IRS Is Phasing Out Paper Refund Checks: How Your New Haven Tax Preparer Can Set Up Fast Direct Deposit

The Paper Check Era is Over!

Effective September 30, 2025, the IRS officially phased out paper refund checks for individual taxpayers. If you're filing your 2025 tax return during this 2026 filing season, your refund will be delivered electronically: no exceptions for most filers.

This isn't a drill. The days of waiting by your mailbox for that government-issued check are done. For New Haven taxpayers still clinging to the old paper check system, it's time to make the switch. The good news? Direct deposit is faster, safer, and ridiculously easy to set up when you work with the right tax preparation service.

Why the IRS Made This Move

The shift to mandatory electronic refunds isn't arbitrary bureaucracy. The numbers tell the story:

Paper checks are over 16 times more likely to be lost, stolen, altered, or delayed compared to electronic payments. That's not a typo: sixteen times. Every tax season, thousands of taxpayers experience the frustration of missing checks, fraud attempts, and delivery delays that can stretch for months.

During the 2025 tax season alone, 93% of refunds were already issued through direct deposit. The IRS simply formalized what most Americans were already doing. By eliminating paper checks, the agency reduces fraud risk, speeds up processing times, and saves taxpayer money on printing and postage costs.

Direct Deposit Speed vs. Paper Checks: The Real Numbers

Here's what you need to know about refund timing in 2026:

Electronic refunds (direct deposit): Issued in less than 21 days when you file electronically, choose direct deposit, and have no issues with your return.

Paper checks: Required 6 weeks or longer for delivery: and that's assuming the check doesn't get lost in transit, stolen from your mailbox, or delivered to the wrong address.

For New Haven residents filing through Jose's Tax Service, most clients who e-file with direct deposit see their refunds within 10-14 days. That's money back in your account faster, giving you the financial flexibility you need without the wait.

How to Set Up Direct Deposit for Your Tax Refund

Setting up direct deposit is straightforward. You'll need three pieces of information when filing your 2025 tax return:

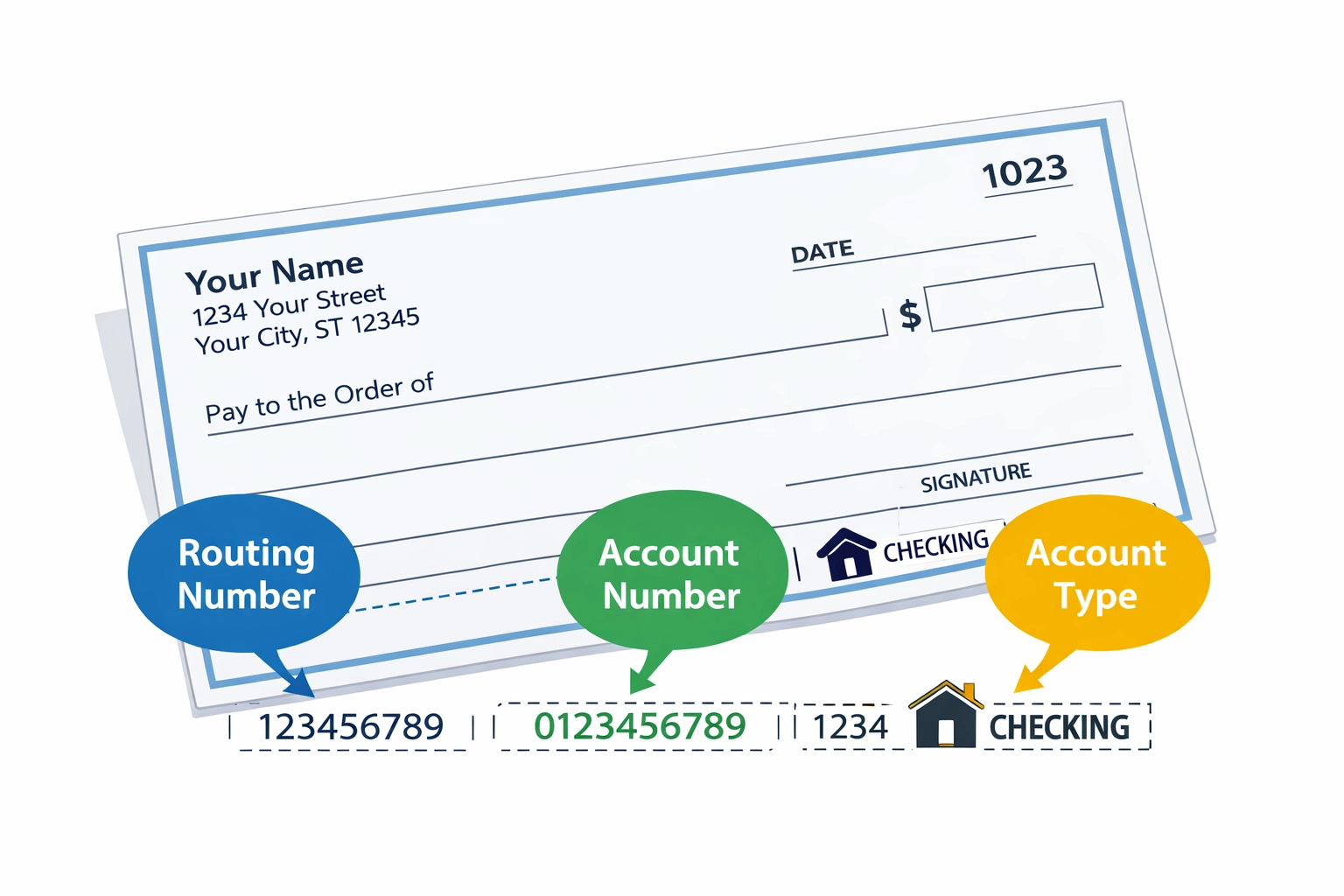

- Your bank account number

- Your bank's routing number (usually a 9-digit number found on the bottom left of your checks)

- The type of account (checking or savings)

Double-check these numbers before submitting your return. A single digit error can delay your refund by weeks or result in the IRS sending you a notice requesting corrected information.

Where to Find Your Banking Information

- Check your bank statement: Both account and routing numbers appear on monthly statements

- Look at a personal check: The routing number is the first 9-digit number on the bottom left; your account number follows

- Call your bank: Customer service can verify your routing and account numbers

- Check your bank's website: Most online banking platforms display this information in account details

Pro tip: Screenshot or write down your routing and account numbers before your tax appointment. This saves time and ensures accuracy when your tax preparer enters the information.

What Happens If You Don't Have a Bank Account?

The IRS isn't leaving unbanked taxpayers behind. If you don't have access to a traditional checking or savings account, you have alternatives:

Prepaid debit cards designed for tax refunds can receive direct deposits. Many of these cards have no monthly fees and can be used anywhere debit cards are accepted.

Digital wallets are also approved for receiving IRS refunds. Check with the IRS for the current list of approved digital payment platforms.

Community banking options exist throughout Connecticut. The IRS recommends visiting FDIC: GetBanked and MyCreditUnion.gov to explore free or low-cost account options. Many credit unions in the New Haven area offer second-chance checking accounts with minimal fees.

Paper checks will only be issued in extremely limited exceptional circumstances, such as documented extreme hardship or specific legal requirements where absolutely no electronic option exists. These situations are rare and require additional documentation.

Form 8888 Changes: No More Paper Check Option

Beginning with the 2026 filing season, Form 8888 (Allocation of Refund) no longer lists paper check as a refund delivery option. This form allows you to split your refund into multiple accounts: up to three different destinations: but all must be electronic deposits.

If you previously used Form 8888 to direct part of your refund to a paper check, you'll need to provide alternative banking information this year.

What If You Don't Provide Banking Information?

File your return without direct deposit details, and the IRS will respond with a CP53E notice. This notice requests either the missing banking information or an explanation for why you cannot provide it.

Responding to a CP53E notice adds weeks to your refund timeline. The IRS must receive your response, process it manually, verify your banking information, and then issue the refund. What could have taken 2-3 weeks now stretches to 6-8 weeks or longer.

Skip this headache. Provide your direct deposit information when you file.

How Jose's Tax Service Handles Direct Deposit Setup

At Jose's Tax Service, we make direct deposit setup part of every tax preparation appointment. Here's what that looks like:

No upfront fees. We don't charge you a penny until your tax return is complete and ready to file. Bring your banking information to your appointment, and we'll verify the numbers with you before submission.

Personalized care. We take the time to explain exactly where your refund is going and walk you through the timeline. No confusing jargon, no rushing through the process.

Competitive rates. Tax preparation shouldn't cost more than your refund. Our pricing is transparent and fair for New Haven residents and small business owners.

Same-day appointments available. Need to file quickly? We offer flexible scheduling to get your return processed fast.

During your appointment, we'll enter your banking information directly into your tax return, review it with you for accuracy, and e-file your return. Most clients walk out knowing their refund is on the way within days: not weeks.

Security Concerns About Direct Deposit

Some New Haven taxpayers worry about providing bank account information for direct deposit. These concerns are understandable but largely unfounded when you file through a reputable tax preparer.

Direct deposit is more secure than paper checks. Your banking information is encrypted during transmission to the IRS and protected under federal privacy laws. Meanwhile, paper checks can be intercepted, forged, or stolen from mailboxes.

The IRS uses bank-level security protocols for all electronic refunds. Once your refund is deposited, it's in your account: no waiting, no wondering if the check will arrive.

Never provide banking information via email or phone unless you initiated the contact. Legitimate tax preparers, including Jose's Tax Service, collect this information in person during your appointment or through secure client portals.

Important 2026 Filing Season Deadlines

Mark these dates on your calendar:

April 15, 2026: Federal tax return deadline for most individual taxpayers.

October 15, 2026: Extended deadline if you file for an extension by April 15.

File early to receive your refund early. The IRS processes returns in the order received. February and early March filers typically see refunds before the April rush begins.

Maximize Your Refund with Professional Tax Preparation in New Haven

The switch to mandatory direct deposit is just one change in an increasingly complex tax landscape. Professional tax preparation in New Haven ensures you're not just getting your refund fast: you're maximizing every dollar you're entitled to receive.

Jose's Tax Service specializes in identifying deductions and credits many DIY filers miss. From Connecticut-specific tax breaks to federal credits for education, childcare, and energy-efficient home improvements, we review your entire financial picture to maximize your refund.

Schedule your appointment today. Bring your W-2s, 1099s, receipts for deductions, and your banking information for direct deposit setup. We'll handle the rest.

Visit josestaxservice.com to book your tax preparation appointment or call for same-day availability. No upfront costs, personalized service, and the fastest refund delivery available in 2026.

The Bottom Line

Paper refund checks are officially history. Direct deposit is now the standard: and for good reason. It's faster, more secure, and eliminates the anxiety of waiting for a check that might never arrive.

For New Haven taxpayers filing in 2026, the transition to electronic refunds is smooth when you work with experienced tax professionals. Bring your banking information to your appointment, verify the numbers for accuracy, and watch your refund hit your account in less than three weeks.

The IRS has modernized refund delivery. Make sure your tax preparation keeps pace. Jose's Tax Service is ready to help you navigate the 2026 filing season with confidence, speed, and maximum refund potential.

Don't wait until the April deadline. File early, choose direct deposit, and get your money back where it belongs: in your account, earning interest or paying down debt, not lost in the mail system.

Leave a Reply

You must be logged in to post a comment.