Amended Returns: Is It Too Late to Fix Last Year's Mistakes?

Look, we've all been there. You filed your taxes, breathed a sigh of relief, and then: weeks or even months later: you realize something wasn't quite right. Maybe you forgot to report some freelance income. Perhaps you missed a deduction that could have saved you hundreds of dollars. Or maybe you just flat-out made a math error.

Here's the good news for New Haven residents: it's probably not too late to fix it.

The IRS actually expects people to make mistakes. That's why they created a process for correcting your tax return after you've already filed. It's called an amended return, and understanding how it works can save you money, stress, and potential headaches down the road.

What Exactly Is an Amended Return?

An amended return is essentially a do-over for your taxes. When you discover an error on a tax return you've already submitted, you can't just log back into your tax software and change it. The original return is locked in. Instead, you file a completely separate form that corrects the mistakes.

The magic form you need is called Form 1040-X. This is the official IRS document used to make changes to your filing status, income, credits, or deductions after your original return has been processed.

Think of it like this: your original return is the first draft, and Form 1040-X is your revision. The IRS will review both and adjust your account accordingly.

When Should You File an Amended Return?

Not every mistake requires an amended return. The IRS actually catches and corrects some errors automatically: like basic math mistakes or missing forms that they already have copies of (like your W-2).

You should file an amended return when:

- You need to change your filing status (single, married filing jointly, head of household, etc.)

- You forgot to report income that wasn't automatically reported to the IRS

- You claimed credits or deductions you weren't entitled to

- You missed credits or deductions you were entitled to

- You made errors in the number of dependents claimed

You don't need to file an amended return when:

- You made simple math errors (the IRS typically corrects these)

- You forgot to attach a form that the IRS already has on file

- You need to correct your mailing address

If you're unsure whether your situation requires an amendment, that's exactly when you should reach out to a tax professional. Better to ask than to guess wrong.

The Timeline: How Long Do You Have?

Here's where a lot of people get surprised. You actually have a pretty generous window to fix your mistakes.

The IRS allows you to file an amended return within three years from the original filing deadline or two years from the date you paid the tax: whichever is later.

Let's break that down with a real example. For your 2024 tax return (the one you filed in early 2025), the original deadline was April 15, 2025. That means you have until April 15, 2028 to file an amended return for that tax year.

That's three full years to discover and correct mistakes. Not bad, right?

Important Timing Considerations

While you have three years to amend, that doesn't mean you should wait around. The timing of your amendment matters, especially depending on whether you'll owe more money or receive a bigger refund.

If your amendment means you owe more taxes:

File as soon as possible. Interest and penalties start accumulating from the original due date of the return. The longer you wait, the more you'll owe. Filing before the original April 15 deadline (if you catch the mistake early) can help you avoid penalties entirely.

If your amendment means you're getting a bigger refund:

You have more flexibility here. You won't lose your refund as long as you file within that three-year window. However, why leave money sitting with the IRS longer than necessary? File your amendment and get your money back.

Pro tip: The IRS recommends waiting until you receive your original refund before submitting an amendment. This helps avoid delays and confusion in processing.

How to File Form 1040-X

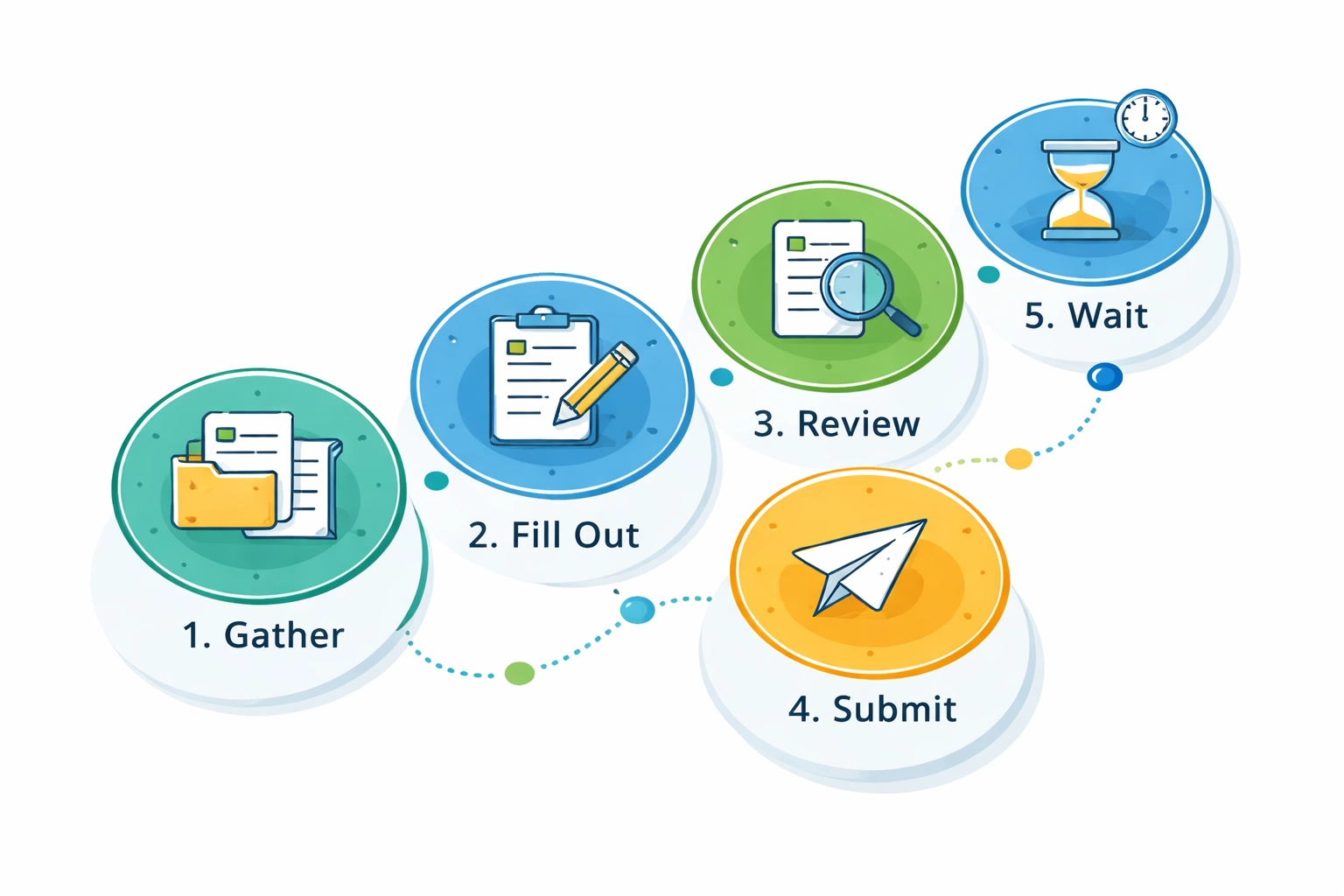

Filing an amended return is more involved than your original return, but it's absolutely doable. Here's the basic process:

Gather your original return. You'll need the information from your original filing to complete the amendment.

Get Form 1040-X. You can download it from the IRS website or use tax preparation software that supports amended returns.

Complete the form carefully. You'll enter your original figures, your corrected figures, and explain the changes you're making.

Attach supporting documents. Include any new forms, schedules, or documentation that supports your changes.

Submit the form. You can now e-file Form 1040-X for the current tax year and the two prior years. For older amendments, you may need to mail a paper form.

Double-check everything. Errors on your amendment can lead to further delays or additional problems.

What to Expect After Filing

Patience is key here. Amended returns take significantly longer to process than original returns.

Processing time for amended returns is typically up to 16 weeks. During peak tax season, it can take even longer. The IRS processes amended returns manually, which is why they take so much longer than electronically filed original returns.

You can track your amendment's status using the IRS "Where's My Amended Return?" tool on their website. This tool is available about three weeks after you file and provides updates throughout the processing period.

Important: Do not file a second amended return while your first one is still processing. This will only create more confusion and delays.

Common Mistakes That Lead to Amendments

Over the years at Jose's Tax Service, we've seen all kinds of errors that require amendments. Here are some of the most common ones:

Forgetting 1099 income. That freelance gig or side hustle income? The IRS knows about it. If you forgot to report it, they'll come looking.

Missing education credits. Many New Haven families qualify for education credits but forget to claim them.

Incorrect filing status. This is especially common for people whose marital status changed during the year.

Overlooked deductions. Charitable donations, medical expenses, home office deductions: these add up and are often forgotten.

Dependent errors. Claiming dependents incorrectly or forgetting to claim qualifying dependents can significantly impact your return.

How Jose's Tax Service Can Help

Let's be honest: filing an amended return isn't exactly fun. The form is more complex than your standard 1040, and getting it wrong can create even more problems.

That's where we come in.

At Jose's Tax Service, we help New Haven residents navigate the amendment process from start to finish. Whether you discovered an error yourself or received a notice from the IRS, our team can:

- Review your original return to identify all necessary corrections

- Prepare and file Form 1040-X accurately

- Ensure all supporting documentation is properly attached

- Help minimize any penalties or interest you may owe

- Track your amendment status and address any IRS follow-up

We've been helping families and small business owners in New Haven get their taxes right for years. If you think you may need to amend a prior return, don't stress about it. Reach out to us, and we'll get it sorted out together.

The Bottom Line

Mistakes happen. The important thing is that you fix them: and the IRS gives you a reasonable window to do exactly that. If you've realized something was wrong with last year's taxes (or even taxes from a few years ago), don't panic. You likely still have time to make it right.

File your amendment as soon as you can, especially if you owe additional taxes. And if the process feels overwhelming, remember that professional help is just a phone call away.

Got questions about amending your return? Stop by Jose's Tax Service or give us a call. We're here to help New Haven residents fix their tax mistakes and move forward with confidence.

Tags: Business taxes, Joses Tax service, New Haven Tax Preparation, New Haven tax preparer, Refund, Self-employed, Smart vault, Tax advisor, Tax Audit, Tax help, Tax planning, Year-End Tax Planning

Leave a Reply

You must be logged in to post a comment.