Maximize Your Tax Refund in 2026: 7 Mistakes You're Making (and How to Fix Them)

New Haven, CT – February 3, 2026 , Tax season is officially here, and millions of Americans are leaving money on the table. The IRS predicts larger refunds this year due to new tax law changes, with the average filer expected to see approximately $1,000 more in their pocket. But only if you file correctly.

Many taxpayers in the New Haven area and across Connecticut make critical errors that cost them hundreds, even thousands, of dollars in potential refunds. These mistakes are preventable. Here are the seven most common tax filing errors and exactly how to fix them before you submit your 2026 return.

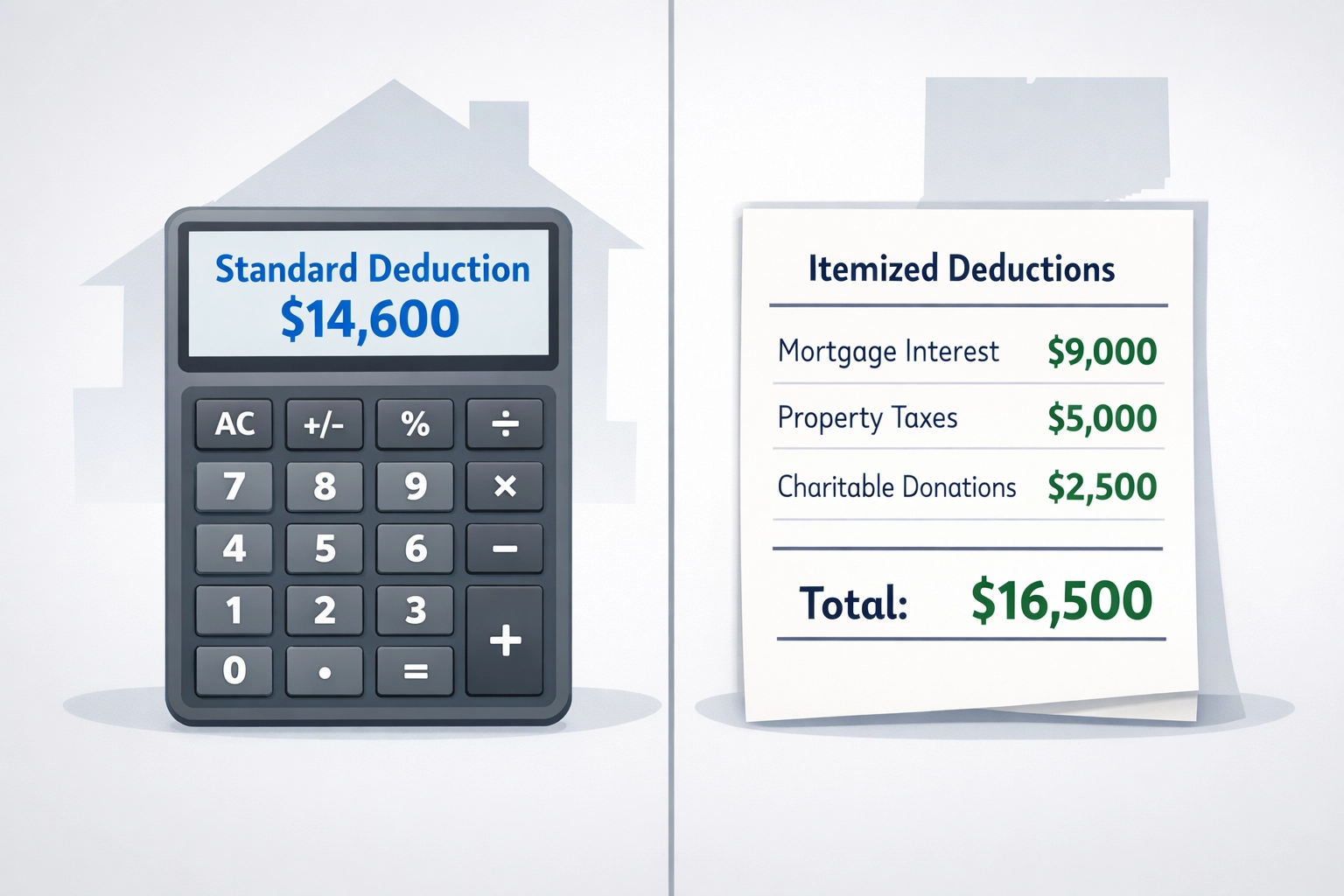

Mistake #1: Taking the Standard Deduction Without Considering Itemization

Most taxpayers automatically select the standard deduction without running the numbers on itemized deductions. This is a costly oversight.

The fix: Calculate both options before filing. The 2026 tax law increased the State and Local Tax (SALT) deduction cap, making itemization more beneficial for Connecticut residents who previously hit the limit.

Review these deductible expenses:

- State and local taxes paid

- Mortgage interest on your primary residence

- Charitable donations (including cash and non-cash contributions)

- Medical expenses exceeding 7.5% of your adjusted gross income

- Property taxes

For New Haven homeowners with significant property taxes and mortgage interest, itemizing often yields substantially larger refunds than the standard deduction. Run both calculations or consult with a tax professional who offers refund optimization services.

Mistake #2: Missing New Deductions Specific to 2026

The 2026 tax legislation introduced deductions that didn't exist in previous years. Many taxpayers are completely unaware these exist.

The fix: Determine if you qualify for these new deductions:

Overtime pay deduction – A portion of overtime earnings may now be deductible. Request documentation from your employer showing overtime hours and pay.

Tip income deduction – Workers in tipping industries (restaurants, salons, delivery services) can deduct part of their tip income. Maintain detailed records of all tips received and reported.

Car loan interest deduction – If you use your vehicle for work-related purposes, you may deduct a portion of your auto loan interest. Keep mileage logs and loan statements.

Contact your HR department for necessary documentation. These deductions require specific forms and detailed record-keeping to withstand IRS scrutiny.

Mistake #3: Failing to Maximize Tax-Advantaged Accounts

Contributions to retirement and health savings accounts reduce your taxable income directly. Yet countless taxpayers don't maximize these opportunities.

The fix: Review your contributions to these accounts before filing:

- 401(k) plans – Check if you contributed the maximum allowed

- Traditional IRAs – Contributions may still be deductible depending on income and employer plan participation

- Health Savings Accounts (HSAs) – Triple tax advantage (deductible contribution, tax-free growth, tax-free withdrawals for medical expenses)

You can make IRA contributions for the 2026 tax year until the filing deadline in April 2027. If you haven't maxed out your IRA, you still have time to reduce your 2026 tax liability and increase your refund.

Mistake #4: Not Claiming All Eligible Tax Credits

Tax credits are more valuable than deductions. Credits reduce your tax bill dollar-for-dollar, while deductions only reduce taxable income. Many taxpayers overlook credits they're entitled to claim.

The fix: Verify you're claiming these credits if eligible:

Child Tax Credit – Recently increased amounts per qualifying child. You'll need Social Security numbers for all dependents.

Child and Dependent Care Credit – Covers expenses for care that allows you to work. Requires provider tax ID numbers.

Earned Income Tax Credit (EITC) – Designed for low-to-moderate income workers. Many eligible taxpayers don't claim it.

Education credits – American Opportunity Credit and Lifetime Learning Credit for college expenses. Cannot claim both in the same year.

Energy credits – Home energy improvements may qualify for substantial credits in 2026.

Credits directly reduce the amount of tax you owe. Missing a single credit can cost you thousands in refund money.

Mistake #5: Filing Under the Wrong Status or Not Claiming Dependents

Your filing status dramatically affects your tax bracket, standard deduction amount, and credit eligibility. Using the incorrect status or failing to claim eligible dependents is leaving money unclaimed.

The fix: Verify your filing status is accurate for your situation:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Surviving Spouse

Head of Household status provides better tax rates and higher standard deductions than Single status, but requires specific qualifications. Review the IRS criteria carefully.

Claim all eligible dependents, including children born in 2026. Obtain Social Security numbers for new babies before filing to claim the Child Tax Credit.

Mistake #6: Waiting Until the Last Minute to File

Procrastination leads to mistakes. Rushing through your tax return at the deadline increases errors that reduce your refund or trigger audits.

The fix: Start your tax preparation now. Gather these documents immediately:

- W-2 forms from all employers

- 1099 forms for interest, dividends, and contract work

- Receipts for deductible expenses

- Previous year's tax return for reference

- Records of estimated tax payments made

Organize everything into labeled folders (physical or digital). Double-check that all income is reported and all deductions are supported by documentation.

Early filing also means earlier refunds. The IRS typically processes returns within 21 days, putting money back in your pocket faster.

Mistake #7: Not Planning Income Timing Strategically

If you have control over when you receive certain income, strategic timing can reduce your overall tax liability and increase your refund.

The fix: Consider these income timing strategies:

Delay year-end bonuses – If a bonus would push you into a higher tax bracket, request payment in early 2027 instead.

Accelerate deductions – Make January mortgage payments or charitable donations in December to claim them in the current tax year.

Manage freelance invoicing – Independent contractors and small business owners can control when they invoice clients and receive payment.

Defer capital gains – Hold investments slightly longer to push gains into the next tax year if beneficial.

This requires planning before year-end, but the tax savings can be substantial. Concierge tax planning services help you develop these strategies year-round, not just at tax time.

Take Action Now!

The difference between a modest refund and a maximum refund often comes down to these seven mistakes. Don't leave money on the table in 2026.

If you're in the New Haven area and want to ensure you're capturing every deduction and credit you're entitled to, professional tax preparation offers peace of mind and typically pays for itself through refund optimization.

The IRS filing deadline approaches quickly. Gather your documents, review these seven mistakes, and file accurately to claim your maximum refund. Your wallet will thank you.

Need help maximizing your 2026 refund? Visit Jose's Tax Service for expert tax preparation and concierge tax planning services designed to get you every dollar you deserve.

Leave a Reply

You must be logged in to post a comment.