Maximize Your Tax Refund in 2026: 7 Mistakes You're Making (and How to Fix Them)

Tax season 2026 brings significant changes that could put an extra $1,000 or more in your pocket. But here's the catch: most taxpayers will miss out because they're repeating the same mistakes from previous years.

The IRS predicts millions of Americans will see larger refunds this year due to new tax rules. The question is: will you be one of them? Let's fix the most common errors that are costing you money.

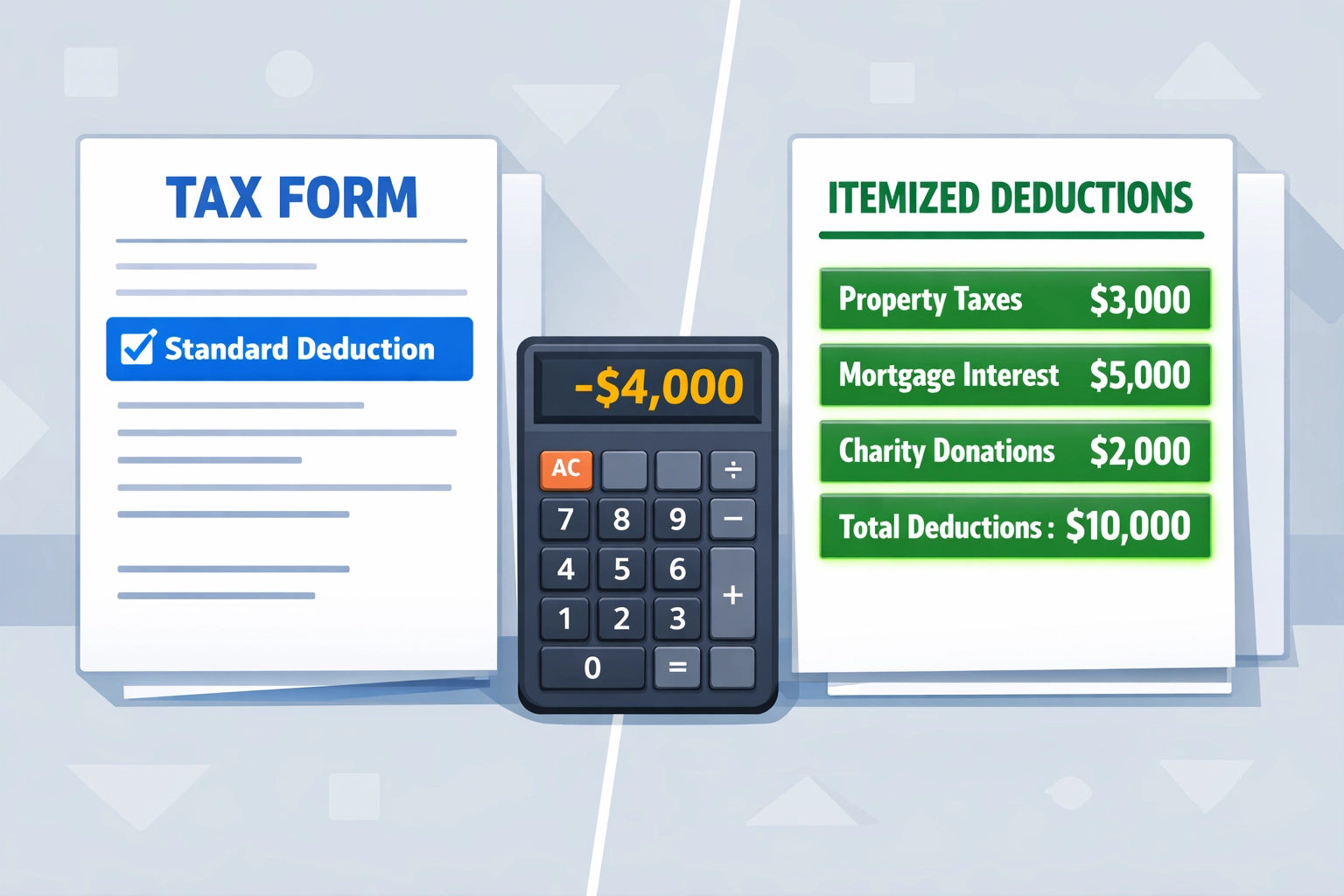

Mistake #1: Defaulting to the Standard Deduction Without Running the Numbers

The biggest mistake? Assuming the standard deduction is your best option without doing the math.

Here's what changed for 2026: The SALT cap increased from $10,000 to $40,000. This means you can now deduct significantly more state and local taxes: property taxes, state income taxes, or sales taxes: than in previous years.

For New Haven homeowners paying substantial property taxes, this is a game-changer. What wasn't worth itemizing last year might now save you thousands.

Action step: Calculate your total itemized deductions including:

- State and local taxes (now up to $40,000)

- Mortgage interest

- Charitable donations

- Medical expenses exceeding 7.5% of your adjusted gross income

If these exceed your standard deduction, itemize. Don't leave money on the table because you didn't take 15 minutes to compare.

Mistake #2: Ignoring Brand-New 2026 Deductions!

The 2026 tax law introduced deductions that didn't exist before. Many taxpayers have no idea these exist.

New deductions for 2026:

- Overtime Pay Deduction: If you worked overtime hours, a portion may now be deductible

- Tips Deduction: Service workers can deduct qualifying tip income

- Vehicle Interest Deduction: Interest on loans for work-related vehicles may be deductible

Even small deductions add up fast. A $500 deduction here and a $300 deduction there can easily translate to an extra $200-$500 in your refund.

Action step: Review your pay stubs and employment records. Identify any overtime pay, tip income, or work-related vehicle expenses. Don't assume these don't apply to you without checking.

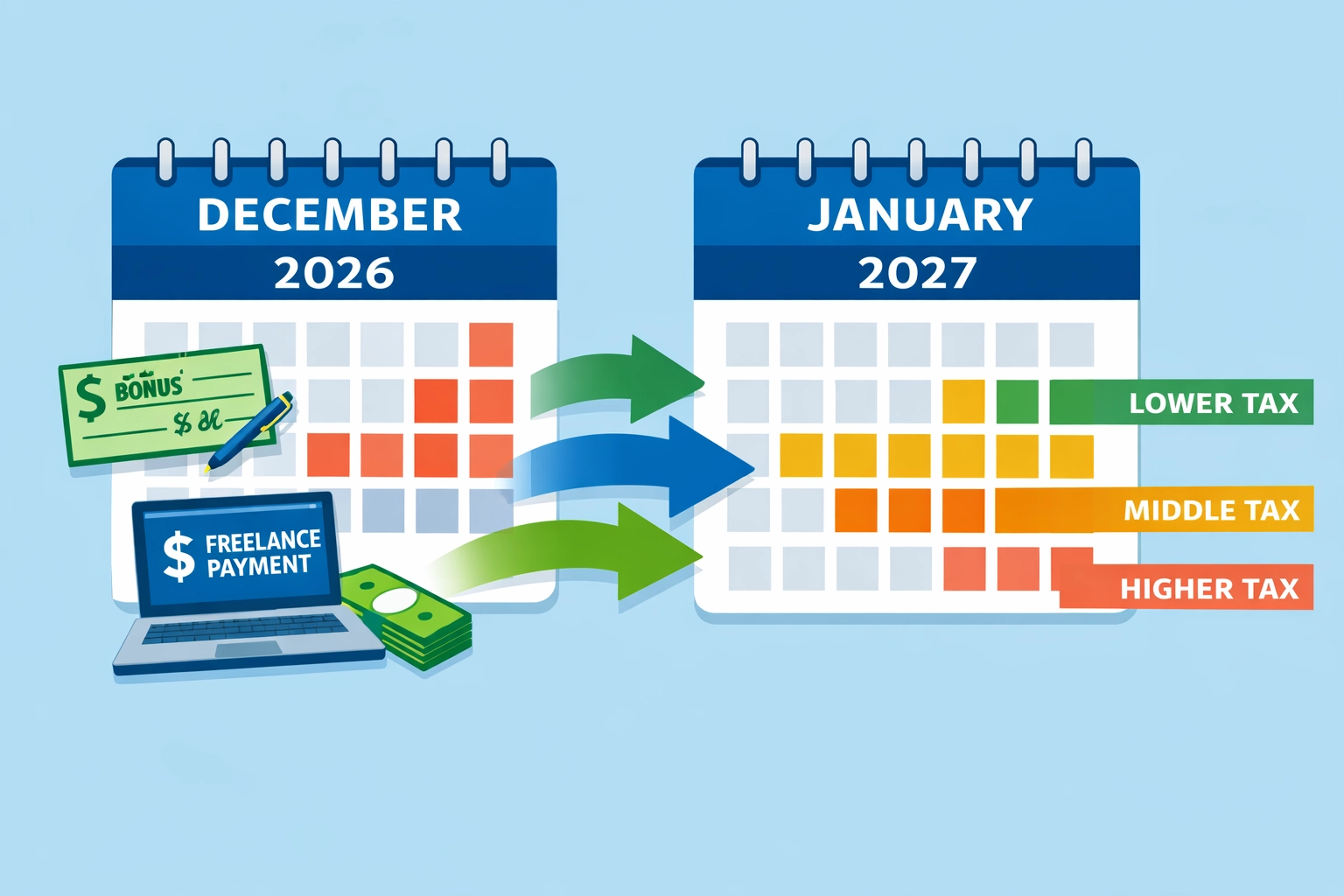

Mistake #3: Missing Strategic Income Timing Opportunities

Smart tax planning isn't just about what you claim: it's about when you report income and take deductions.

If you're expecting a year-end bonus or freelance payment that could push you into a higher tax bracket, consider whether delaying it to early 2027 makes sense. Conversely, if you had high expenses this year, accelerating deductible payments into 2026 can reduce your current tax bill.

This strategy works especially well for:

- Self-employed individuals with flexible billing

- Freelancers and contractors

- Small business owners

- Commission-based professionals

Action step: Review your year-end income projections. If you're close to a tax bracket threshold, consult with a tax professional about income timing strategies. This single move can save you thousands.

Mistake #4: Failing to Max Out Tax-Advantaged Accounts

Contributions to retirement and health savings accounts don't just build your future: they reduce your tax bill today.

Key accounts to consider:

- 401(k) contributions: Reduce taxable income dollar-for-dollar

- Traditional IRA contributions: Up to $7,000 ($8,000 if 50+) for 2026

- Health Savings Accounts (HSAs): Triple tax advantage: deductible contributions, tax-free growth, tax-free withdrawals for medical expenses

Many people contribute just enough to get their employer match. That's leaving money on the table. Every additional dollar you contribute reduces your taxable income and potentially increases your refund.

Action step: Review your year-end account contribution limits. If you haven't maxed out and have the cash flow, make additional contributions before the deadline. For IRAs, you have until the tax filing deadline to contribute for the previous year.

Mistake #5: Not Claiming Every Credit You're Eligible For

Tax credits are more valuable than deductions because they reduce your tax bill dollar-for-dollar. Yet millions of taxpayers miss out on credits they qualify for.

Major credits to review for 2026:

- Child Tax Credit: Increased amounts for new dependents in 2026

- Child and Dependent Care Credit: Up to $3,000 for one dependent, $6,000 for two or more

- Education Credits: American Opportunity Credit (up to $2,500) or Lifetime Learning Credit (up to $2,000)

- Earned Income Tax Credit (EITC): Often overlooked by eligible low-to-moderate income workers

- Saver's Credit: For retirement contributions if you meet income requirements

The difference between a deduction and a credit? A $1,000 deduction might save you $220 in taxes. A $1,000 credit saves you $1,000. Period.

Action step: Go through the IRS credit checklist or work with a tax professional who specializes in maximizing credits. At Jose's Tax Service, our concierge tax preparation process includes a comprehensive credit review: we've found thousands in overlooked credits for New Haven families.

Mistake #6: Filing Last-Minute Without Organization

Rushing through your tax return guarantees mistakes and missed opportunities.

Filing unprepared means:

- Forgetting deductible expenses

- Missing receipts and documentation

- Claiming incorrect amounts

- Overlooking credits entirely

- Making errors that delay processing or trigger audits

The IRS may request documentation for deductions. If you can't produce records, you'll lose those deductions: and potentially face penalties.

Action step: Start organizing NOW. Create folders (physical or digital) for:

- W-2s and 1099 forms

- Receipts for deductible expenses

- Charitable contribution records

- Medical expense documentation

- Education-related expenses

- Mortgage interest statements

- Property tax bills

Set up a simple system to track expenses throughout the year. Future you will be grateful.

Mistake #7: Overlooking Tax-Loss Harvesting for Investment Accounts

If you hold investments in taxable brokerage accounts (not retirement accounts), tax-loss harvesting can significantly reduce your tax bill.

How it works: Sell investments that have lost value to offset capital gains from profitable investments. Losses can also offset up to $3,000 of ordinary income annually. Any remaining losses carry forward to future years.

This strategy is especially valuable in volatile markets. Many investors had losses in certain sectors this past year: these losses can be strategically used to reduce your 2026 tax liability.

Action step: Review your investment portfolio for unrealized losses. Consider selling losing positions before year-end to capture the tax benefit. Be aware of wash-sale rules (you can't buy the same security within 30 days). This is complex: consult with a tax advisor experienced in investment taxation.

The Bottom Line: Professional Help Pays for Itself

Here's the reality: tax law changes constantly, and the 2026 updates are substantial. The average taxpayer can't reasonably keep up with every change, deduction, and credit they qualify for.

A DIY approach using software might save you $200 in preparation fees: but cost you $2,000 in missed deductions and credits.

Professional tax preparation, especially concierge-level service, identifies opportunities you didn't know existed. At Jose's Tax Service, we specialize in maximizing refunds for New Haven taxpayers through comprehensive tax planning: not just basic return preparation.

Our process includes:

- Detailed review of all income sources

- Line-by-line deduction analysis

- Credit eligibility assessment

- Strategic planning for future tax years

- Year-round support (not just during tax season)

Take Action Before It's Too Late

Don't wait until April to start thinking about your taxes. The strategies that maximize your refund require planning: not last-minute scrambling.

Next steps:

- Schedule a consultation to review your 2026 tax situation

- Gather your financial documents and records

- Discuss income timing and contribution strategies

- Identify new deductions and credits you qualify for

Ready to stop leaving money on the table? Contact Jose's Tax Service for professional tax preparation in New Haven. Let's make sure you're getting every dollar you deserve this tax season.

Visit josestaxservice.com or call us today to schedule your consultation. Your bigger refund is waiting.

Leave a Reply

You must be logged in to post a comment.