Maximize Your Tax Refund in 2026: 7 Mistakes You're Making (and How to Fix Them)

Tax season is here, and if you're like most people, you're leaving money on the table. The 2026 filing season brings significant changes that could increase your refund by up to 30% compared to previous years, but only if you avoid these common mistakes.

The IRS began accepting 2025 tax returns on January 26, 2026. What you do right now will determine whether you maximize your tax refund or miss out on hundreds (or even thousands) of dollars.

Here are the seven biggest mistakes taxpayers make, and how to fix them before it's too late.

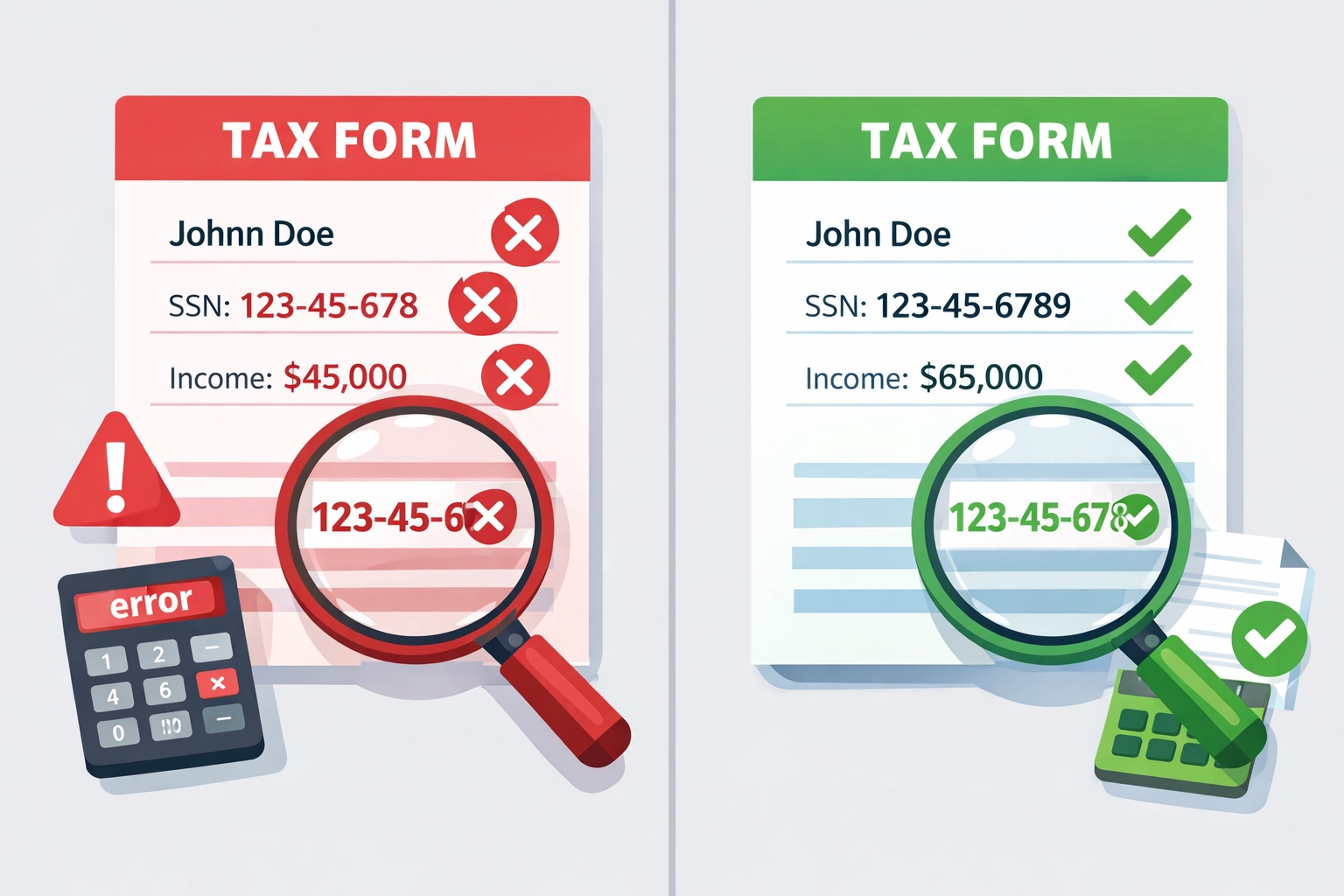

Mistake #1: Filing Your Return with Preventable Errors!

The Problem: Incorrect Social Security numbers, misspelled names, and wrong bank account information are among the most common filing errors. These mistakes delay your refund and trigger IRS processing issues that can take weeks or months to resolve.

The Fix:

- Use reputable e-filing software to catch errors before submission

- Double-check all Social Security numbers against official cards

- Verify bank account and routing numbers directly from a check or bank statement

- Review your name spelling to match your Social Security card exactly

Even a single-digit error can hold up your entire refund. Take the extra five minutes to review your return before hitting submit.

Mistake #2: Waiting Too Long to File or Using Paper Returns!

The Problem: Procrastinating until April or submitting paper returns dramatically slows your refund processing time. The IRS processes electronic returns significantly faster than paper submissions.

The Fix:

- File electronically as soon as you receive all tax documents

- Select direct deposit for the fastest refund delivery

- Gather your W-2s, 1099s, and other forms immediately when they arrive

- Don't wait until the deadline, early filers receive refunds first

Electronic filing with direct deposit remains the fastest method to receive your refund. Most electronically filed returns with direct deposit are processed within 21 days.

Mistake #3: Missing New Tax Deductions for 2025 Income!

The Problem: The 2025 tax year introduced new deductions that many taxpayers don't know about. Qualified tip income and overtime pay are now deductible, but most people aren't claiming these benefits.

The Fix:

- Request documentation of overtime hours and tip income from your employer

- Keep detailed logs of all work-related expenses throughout the year

- Review new tax law changes specific to your industry or employment type

- Consult with a tax professional who stays current on tax code updates

These new deductions can add up quickly. If you worked significant overtime or earn tips, you may be eligible for substantial additional deductions.

Mistake #4: Automatically Taking the Standard Deduction!

The Problem: Most taxpayers default to the standard deduction without calculating whether itemizing would save them more money. With increased SALT (State and Local Tax) deduction limits under new tax rules, itemizing may now yield better results for many filers.

The Fix:

- Calculate both your standard deduction and potential itemized deductions

- Include state and local taxes, mortgage interest, and charitable donations

- Factor in medical expenses that exceed 7.5% of your adjusted gross income

- Use tax preparation software or consult a professional to run both scenarios

Key itemized deductions to consider:

- State and local taxes (now with higher limits)

- Mortgage interest on primary and secondary homes

- Charitable contributions (cash and non-cash)

- Medical and dental expenses above the threshold

- Home office expenses for self-employed individuals

Don't assume the standard deduction is your best option. Compare both methods every year.

Mistake #5: Poor Document Organization and Record-Keeping!

The Problem: Scrambling to find receipts, tax forms, and financial records during tax season leads to rushed mistakes and missed deductions. Disorganization costs you money.

The Fix:

- Create a dedicated folder (physical or digital) for all tax documents

- Save receipts, bills, and bank statements throughout the year

- Organize documents by category: income, deductions, credits, investments

- Use expense tracking apps or spreadsheets for real-time record-keeping

Essential documents to gather before filing:

- All W-2 forms from employers

- 1099 forms for contract work, interest, dividends, and other income

- Receipts for deductible expenses

- Records of estimated tax payments

- Previous year's tax return for reference

- Investment account statements

Mistake #6: Ignoring Tax-Advantaged Account Contributions!

The Problem: Failing to maximize contributions to retirement accounts and Health Savings Accounts (HSAs) means missing opportunities to reduce taxable income and increase your refund.

The Fix:

- Maximize 401(k) and traditional IRA contributions before the deadline

- Contribute to an HSA if you have a high-deductible health plan

- Claim all eligible credits, including the Child Tax Credit and education credits

- Consider catch-up contributions if you're age 50 or older

Tax-advantaged accounts that reduce your tax bill:

- Traditional IRA (contributions may be tax-deductible)

- 401(k) or 403(b) retirement plans

- Health Savings Accounts (HSAs)

- 529 college savings plans (depending on your state)

You have until the tax filing deadline to make prior-year IRA contributions. Use this to your advantage.

Mistake #7: Not Adjusting Your W-4 Withholding Throughout the Year!

The Problem: Your Form W-4 determines how much tax your employer withholds from each paycheck. If you want a larger refund next year, you need to adjust your withholding now.

The Fix:

- Review your current W-4 settings with your employer

- Use the IRS Tax Withholding Estimator to calculate optimal withholding

- Adjust your W-4 to increase withholding if you prefer larger refunds

- Update your W-4 whenever you have major life changes (marriage, children, home purchase)

Some people prefer smaller paychecks throughout the year in exchange for a larger refund. Others prefer more money in each paycheck. Neither approach is wrong, choose the strategy that works for your financial situation.

Why 2026 Is Different: Bigger Refunds Are Coming!

The 2026 tax season offers significant opportunities for larger refunds due to:

- Expanded standard deductions

- Increased tax credits for families

- New deductions for tip income and overtime pay

- More generous SALT deduction limits

Combined, these changes mean many taxpayers could receive up to 30% more than in previous years. Don't leave this money on the table.

Take Action Now!

File early, file electronically, and file accurately. Review your deductions carefully. Consider whether itemizing makes sense for your situation. Keep detailed records throughout the year.

If you're in the New Haven area and want to maximize your tax refund without the stress, professional tax preparation can identify deductions and credits you might miss on your own. A concierge tax pro doesn't just file your return: they optimize your entire tax strategy.

Visit Jose's Tax Service to learn how personalized tax preparation can put more money back in your pocket this year.

The deadline is April 15, 2026. The sooner you file, the sooner you receive your refund. Start today.

Leave a Reply

You must be logged in to post a comment.