7 Mistakes New Haven Taxpayers Are Making with Payment Apps (And How Concierge Tax Pros Fix Them)

New Haven, CT – February 10, 2026 – The IRS is watching your Venmo. Your Cash App transactions. That $600 you got from your cousin for selling furniture on Facebook Marketplace. If you're using payment apps and not tracking them properly, you're setting yourself up for a world of hurt come April 15.

Here's the reality: In 2024, the IRS started requiring payment platforms to report transactions over $600. That means your side hustle, your freelance gigs, and yes, even that Etsy shop you "casually" run are now on the IRS radar.

Most New Haven taxpayers are making critical mistakes with these apps: and they don't even know it yet. Here are the seven biggest ones we're seeing at Jose's Tax Service, and how our concierge tax preparation approach fixes them before they become problems.

Mistake #1: Treating All Payment App Money as "Personal"

The Problem: You received $8,000 through Venmo this year. Half was genuine reimbursements from friends (dinner splits, concert tickets). The other half was payment for graphic design work. You mark it all as "friends and family" and assume you're good.

Why It's Dangerous: The IRS received a 1099-K from Venmo showing $8,000 in transactions. On your tax return, you report $4,000 in freelance income. The IRS computer system flags the discrepancy. Now you're looking at a CP2000 notice, basically an IRS letter saying "we think you owe us money."

How We Fix It: Our tax preparation process in New Haven starts with a payment app audit. We review your transaction history across all platforms: Venmo, Cash App, PayPal, Zelle: and correctly categorize business versus personal transactions. We document reimbursements with supporting evidence and report actual business income accurately. This eliminates discrepancies before filing.

Mistake #2: Not Tracking Business Expenses for App-Based Income

The Problem: You made $12,000 driving for Uber and DoorDash, paid through their apps. You report the full amount as income but don't deduct your mileage, phone bills, or car maintenance because "it's too complicated."

The Tax Hit: At a 22% tax bracket, you're paying $2,640 in taxes. With proper expense tracking, your actual taxable income might be $6,000: cutting your tax bill to $1,320. You just left $1,320 on the table.

How We Fix It: Jose's Tax Service specializes in gig economy tax preparation. We reconstruct your deductible expenses even if you didn't track them perfectly. Using IRS-approved methods, we calculate your standard mileage deduction (67 cents per mile for 2026), home office deductions, and business use of phone. We maximize your refund legally and defensibly.

Mistake #3: Ignoring the $600 Reporting Threshold

The Problem: You sold handmade jewelry through Instagram and received $4,800 in payments via PayPal Goods & Services. You think "it's just a hobby" and don't report it.

Reality Check: PayPal sent you a 1099-K. The IRS has a copy. This isn't optional income: it's reportable income. Failing to report it is considered tax evasion.

How We Fix It: During tax planning sessions, we identify all your income sources: including those "hobby" businesses. We determine whether your activity qualifies as a business (allowing deductions) or hobby income (limited deductions). For New Haven small business owners, we structure your entity correctly to minimize tax liability while staying compliant.

Mistake #4: Mixing Business and Personal Transactions in One Account

The Problem: Your Venmo account receives rent from your roommate ($800/month), payment for freelance consulting ($3,000), birthday money from grandma ($200), and proceeds from selling your old furniture ($600).

The Nightmare: Come tax time, you can't remember which transactions were taxable business income versus non-taxable personal transfers. You either over-report (paying too much tax) or under-report (risking audit and penalties).

How We Fix It: Our concierge tax service includes bookkeeping assistance. We help New Haven taxpayers separate business and personal finances from day one. For clients who've already mixed transactions, we perform forensic accounting to reconstruct the actual business income using bank statements, invoices, and transaction descriptions.

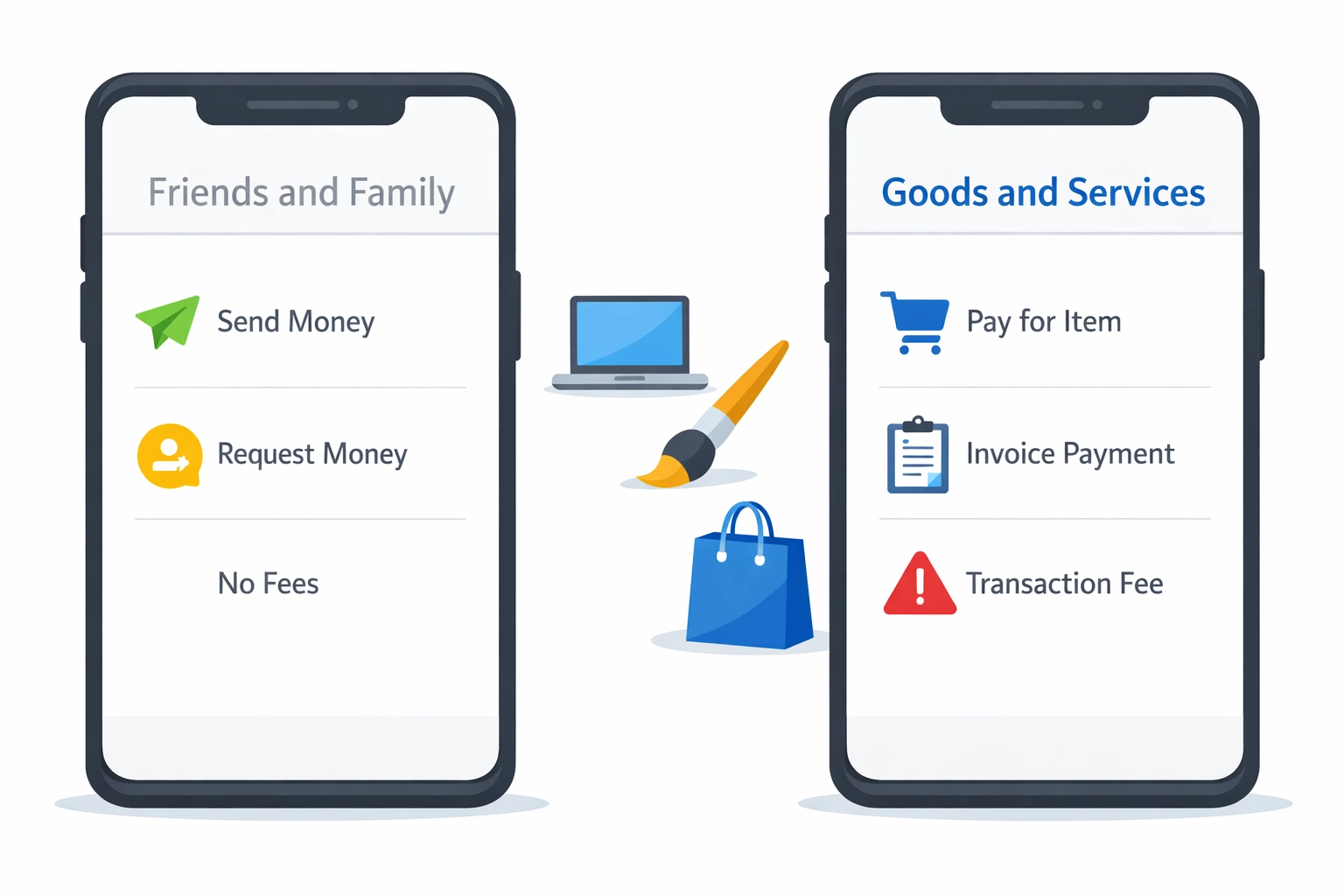

Mistake #5: Not Understanding "Goods and Services" vs. "Friends and Family"

The Problem: Your client pays you $2,500 for web design work via PayPal. To "save on fees," you ask them to send it as "friends and family." They comply.

Why This Backfires: The IRS specifically looks for this pattern. When your business activity shows evidence of income (you have a website, business cards, advertising), but your payment apps show no business transactions, it raises red flags. Additionally, you lose buyer/seller protection, and if audited, this looks like intentional tax evasion.

How We Fix It: We educate clients on proper transaction categorization and help them set up legitimate business accounts with payment processors. For tax preparation, we ensure all business income is properly reported regardless of how it was categorized in the app. We document everything to withstand IRS scrutiny.

Mistake #6: Forgetting About State Taxes on App Income

The Problem: You're a Connecticut resident who properly reports your $15,000 in Cash App business income on your federal return. You forget that Connecticut also taxes this income: and Connecticut has its own reporting requirements.

The Connecticut Factor: Connecticut's Department of Revenue Services (DRS) receives payment app data too. Failing to report on your CT state return can trigger a state audit, penalties, and interest.

How We Fix It: Jose's Tax Service handles both federal and Connecticut state returns simultaneously. We ensure your payment app income is properly reported on both returns, taking advantage of Connecticut-specific deductions and credits. Our New Haven location means we're intimately familiar with Connecticut tax law and DRS procedures.

Mistake #7: Not Keeping Records When the IRS Comes Calling

The Problem: You receive an IRS notice questioning $10,000 in Venmo income. You deleted the app six months ago. Your bank statements show deposits but not transaction details. You have no receipts, no invoices, no documentation.

The Consequences: Without documentation, the IRS assumes the entire amount is taxable income with no deductible expenses. You're liable for taxes, penalties (20-25% of underpayment), and interest.

How We Fix It: Our tax preparation service includes document retention planning. We advise clients on what to keep, how long to keep it, and how to organize it. For clients facing IRS inquiries, we handle all correspondence and reconstruct transaction histories using bank records, payment app data exports, and third-party documentation.

When the IRS sends that letter, you don't face it alone: you have Jose's Tax Service representing you with documentation and expertise.

The Concierge Difference: Proactive Tax Planning for New Haven's Digital Economy

Here's what makes Jose's Tax Service different: We don't just prepare your return in April and disappear. Our concierge tax preparation model means:

Year-Round Support: Call us in July when you're not sure if that eBay sale is taxable. We're here.

Quarterly Check-Ins: We review your payment app activity quarterly and adjust estimated tax payments to avoid surprises in April.

Same-Day Appointments: Need to discuss your gig income before making a business decision? We offer same-day consultations for New Haven clients.

Audit Protection: If the IRS questions your payment app income, we handle all communication and documentation.

Technology Integration: We can directly import data from QuickBooks, payment apps, and accounting software: no more manual entry mistakes.

Take Action Before April 15

Tax season 2026 is different. The IRS has more data, better technology, and increased enforcement around payment apps and gig economy income. Making these seven mistakes won't just cost you money: it could trigger audits, penalties, and years of IRS headaches.

The good news? You still have time to fix this.

Schedule your tax planning consultation with Jose's Tax Service today. We'll review your payment app activity, identify potential issues, and create a strategy to maximize your refund while minimizing audit risk.

Don't wait until April 14 to discover you've been under-reporting income all year. Let New Haven's concierge tax preparation experts handle it correctly from the start.

Visit josestaxservice.com or call us to book your same-day appointment. Because when it comes to payment apps and taxes, what you don't know absolutely can hurt you.

Leave a Reply

You must be logged in to post a comment.