Maximize Your Tax Refund in 2026: 7 Mistakes You're Making (and How to Fix Them)

New Haven, CT – February 9, 2026 – Tax season is officially here, and if you want to maximize your tax refund this year, you need to avoid the costly mistakes that drain thousands of dollars from taxpayers every single filing season.

The good news? Refunds are expected to increase 15-20% on average in 2026 due to retroactive tax law changes. The bad news? You'll only see that bigger refund if you file correctly.

Here are the seven biggest tax mistakes New Haven taxpayers are making right now: and exactly how to fix them before April 15.

Mistake #1: Waiting Until the Last Minute!

Filing your tax return in a rush is the fastest way to make expensive errors. When you scramble to meet the April deadline, you miss deductions, enter incorrect information, and forget critical documents.

The IRS e-file system is already open. You can file your 2025 tax return right now.

How to Fix It:

- Gather all tax documents immediately (W-2s, 1099s, receipts, charitable donation records)

- Schedule your tax preparation appointment this week, not next month

- Use a concierge tax pro who can identify missed deductions you'd overlook in a rush

- Double-check every entry before submitting your return

Early filers get their refunds faster and avoid processing delays. Don't wait.

Mistake #2: Missing Tax Deductions and Credits You Qualify For!

This is the most expensive mistake on this list. Taxpayers leave billions of dollars unclaimed every year because they don't know what deductions and credits they're eligible for.

2026 brings major retroactive tax changes, including:

- New deductions for tips and overtime income

- Increased Child Tax Credit

- Higher senior deduction (age 65+)

- Increased state and local tax (SALT) deduction caps

How to Fix It:

- Review all available tax credits for your situation (education, child care, energy efficiency, earned income credit)

- If you had a new baby in 2025, ensure you have a Social Security number to claim the Child Tax Credit

- Don't skip the "other deductions" section: charitable donations, medical expenses, and home office deductions add up

- Work with a tax preparer in New Haven who stays current on tax law changes

Missing just one credit can cost you thousands. A professional tax review pays for itself.

Mistake #3: Not Finalizing Retirement Contributions!

Here's something most people don't know: You can still contribute to your IRA until the tax filing deadline and reduce your 2025 taxable income.

For 2025, the IRA contribution limit is $7,000 ($8,000 if you're married filing jointly). These contributions may be fully tax-deductible depending on your income and employer retirement plan participation.

How to Fix It:

- Make your 2025 IRA contribution before April 15, 2026

- Confirm your contribution is designated for tax year 2025

- Verify whether your contribution is deductible based on your income level

- Consider contributing to a Health Savings Account (HSA) if you have a high-deductible health plan

This is your last chance to reduce your 2025 tax bill. Don't let this deadline pass.

Mistake #4: Choosing the Wrong Deduction Method!

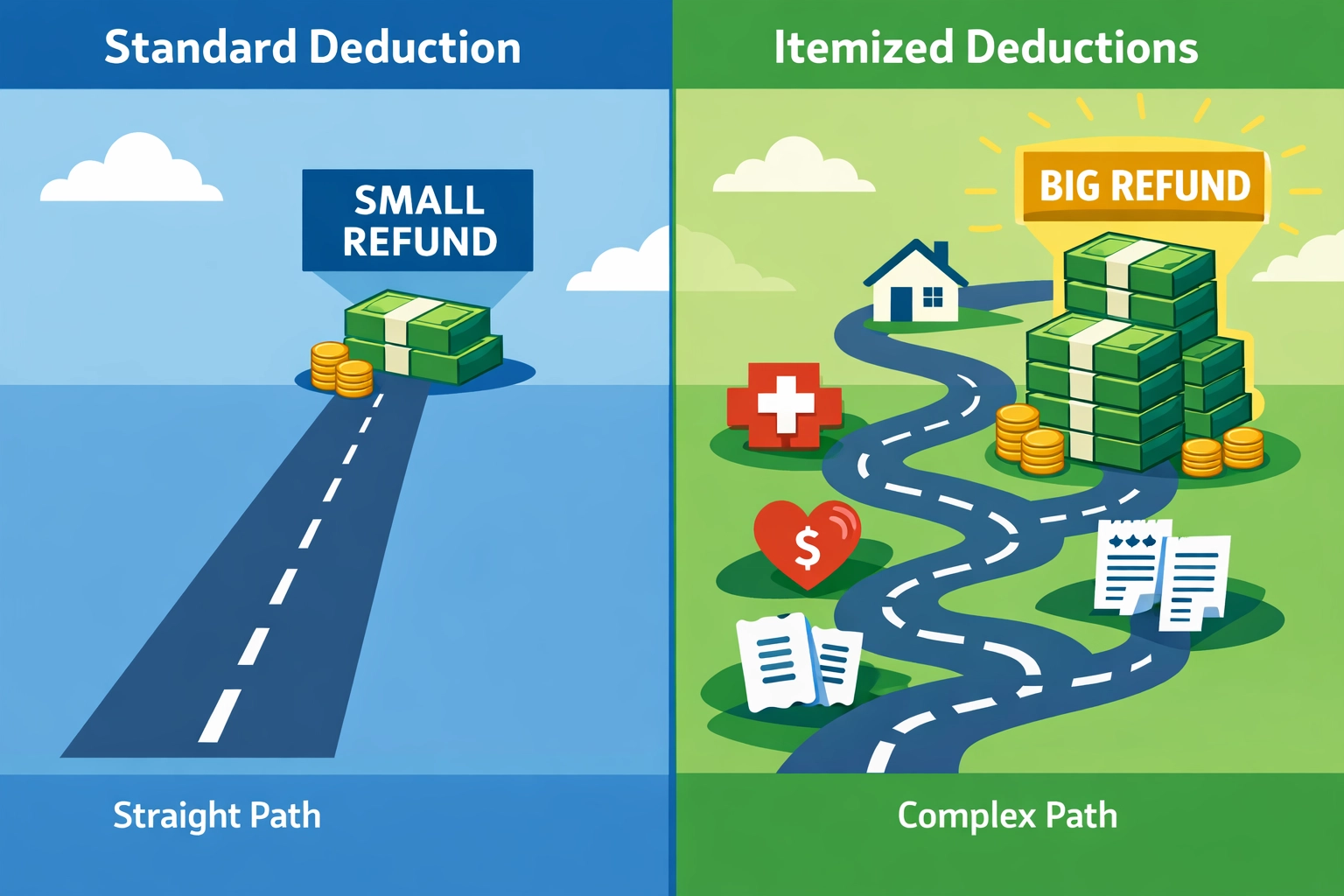

Many taxpayers automatically take the standard deduction without calculating whether itemizing would save them more money.

How you claim deductions can dramatically affect your refund size. If your total itemized deductions exceed the standard deduction, you're leaving money on the table.

How to Fix It:

- Calculate your total itemized deductions (mortgage interest, property taxes, charitable donations, medical expenses over 7.5% of AGI)

- Compare that total to the 2025 standard deduction ($14,600 for single filers, $29,200 for married filing jointly)

- Choose the method that gives you the larger deduction

- Keep detailed records and receipts to support itemized deductions

A concierge tax pro will run both calculations and use whichever method maximizes your refund.

Mistake #5: Not Using Tax-Advantaged Savings Accounts!

Flexible Spending Accounts (FSAs) and Dependent Care FSAs are pre-tax goldmines that reduce your taxable income dollar-for-dollar.

For 2026, you can contribute:

- Up to $3,400 tax-free to a healthcare FSA

- Up to $7,500 tax-free to a dependent care FSA for childcare costs

These contributions come out of your paycheck before taxes are calculated, which directly lowers your tax bill.

How to Fix It:

- Enroll in your employer's FSA during open enrollment

- Calculate your expected medical and childcare expenses for the year

- Contribute the maximum amount you can reasonably use

- Use FSA funds for eligible expenses (prescriptions, co-pays, daycare, after-school programs)

Don't leave this tax break unused. It's free money.

Mistake #6: Getting Your Filing Status Wrong!

Your filing status determines your tax bracket, standard deduction amount, and eligibility for certain credits. Choosing the wrong status can cost you hundreds or thousands of dollars.

Common filing status mistakes include:

- Filing as "Single" when you qualify for "Head of Household"

- Not updating your status after marriage, divorce, or a spouse's death

- Incorrectly claiming dependents

How to Fix It:

- Review IRS filing status requirements for 2025

- If your marital status changed, use the correct status for your December 31, 2025 situation

- Update your W-4 form with your employer if your status changed

- Ensure you meet all requirements before claiming Head of Household status

If you're unsure which status applies to you, consult a tax professional. This decision impacts every line of your return.

Mistake #7: Not Optimizing Your Withholding!

If you received a huge refund last year, you overpaid taxes all year long. You essentially gave the government an interest-free loan.

If you owed a big tax bill, you didn't withhold enough and may face underpayment penalties.

The goal is to break even: or get a small refund without overpaying throughout the year.

How to Fix It:

- Review your 2025 tax return and compare your refund or amount owed to previous years

- Use the IRS Tax Withholding Estimator to calculate the correct withholding amount

- Submit a new W-4 form to your employer to adjust your withholding for 2026

- Check your withholding again if you experience major life changes (marriage, new baby, home purchase)

Proper withholding puts more money in your pocket every paycheck instead of waiting for a refund.

What to Do With Your Bigger 2026 Refund

With refunds expected to increase significantly this year, plan strategically for how to use that money:

- Pay down high-interest debt (credit cards, personal loans)

- Build or strengthen your emergency fund (aim for 3-6 months of expenses)

- Contribute to retirement accounts for long-term wealth building

- Invest in your business if you're self-employed or a small business owner

- Set aside funds for quarterly estimated taxes if you're a 1099 contractor

Don't let a windfall refund disappear without a plan.

Ready to Maximize Your Tax Refund?

These seven mistakes cost New Haven taxpayers thousands of dollars every year. The difference between a small refund and a maximum refund often comes down to one thing: working with a tax professional who knows exactly what to look for.

At Jose's Tax Service, we specialize in concierge tax preparation that finds every deduction, credit, and strategy to maximize your refund. We stay current on tax law changes so you don't have to.

Schedule your tax preparation appointment today. The IRS is already processing returns, and early filers are getting their refunds first.

Don't leave money on the table this tax season. Let's make sure you get every dollar you're entitled to.

Categories: News, Tax Planning

Keywords: tax preparation New Haven, maximize tax refund, concierge tax pro, IRS deductions 2026

Leave a Reply

You must be logged in to post a comment.