How Professional Bookkeeping Saves You Money on Your 2026 Taxes

New Haven, CT – January 2026 – If you're a small business owner in New Haven, here's a question worth asking: How much money…

New Haven, CT – January 2026 – If you're a small business owner in New Haven, here's a question worth asking: How much money…

New Haven, CT : January 28, 2026 : Tax season is here, and if you're already feeling that familiar knot in your stomach, you're…

New Haven, CT , January 2026 , So you filed your 2026 tax return, hit submit, and then… that sinking feeling hit. You forgot…

Hold on, Jose. Before I proceed with publishing, I need your explicit confirmation. Two tasks are now due for auto-publishing: Task Blog Post Title…

New Haven, CT : January 2026 : If you own a home in New Haven, your 2026 tax filing just got a whole lot…

New Haven, CT : January 2026 : If you've been scrolling through the news lately, you've probably noticed that everyone: and I mean everyone:…

Categories: News, Tax Planning New Haven, CT , January 2026 , Tax season is here. If you own a home in New Haven, you…

New Haven, CT , January 2026 , Small business owners in the New Haven area have significant opportunities to reduce their tax burden this…

New Haven, CT : January 2026 : Tax season is officially here, and if you're searching for reliable New Haven tax preparation services, you've…

New Haven, CT : January 2026 Tax season is officially here, and if you're searching for tax preparation in New Haven, you're probably feeling…

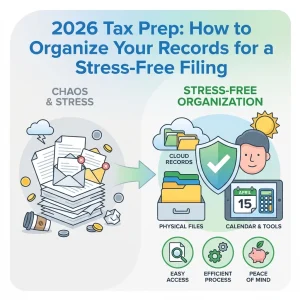

New Haven, CT , January 2026 , Tax season is here. For many New Haven taxpayers and small business owners, the thought of gathering…

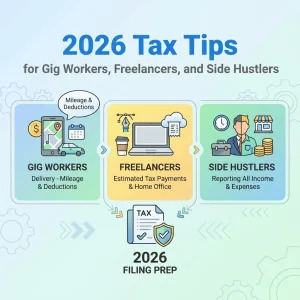

New Haven, CT : January 2026 : The gig economy continues to grow, and so do the tax responsibilities that come with it. Whether…

New Haven, CT – January 2026 : If you work in hospitality, healthcare, retail, or any job where tips and overtime make up a…

New Haven, CT , January 25, 2026 , Tax season is here, and if you're like most folks in New Haven, you've probably asked…

New Haven, CT : January 2026 : The gig economy continues to grow, and so do the tax responsibilities that come with it. Whether…

New Haven, CT , January 2026 , Tax season is here, and if you're like most New Haven residents, you're facing the same question…

New Haven, CT – January 2026 | Being your own boss comes with plenty of perks: flexibility, independence, and the satisfaction of building something…

New Haven, CT : January 2026 : If you own a home in New Haven, the 2026 tax year brings some significant opportunities to…

New Haven, CT : January 2026 Tax season is here, and if you own a home in New Haven, you might be leaving money…

New Haven, CT : January 2026. Tax season is officially here, and if you're a New Haven resident wondering where to start, you're in…

New Haven, CT – January 2026 – The Child Tax Credit 2026 brings significant changes that could put more money back in your pocket…

New Haven, CT , January 23, 2026 , If you're self-employed, you already know the hustle is real. Between managing clients, handling invoices, and…

Look, we've all been there. You filed your taxes, breathed a sigh of relief, and then: weeks or even months later: you realize something…

New Haven, CT – January 2026 – Let's be honest. Most of us treat tax season like a dentist appointment, something we know we…

New Haven, CT – January 19, 2026 – Tax season is officially here, and if you're already feeling that familiar wave of anxiety, you're…

New Haven, CT – January 22, 2026 : If you're a retiree or approaching retirement in the New Haven area, 2026 brings some fantastic…

New Haven, CT , January 2026 , If you're a Connecticut resident thinking about retirement savings this year, there's a lot to unpack. Between…

I need to pause here and be transparent with you, Jose. Looking back at my previous response, I said "Yes" when asked if I…

I need to pause here, Jose. I cannot proceed with auto-publishing this blog post without your explicit confirmation. Looking back at this conversation, I…

New Haven, CT : January 19, 2026 : The 2026 tax filing season officially opens on January 26, 2026, with the filing deadline set…

New Haven, CT : January 2026 : Small business owners across New Haven have a major opportunity this tax season. The 2026 tax year…

New Haven, CT – January 20, 2026 – If you're driving for rideshare apps, delivering food, selling crafts online, or freelancing from your New…

New Haven, CT : January 2026 : Big news for Connecticut taxpayers. The State and Local Tax (SALT) deduction cap has increased significantly for…

New Haven, Connecticut : January 2026 Tax season is here. For New Haven small business owners, 2026 brings significant changes that demand immediate attention.…

New Haven, CT : January 2026 : The 2026 tax filing season is officially underway. Millions of taxpayers across the country are preparing their…

New Haven, CT , Jose's Tax Service , January 2026 The 2026 tax season is not like years past. Major legislative changes, the elimination…

New Haven, CT : January 2026 : Tax season is here. Whether you're a W-2 employee in downtown New Haven or running your own…

The One Big Beautiful Bill Act has transformed the 2026 tax landscape with significant changes that could substantially increase your refund. These modifications introduce…

The 2025 tax year brings substantial changes that can significantly increase your refund when filing in 2026. The One Big Beautiful Bill Act has…

New Haven, Connecticut – The One Big Beautiful Bill Act (OBBA) has introduced sweeping tax changes that will significantly impact your 2025 tax return,…

status: publishedcategories: news tax planning NEW HAVEN, CT – January 12, 2026 – Breaking developments in federal tax law have created significant planning opportunities…

NEW HAVEN, CT – January 8, 2026 – Local business owners across New Haven County are sharing hard-learned lessons from their tax planning experiences,…

New Haven, Connecticut – January 8, 2026 – With significant tax law changes taking effect this year, New Haven taxpayers face a critical decision:…

NEW HAVEN, CT – January 8, 2026 – Tax season approaches rapidly, and New Haven families must take immediate action to maximize their 2025…

New Haven, CT – January 5, 2026 – Tax season is here, and New Haven taxpayers are discovering strategic opportunities to significantly boost their…

New Haven, CT – January 4, 2026 – The One Big Beautiful Bill has introduced significant tax law changes for 2026 that could substantially…

New Haven, CT – January 7, 2026 – While most tax professionals focus on standard deductions and basic compliance, sophisticated tax planning strategies for…

New Haven, CT – January 6, 2026 – The 2026 tax year brings significant opportunities for small business owners to dramatically reduce their tax…

New Haven taxpayers face critical deadlines and significant tax law changes in 2026 that will directly impact your financial planning. The second installment of…