In a time when communities across America are struggling with rising costs, outdated infrastructure, and a lack of opportunity, the Big Beautiful Bill Act...

September 4, 2025

Finding a job can be a challenge and for certain groups, it can be even harder. The Work Opportunity Tax Credit is a federal...

It’s back to school season, and with that comes potential out-of-pockets costs for educators. The Educator Expense Deduction lets eligible teachers and administrators deduct...

August 19, 2025

By Jose’s Tax Service, New Haven, CT Tax planning isn’t just about filing your return once a year—it’s about creating a strategy that helps...

Taxpayers who requested an extension to file have until Oct. 15, 2025, to do so, and some may choose to hire a tax return...

July 19, 2025

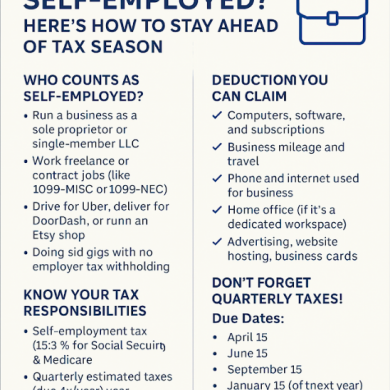

Jose’s Tax Service | Trusted. Transparent. Tax-Smart. Being your own boss comes with freedom — and a whole lot of responsibility. When you’re self-employed,...

July 17, 2025

Jose’s Tax Service | Trusted. Transparent. Tax-Smart. Owning rental property is a great way to build long-term wealth, but it also comes with complex...

July 16, 2025

Jose’s Tax Service | Trusted. Transparent. Tax-Smart. Opening your mailbox and seeing a letter from the IRS can be enough to send your heart...

July 15, 2025

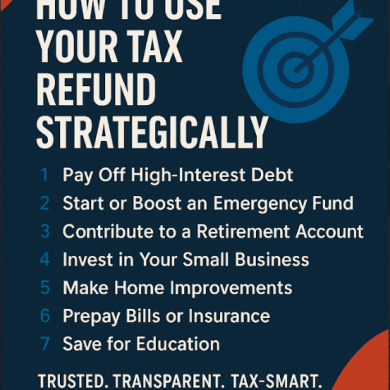

Jose’s Tax Service | Trusted. Transparent. Tax-Smart. Getting a tax refund feels great — but what you do with that money can make a...

July 14, 2025

Jose’s Tax Service | Trusted. Transparent. Tax-Smart. Solid bookkeeping is the foundation of every successful business — yet it’s often one of the most...