2026 Tax Planning Moves to Maximize Your Refund Before April 15

categories: [news, tax planning]

NEW HAVEN, CT , February 2026 , This tax season brings unprecedented opportunities for taxpayers to maximize their refunds. With an average $1,000 increase in refunds compared to previous years and approximately $60 billion in tax cuts hitting bank accounts this filing season, 2026 may deliver one of the best refund seasons in 15 years.

The April 15 deadline is approaching fast. Strategic tax planning now can mean hundreds, or even thousands, of extra dollars in your pocket. Use the steps below to maximize tax refund results before time runs out.

Review Your Deduction Strategy Immediately!

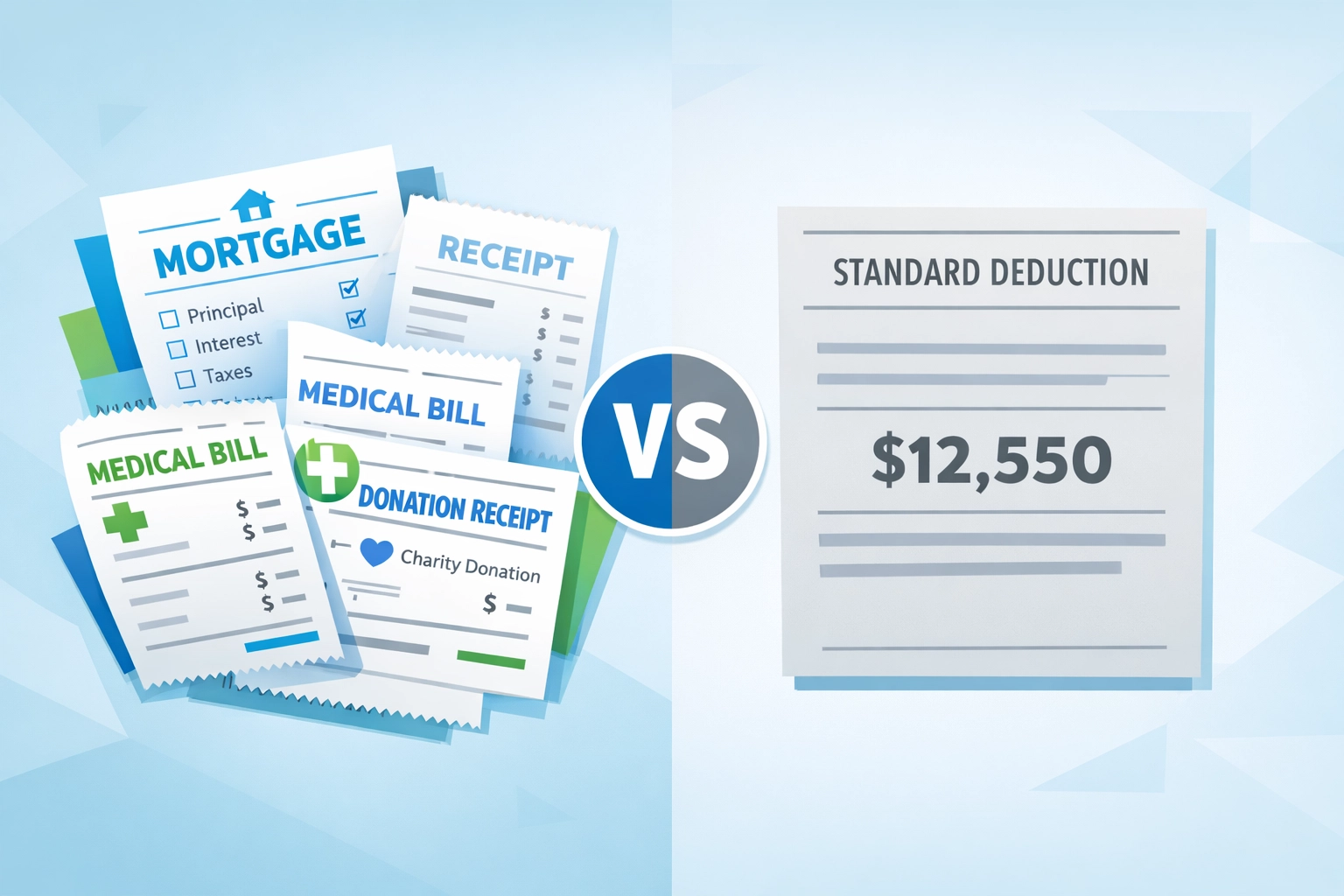

Standard deduction or itemized deductions? This question determines how much money you leave on the table.

The 2026 tax rules have increased the state and local taxes (SALT) cap, making itemizing more attractive than in previous years. New Haven taxpayers who previously took the standard deduction should reassess their situation immediately.

Itemizable expenses include:

- State and local taxes (property taxes, state income taxes)

- Mortgage interest on your primary residence

- Charitable donations to qualified organizations

- Medical and dental expenses exceeding 7.5% of your adjusted gross income

- Work-related expenses and job-related education costs

Run the numbers. If your total itemized deductions exceed the standard deduction for your filing status, you can significantly increase your refund. Keep all receipts, bills, and documentation, the Internal Revenue Service (IRS) may request verification during processing. This is a core tax planning step for anyone seeking tax preparation New Haven services.

Claim Every Available Tax Credit and New 2026 Deduction!

Tax credits reduce your tax bill dollar-for-dollar, making them more valuable than deductions. The 2026 tax law introduces new deductions not available in previous years, and the Child Tax Credit has been increased.

Priority credits to claim:

- Earned Income Tax Credit (EITC) , Income-based credit for working families

- Child Tax Credit , Increased amounts for qualifying dependents

- Child and Dependent Care Credit , For childcare expenses while you work

- Education credits , American Opportunity Tax Credit or Lifetime Learning Credit

- Residential Energy Credit , For qualifying energy-efficient home improvements

New for 2026: If you receive tips or overtime pay, document these carefully. New deductions for tip income, overtime wages, and work-related vehicle expenses are now available under the 2026 tax rules.

Missing even one eligible credit can cost you hundreds of dollars. Review your situation thoroughly or consult with a tax preparation professional who understands the latest regulations.

Make Last-Minute Retirement Contributions Before April 15!

You still have time to reduce your taxable income for 2025 by making contributions to tax-advantaged retirement accounts before the filing deadline.

Eligible accounts include:

- Traditional IRA , Contributions may be deductible depending on your income and workplace retirement plan coverage

- Health Savings Account (HSA) , Triple tax advantage for those with qualifying high-deductible health plans

- Self-Employed retirement plans , SEP-IRA or Solo 401(k) for business owners

The math is simple: Every $25 reduction in taxable income lowers your taxes by approximately $5. A $500 contribution could add roughly $100 to your refund. Maximize contributions within your financial capacity to boost your refund while building retirement security.

Execute Strategic Charitable Donations Now!

For taxpayers who itemize deductions, charitable giving reduces taxable income while supporting causes you care about. This strategy only works if your total itemized deductions exceed the standard deduction threshold.

Donation options include:

- Cash contributions to qualified 501(c)(3) organizations

- Property donations (clothing, furniture, vehicles)

- Stock or investment donations (may provide additional capital gains benefits)

Document all charitable contributions with receipts from the receiving organizations. The IRS requires written acknowledgment for donations of $250 or more. For property donations, maintain records of fair market value and item condition.

New Haven has numerous qualified charitable organizations. Strategic giving before April 15 can reduce your 2025 tax liability while making a meaningful impact in your community.

Organize Your Tax Documents Immediately to Avoid Costly Mistakes!

Filing rushed, incomplete returns is the fastest way to reduce your refund or trigger IRS penalties. Organize your documentation now: before the deadline pressure intensifies.

Required documents include:

- W-2 forms from all employers

- 1099 forms (interest, dividends, freelance income, unemployment benefits)

- 1098 forms (mortgage interest, student loan interest)

- Receipts for itemized deductions

- Records of estimated tax payments

- Prior year tax return for reference

Missing forms delay processing. Errors trigger audits. Incomplete documentation means missed deductions. Gather everything now to ensure accuracy and maximize your refund potential.

Plan Your Refund Allocation Strategy Before You File!

Most taxpayers wait until their refund arrives to decide how to use it. This reactive approach often results in spending rather than strategic financial improvement.

Recommended allocation framework:

- One-third toward highest-interest debt : Credit cards, personal loans, or other high-rate obligations

- One-third into emergency savings : Build or strengthen your financial safety net

- One-third toward financial goals : Down payment fund, investment account, or home improvements

This balanced approach addresses immediate financial pressures while building long-term security. Decide your allocation strategy before filing to avoid impulsive spending decisions.

Access Your Refund Faster With Modern Filing Options!

Traditional paper filing can delay your refund by weeks. Electronic filing with direct deposit provides the fastest access to your money.

Refund acceleration options include:

- E-file with direct deposit : Standard refund within 21 days of IRS acceptance

- Refund Advance programs : Receive up to $4,000 upon IRS acceptance through participating tax preparation services

- Early refund access : Some services offer access to federal refunds up to five days early

Speed matters when you're counting on refund dollars for bills, debt payments, or planned purchases. Choose filing methods that prioritize fast, secure refund delivery.

Why New Haven Taxpayers Choose Jose's Tax Service for Maximum Refunds

Tax laws change constantly. The 2026 modifications present opportunities: but only if you know how to claim them. Missing deductions, overlooking credits, or making filing errors can cost you hundreds or thousands of dollars.

Jose's Tax Service provides New Haven taxpayers with:

- Expert knowledge of 2026 tax law changes : Including new deductions for tips, overtime, and increased credits

- Year-round tax planning support : Not just April scrambling, but strategic guidance throughout the year

- $0 upfront payment options : Making professional tax preparation accessible without immediate out-of-pocket costs

- Refund optimization strategies : Identifying every eligible deduction and credit to maximize your return

Professional tax preparation pays for itself when it uncovers deductions and credits you would have missed. With potential refunds averaging $1,000 higher this year, expert guidance ensures you capture every dollar you've earned.

File Before April 15 to Maximize Your 2026 Refund!

The deadline approaches. Every day of delay increases your risk of rushed filing, missed deductions, and reduced refunds.

Take action now:

- Gather all tax documents and receipts

- Calculate whether itemizing deductions exceeds your standard deduction

- Make final retirement account contributions if beneficial

- Review eligibility for all 2026 tax credits

- Organize charitable donation documentation

- Choose your refund allocation strategy

- File electronically with direct deposit for fastest processing

This year's tax season offers exceptional refund potential for taxpayers who file strategically. Don't leave money on the table. Plan now, file accurately, and maximize your 2026 refund before the April 15 deadline.

Need expert guidance to capture every available dollar? Contact Jose's Tax Service today for tax preparation New Haven clients can rely on, plus year-round tax planning to help maximize tax refund outcomes while ensuring full compliance with 2026 tax regulations. New Haven's trusted tax professionals are ready to help you navigate this year's exceptional refund opportunities.

Leave a Reply

You must be logged in to post a comment.