Are You Making These Common Tax Consultation Mistakes? How SmartVault Document Management Can Save You Thousands

New Haven, CT – December 26, 2025 – Tax season approaches rapidly, and costly consultation mistakes continue to drain thousands from taxpayers' pockets. Professional tax preparers at Jose's Tax Service identify recurring errors that result in missed deductions, audit penalties, and unnecessary fees.

The Hidden Cost of Poor Documentation!

Documentation failures represent the most expensive mistake taxpayers make during consultations. Missing receipts, unorganized expense records, and incomplete financial statements force tax professionals to spend additional hours reconstructing your financial picture.

Key documentation errors include:

• Failing to separate business and personal expenses

• Missing receipts for deductible business meals and travel

• Incomplete mileage logs for vehicle deductions

• Unreconciled bank statements and credit card records

• Lost or damaged paper documents

These mistakes can cost you $2,000 to $5,000 annually in missed deductions alone. Professional tax preparers charge additional hourly fees ranging from $150 to $400 to organize disorganized records.

Mistake #1: Choosing Tax Consultants Based on Price Alone!

Selecting the lowest-cost tax preparation service creates expensive long-term consequences. Budget preparers typically rush through returns, miss valuable deductions, and provide minimal year-round support.

Price-focused selection leads to:

• Incomplete review of eligible tax credits

• Missed business expense deductions

• Failure to optimize filing status

• No strategic tax planning guidance

• Higher probability of IRS audits

The average taxpayer loses $1,200 in unclaimed deductions when using discount tax services. Professional consultation fees represent an investment that typically returns $3 to $7 for every dollar spent.

Mistake #2: Failing to Verify Professional Credentials!

Unqualified tax preparers cause significant financial damage through incompetent advice and filing errors. The IRS does not require preparers to hold specific certifications, allowing unqualified individuals to offer tax services.

Essential credentials to verify:

• Certified Public Accountant (CPA) license

• Enrolled Agent (EA) status with IRS

• Annual continuing education completion

• Professional liability insurance coverage

• Clean disciplinary record with state boards

Unqualified preparers often miss complex deduction opportunities and may provide incorrect advice that triggers costly IRS penalties.

How SmartVault Document Management Eliminates These Costly Errors!

SmartVault's cloud-based document management system directly addresses the most expensive consultation mistakes. This professional-grade platform organizes, secures, and streamlines all tax-related documentation.

SmartVault provides:

• Automatic document categorization and tagging

• Secure cloud storage with bank-level encryption

• Real-time collaboration between taxpayers and preparers

• Mobile document capture for instant receipt processing

• Automated backup and disaster recovery protection

SmartVault Feature #1: Organized Document Categories!

The platform automatically sorts uploaded documents into predefined tax categories, eliminating the chaos of paper filing systems.

Primary categories include:

• Business expense receipts and invoices

• Income statements and 1099 forms

• Property tax and mortgage interest statements

• Medical expense documentation

• Charitable contribution records

This organization reduces consultation preparation time by 60-75%, directly lowering professional service fees.

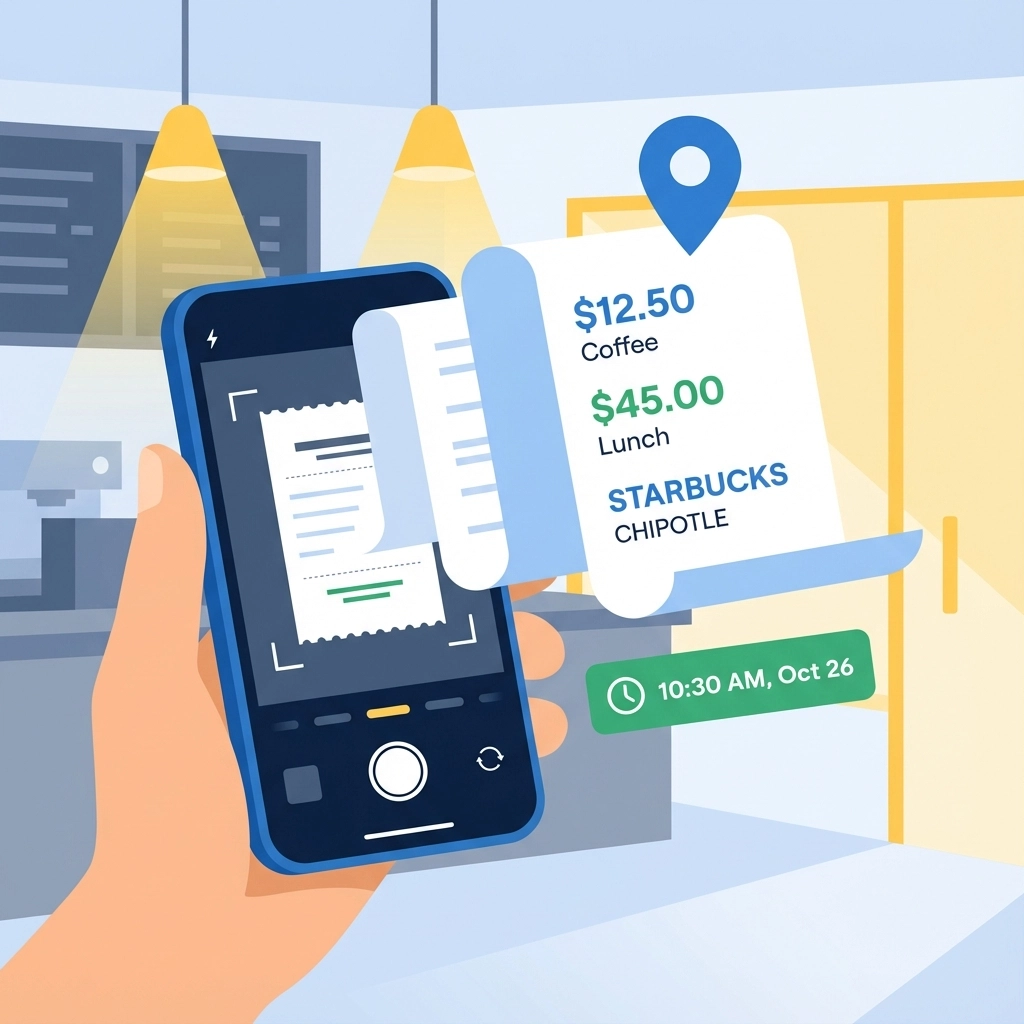

SmartVault Feature #2: Mobile Receipt Capture Technology!

The SmartVault mobile application allows instant receipt photography and automatic data extraction. GPS location tracking and timestamp verification provide audit-ready documentation.

Mobile features include:

• Optical character recognition (OCR) for expense amounts

• Automatic vendor name and date extraction

• GPS location stamps for business travel verification

• Cloud synchronization across all devices

• Offline functionality for remote locations

This technology prevents the loss of deductible expenses that typically cost taxpayers $800 to $1,500 annually.

SmartVault Feature #3: Real-Time Tax Professional Collaboration!

Secure document sharing enables year-round communication between taxpayers and their tax professionals. This continuous engagement identifies tax-saving opportunities throughout the year.

Collaboration benefits:

• Quarterly estimated tax payment optimization

• Mid-year tax strategy adjustments

• Business expense categorization guidance

• Retirement contribution planning reminders

• End-of-year tax move recommendations

Year-round tax planning through SmartVault typically increases annual tax savings by $1,500 to $4,000 for small business owners.

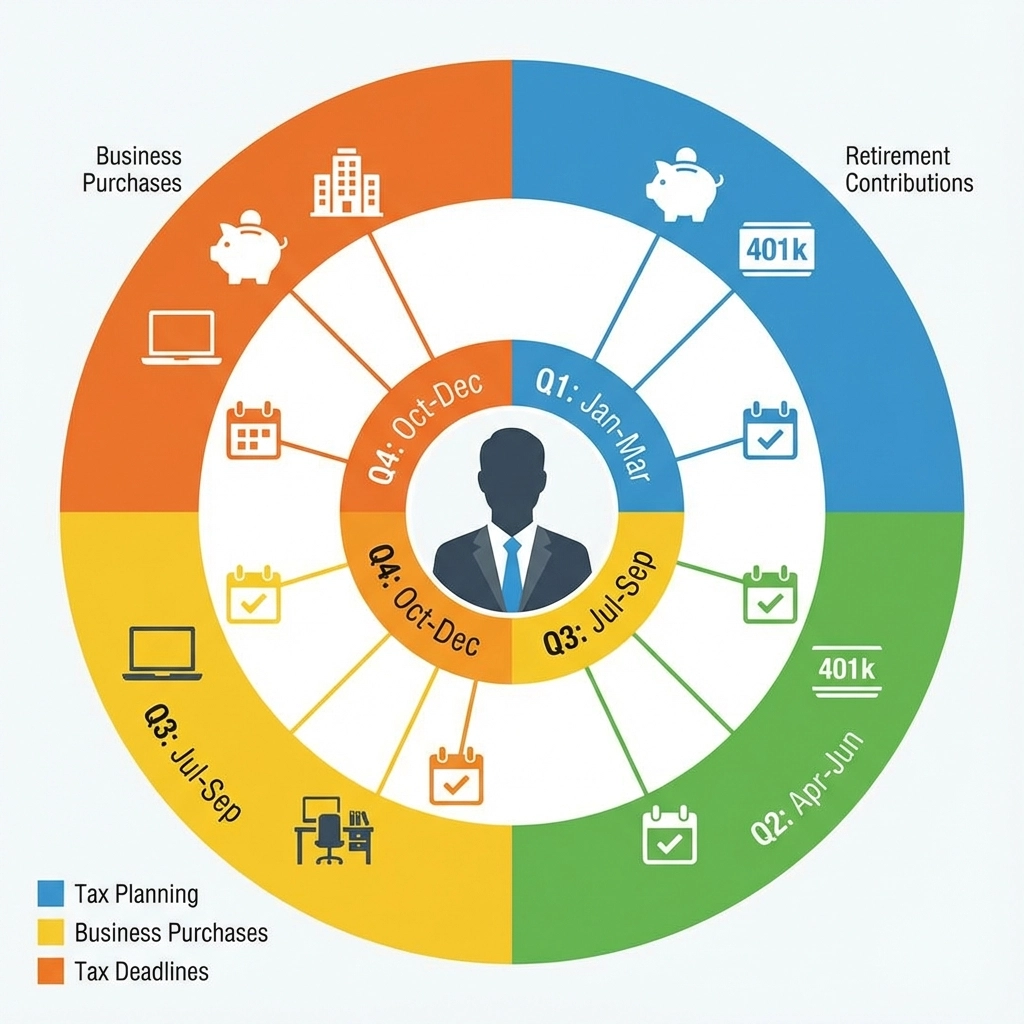

Mistake #3: Treating Taxes as Annual Events Instead of Year-Round Strategy!

Most taxpayers contact tax professionals only during filing season, missing numerous opportunities for tax reduction throughout the year. Strategic tax planning requires continuous monitoring and periodic adjustments.

Year-round planning opportunities:

• Quarterly estimated payment calculations

• Retirement account contribution timing

• Business equipment purchase optimization

• Tax-loss harvesting for investments

• Health savings account maximization

SmartVault's notification system alerts users to time-sensitive tax opportunities and ensures critical deadlines are never missed.

Mistake #4: Incomplete Information Sharing with Tax Professionals!

Taxpayers often withhold or forget to share relevant financial information during consultations. This incomplete disclosure prevents professionals from identifying all available deductions and credits.

Commonly omitted information:

• Side business or freelance income

• Investment account statements

• State tax nexus complications

• Foreign account ownership

• Cryptocurrency transactions

SmartVault's comprehensive document checklist ensures all relevant financial information reaches tax professionals before consultation sessions begin.

Implementing SmartVault: Immediate Action Steps!

Step 1: Schedule a SmartVault demonstration with Jose's Tax Service professional staff.

Step 2: Upload existing tax documents using the guided categorization system.

Step 3: Install the mobile application and configure automatic receipt capture.

Step 4: Establish document sharing permissions with your assigned tax professional.

Step 5: Review and organize historical tax records within the platform.

Cost Analysis: SmartVault Investment vs. Traditional Methods!

Traditional paper-based tax preparation typically costs taxpayers through:

• Lost deductions from missing receipts: $1,200 annually

• Extended preparation time fees: $300-600 per session

• Audit penalties from poor documentation: $500-2,000 potential

• Missed strategic planning opportunities: $1,500-4,000 annually

SmartVault subscription costs represent a fraction of these potential losses while providing comprehensive document security and professional collaboration tools.

Professional Recommendation from Jose's Tax Service!

Our certified tax professionals recommend SmartVault for all clients seeking maximum tax efficiency and audit protection. The platform's integration with our consultation process reduces preparation time and increases deduction identification accuracy.

Contact Jose's Tax Service today to:

• Schedule your SmartVault setup consultation

• Review current documentation practices

• Identify immediate tax-saving opportunities

• Establish year-round tax planning strategies

Remember: Tax season begins January 27, 2025. Document organization and professional consultation scheduling should commence immediately to ensure optimal preparation and maximum refund potential.

Visit Jose's Tax Service or call our New Haven office to begin your SmartVault implementation and comprehensive tax planning consultation.

Tags: Business taxes, Joses Tax service, New Haven Tax Preparation, New Haven tax preparer, Refund, Self-employed, Tax advisor, Tax Audit, Tax help, Tax planning, Year-End Tax Planning

Leave a Reply

You must be logged in to post a comment.