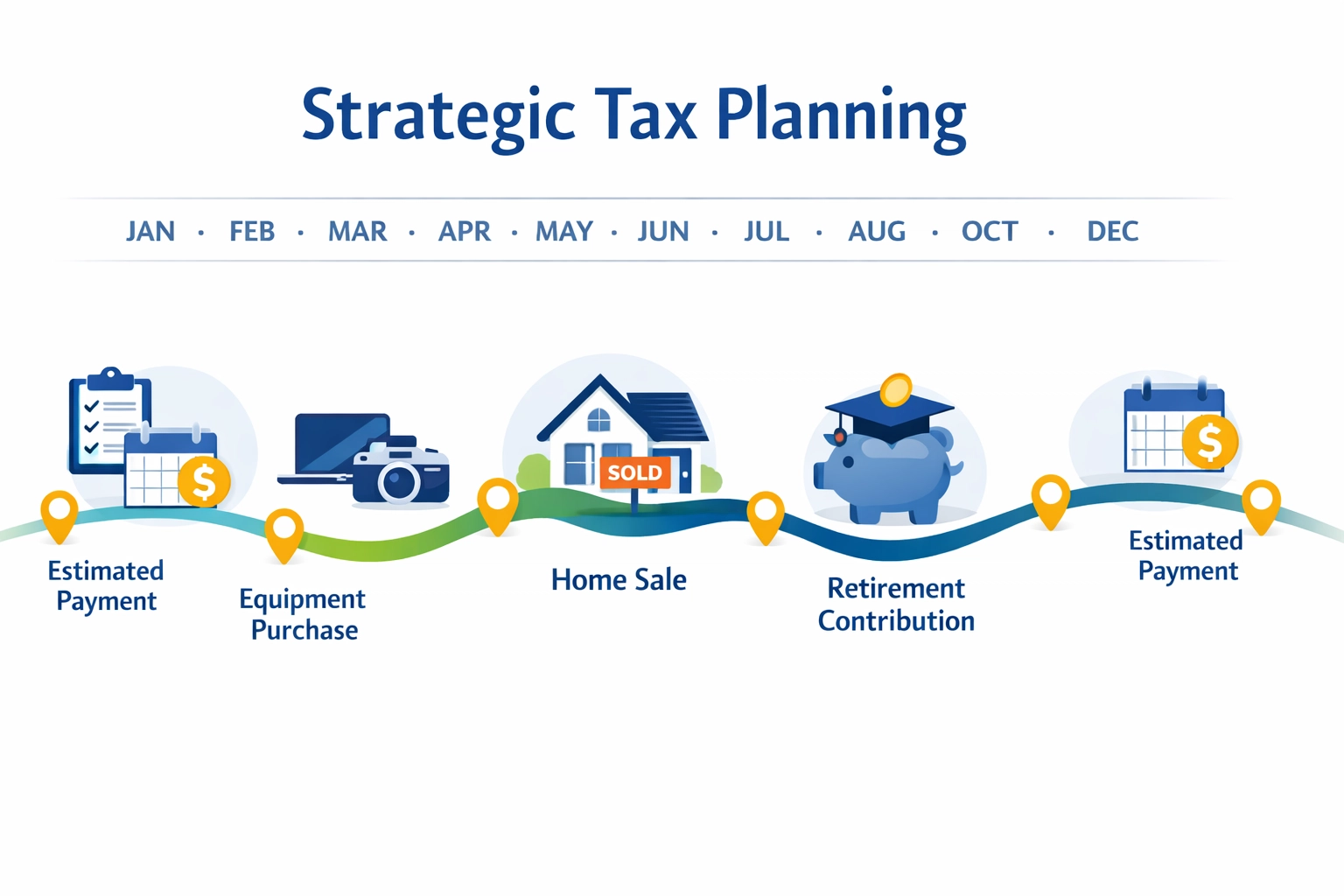

Here's the secret sauce: tax preparation new haven clients who work with concierge pros don't just file once a year. They receive ongoing guidance about quarterly estimated payments, business purchases, retirement contributions, and timing of income.

Sold a rental property in July? Your concierge tax pro calculates the estimated tax immediately and helps you avoid underpayment penalties. Considering a Roth conversion before December 31? They run the numbers in October, not April.

What This Saves You: Penalties, interest charges, and missed opportunities. The IRS charges interest on underpayments: money that disappears into federal coffers instead of your savings account.

3. They Know Connecticut's Tax Quirks (Because They Work Here Every Day)

Connecticut has its own personality when it comes to taxes. Pass-through entity tax elections. Municipal tax credits. Property tax credit calculations that vary by town. A concierge tax preparer in New Haven lives and breathes these rules because they serve Connecticut clients exclusively.

Example: New Haven homeowners may qualify for property tax relief programs that reduce their Connecticut tax liability. A national chain preparer working from a script? They're not asking about your local tax assessment or whether you applied for elderly or disabled relief.

4. Business Owners Get Real Advisory Services (Not Just Data Entry)

If you run a business in New Haven: whether it's a food truck on the Green, a consulting practice, or a retail shop on Chapel Street: your concierge tax pro becomes part of your financial team.

They help you structure business purchases to maximize tax refund potential. Should you buy that equipment in December or January? Lease or purchase? S-corp or LLC? These aren't questions a seasonal tax preparer at H&R Block has time to answer during peak season.

What You're Actually Paying For: Strategic advice that reduces your tax bill by thousands, not just form completion that costs hundreds.

5. Audit Support That Actually Shows Up

Both concierge tax services and big chains offer audit support. But here's the difference: when the IRS sends you a notice, a concierge tax pro picks up the phone on the first ring. They know your return intimately because they prepared it with care, not speed.

H&R Block's audit support often means you're passed to a call center representative who's reading your return for the first time while you're on hold.

Real Talk: Audit anxiety costs you sleep and productivity. Having a tax professional who knows your financial situation backward and forward? That's worth every penny.

6. Technology Integration Without the Corporate Upsell

National chains push proprietary software and charge premium prices for features you don't need. A concierge tax preparation service integrates with the tools you already use: QuickBooks, payment apps, invoicing software: without upselling you on unnecessary packages.

2026 Tax Update: With new 1099-K reporting thresholds, payment app transactions require careful reconciliation. A concierge tax pro helps you organize this data throughout the year, not just during tax season when it's too late to fix mistakes.

They'll show you how to categorize transactions in real-time so your business bookkeeping feeds directly into your tax preparation. That's tax planning, not just tax filing.

7. You're Not Subsidizing Their Super Bowl Commercials

Let's be honest about pricing. H&R Block spends millions on advertising. Someone pays for those commercials: and it's you, built into their fee structure.

Concierge tax pros invest in their expertise, continuing education, and client relationships instead of brand awareness campaigns. You're paying for skill and attention, not shareholder profits and marketing budgets.

Fee Transparency: A concierge tax service quotes fees based on your actual tax situation complexity, not tiered packages designed to upsell you from "basic" to "deluxe" to "premium."

Why New Haven Taxpayers Are Making the Switch

Tax preparation new haven residents are discovering what small business owners have known for years: personalized service costs less in the long run when you factor in the money saved through strategic planning, avoided penalties, and maximized deductions.

The 2026 tax season brings new complications: payment app reporting, continued remote work deductions, Connecticut tax law changes. A concierge tax pro stays current on these updates because it's their profession year-round, not seasonal work.

The Bottom Line

Big-box tax preparation works if your tax situation is genuinely simple: W-2 income, standard deduction, maybe a student loan interest deduction. But if you own property, run a business, have investment income, or want to maximize tax refund potential through strategic planning? A concierge tax preparer pays for themselves.

The question isn't whether you can afford concierge tax service. It's whether you can afford to keep leaving money on the table with rushed, impersonal tax preparation.

Ready to see the difference? Contact Jose's Tax Service to discuss how personalized tax planning can reduce your tax liability and increase your refund. Same-day appointments available for New Haven area taxpayers who are tired of feeling like a number in a corporate system.

Tax season doesn't have to mean settling for less. Your financial future deserves more than a 45-minute appointment and a handshake.

Leave a Reply

You must be logged in to post a comment.