Tax Consultation vs. DIY Filing: Which Is Better For Your 2026 New Haven Tax Return?

New Haven, Connecticut – January 8, 2026 – With significant tax law changes taking effect this year, New Haven taxpayers face a critical decision: handle their 2026 tax return independently or seek professional consultation. The choice between DIY filing and professional tax services can impact your refund, compliance status, and long-term financial strategy.

Understanding the 2026 Tax Landscape!

The 2026 tax year introduces substantial changes that directly affect New Haven residents and Connecticut taxpayers. The Qualified Business Income (QBI) deduction provisions have evolved, Connecticut's estate tax thresholds have adjusted, and new SALT (State and Local Tax) cap modifications create additional complexity for high-income earners in our region.

Key 2026 Changes Include:

- Modified QBI deduction calculations for pass-through entities

- Adjusted Connecticut estate tax exemption amounts

- Updated SALT cap provisions affecting property tax deductions

- New business expense categorization requirements

- Enhanced retirement account contribution limits

These changes require careful evaluation of your tax situation to determine the most beneficial filing approach.

When DIY Filing Makes Financial Sense!

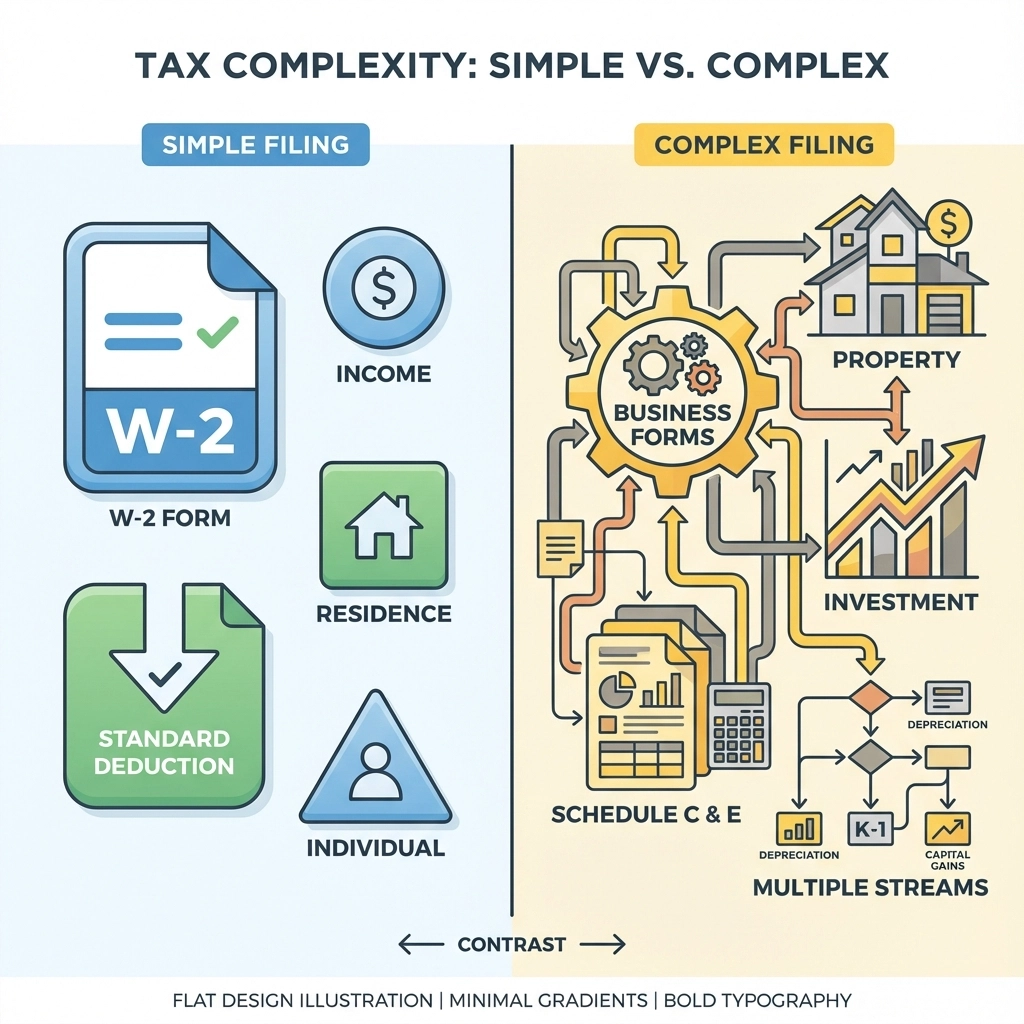

Simple Tax Situations Favor Self-Filing

DIY filing proves most effective for taxpayers with straightforward financial circumstances. If your 2026 tax return includes only W-2 income, standard deductions, and basic tax credits, self-filing software can handle your needs efficiently.

Qualifying Scenarios for DIY Filing:

- Single or married filing jointly with W-2 income only

- No business ownership or rental property income

- Standard deduction usage without itemizing

- No significant investment income or capital gains

- No major life changes during 2025

Cost Advantages Are Substantial

The financial benefits of DIY filing remain significant for 2026. Professional tax preparation services in New Haven typically charge $200-$600 for individual returns, while DIY software ranges from free to $150 for complex situations.

DIY Filing Cost Structure:

- Free filing: Available for taxpayers earning under $73,000 annually

- Basic software: $50-$100 for simple returns

- Premium software: $100-$150 for complex scenarios including rental income

- Professional services: $200-$600+ depending on complexity

Professional Tax Consultation: When Expertise Pays!

Complex Financial Situations Require Professional Guidance

New Haven business owners and high-income earners should strongly consider professional tax consultation for their 2026 returns. The complexity of Connecticut's tax environment, combined with federal changes, creates opportunities for significant savings through expert guidance.

Scenarios Requiring Professional Help:

- Business ownership (sole proprietorship, partnership, S-Corp, LLC)

- Multiple income sources including rental properties

- Investment portfolios with capital gains and losses

- Connecticut estate planning considerations

- Multi-state tax filing requirements

- Previous year tax issues or audit concerns

Strategic Tax Planning Benefits

Professional tax consultants provide value beyond simple return preparation. They develop comprehensive strategies that can reduce your tax burden for years, often saving amounts that exceed their service fees.

Long-term Planning Advantages:

- Retirement account optimization strategies

- Business structure recommendations for tax efficiency

- Connecticut-specific deduction maximization

- Multi-year tax planning coordination

- Estate tax planning for high-net-worth individuals

New Haven-Specific Tax Considerations!

Connecticut State Tax Implications

New Haven residents face unique tax challenges due to Connecticut's tax structure. The state's income tax rates, property tax assessments, and estate tax provisions require careful consideration when choosing between DIY and professional filing.

Connecticut Tax Factors for 2026:

- State income tax rates ranging from 3% to 6.99%

- Property tax deduction limitations under SALT cap provisions

- Connecticut estate tax threshold of $12.92 million for 2026

- Pass-through entity tax (PTET) considerations for business owners

Local New Haven Tax Issues

New Haven property owners must navigate complex property tax calculations, potential appeals processes, and coordination with federal deductions. Professional guidance becomes particularly valuable for taxpayers with properties in multiple Connecticut municipalities.

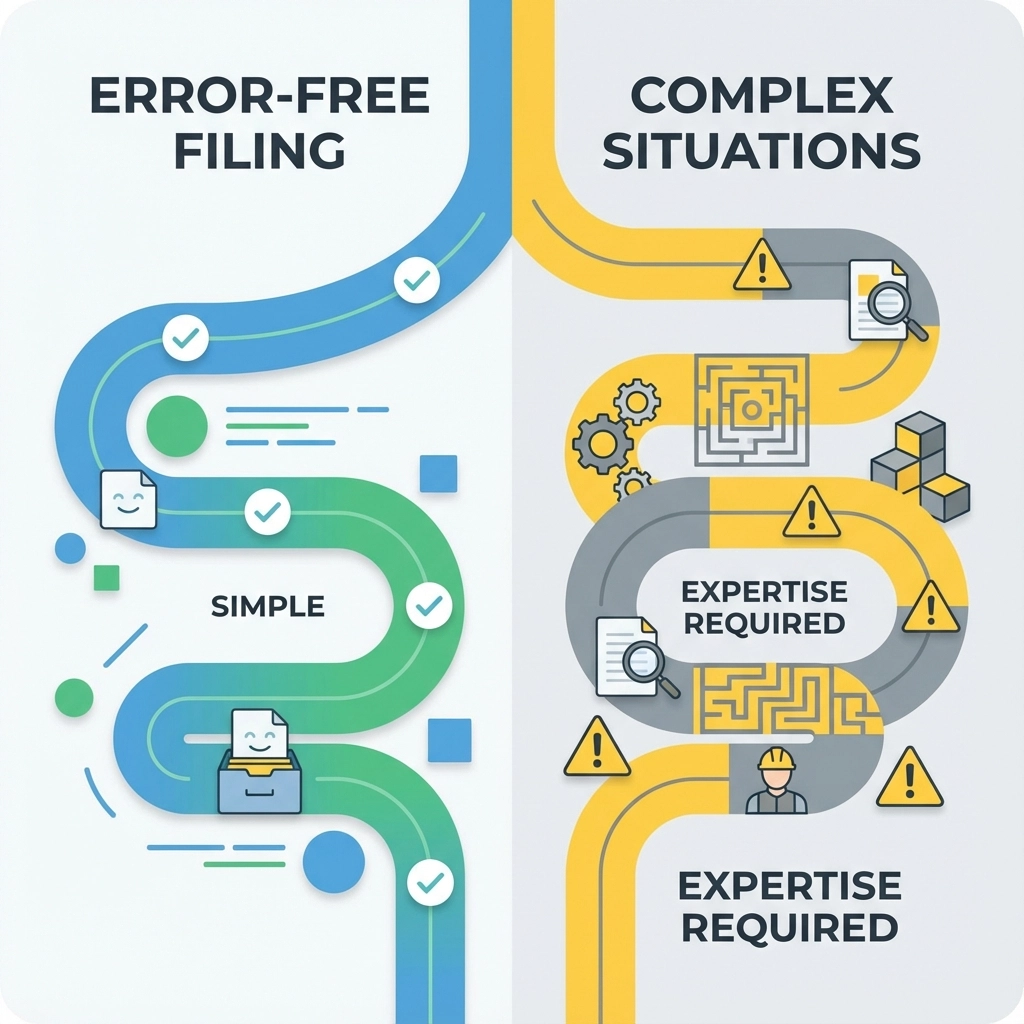

Risk Assessment: Errors and Compliance!

DIY Filing Error Rates

The Internal Revenue Service reports that self-prepared returns show higher error rates compared to professionally prepared returns. Common mistakes include mathematical errors, incorrect deduction calculations, and missed tax credit opportunities.

Frequent DIY Filing Errors:

- Calculation mistakes in tax computations

- Incorrect filing status selection

- Missed deduction and credit opportunities

- Improper business expense categorization

- Social Security number and dependent information errors

Professional Accuracy Advantages

Tax professionals maintain lower error rates due to specialized training, software capabilities, and experience with complex tax situations. They provide audit support and representation services if the IRS questions your return.

Professional Service Benefits:

- Error rates below 2% for experienced preparers

- Audit protection and representation services

- Amendment services for correcting previous year errors

- Year-round tax advice and planning support

- Electronic filing with faster processing times

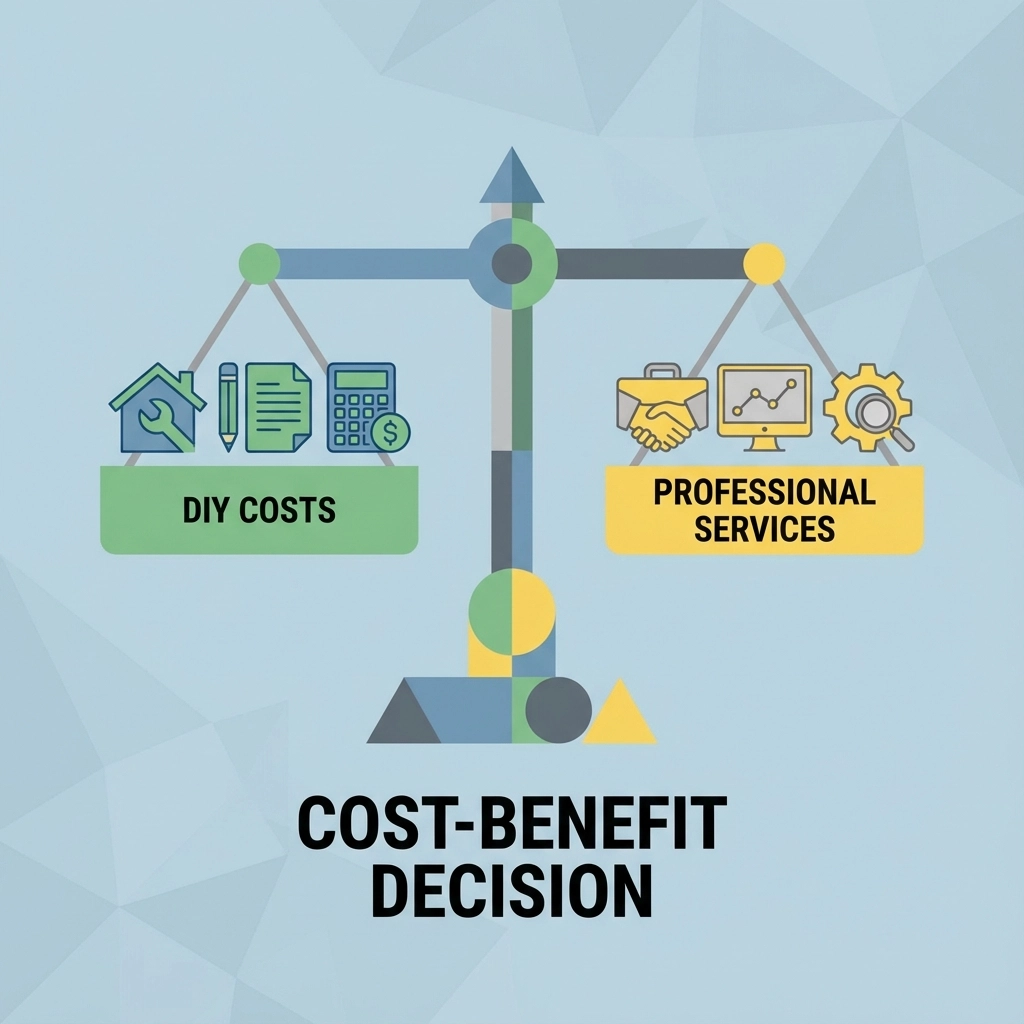

Cost-Benefit Analysis for New Haven Taxpayers!

Breaking Even on Professional Services

Professional tax preparation pays for itself when the additional deductions, credits, and strategic planning exceed service costs. New Haven taxpayers with moderate complexity should evaluate potential savings against professional fees.

Factors Favoring Professional Services:

- Potential tax savings exceeding $500 annually

- Business income requiring Schedule C preparation

- Rental property income and expense calculations

- Investment transactions requiring capital gains analysis

- Connecticut estate planning coordination needs

When DIY Filing Remains Optimal

Simple tax situations with minimal deduction opportunities may not justify professional preparation costs. Young professionals with straightforward W-2 income and standard deductions often benefit from DIY approaches.

Technology and Software Considerations!

2026 Tax Software Capabilities

Modern tax software has evolved significantly, offering guided interviews, error checking, and audit support for DIY filers. Leading platforms provide Connecticut-specific guidance and integration with federal requirements.

Software Feature Evaluation:

- Step-by-step interview processes

- Error detection and correction capabilities

- Connecticut state tax integration

- Previous year data import functionality

- Audit assistance and support services

Professional Software Advantages

Tax professionals utilize advanced software platforms unavailable to consumers, providing superior calculation accuracy and comprehensive tax planning capabilities.

Making Your Decision for 2026!

Evaluation Criteria Checklist

Use these factors to determine the optimal approach for your 2026 New Haven tax return:

Choose DIY Filing If:

- Your income comes primarily from W-2 wages

- You plan to use standard deductions

- You have no business or rental income

- Your tax situation remained unchanged from 2025

- You feel comfortable navigating tax software

Choose Professional Consultation If:

- You own business interests or rental properties

- You experienced major life changes in 2025

- You have complex investment portfolios

- You need multi-year tax planning strategies

- You prefer audit protection and representation services

Hybrid Approach Consideration

Some New Haven taxpayers benefit from a hybrid strategy: preparing their return using DIY software, then having a professional review the completed return before filing. This approach provides cost savings while maintaining professional oversight.

Conclusion: Timing and Implementation!

Your 2026 tax filing decision should align with your financial complexity, risk tolerance, and long-term planning needs. New Haven taxpayers with straightforward situations can confidently use DIY software, while those with business interests or complex financial situations should invest in professional consultation.

Action Steps for New Haven Taxpayers:

- Assess your 2025 financial activity complexity

- Evaluate potential deduction and credit opportunities

- Compare estimated software costs against professional fees

- Consider your comfort level with tax preparation tasks

- Schedule consultations if professional services seem beneficial

Remember that professional tax consultation extends beyond simple return preparation. The strategic planning and ongoing advice often provide value that justifies the investment, particularly for New Haven residents navigating Connecticut's complex tax environment alongside federal requirements.

Categories: news, tax planning

Tags: Business taxes, Joses Tax service, New Haven Tax Preparation, New Haven tax preparer, Refund, Self-employed, Smart vault, Tax advisor, Tax Audit, Tax help, Tax planning, Year-End Tax Planning

Leave a Reply

You must be logged in to post a comment.