7 Mistakes You're Making with Your 2026 Tax Return (and How to Fix Them)

New Haven, CT : January 2026 : The 2026 tax filing season is officially underway. Millions of taxpayers across the country are preparing their returns, and many will make costly errors that delay refunds, trigger audits, or leave money on the table.

The IRS processes over 150 million individual tax returns each year. A significant percentage contain preventable mistakes. These errors cost taxpayers time, money, and unnecessary stress.

This guide identifies the seven most common tax return mistakes for the 2026 filing season and provides clear instructions on how to avoid them.

Mistake #1: Filing Before You Have All Your Documents!

The problem: Eager taxpayers rush to file in late January before receiving all required tax documents. This includes W-2 forms from employers, 1099-NEC forms from freelance work, 1099-INT from banks, and 1099-DIV from investment accounts.

Filing an incomplete return creates serious complications. You may need to file an amended return (Form 1040-X), which delays your refund by several months. Incomplete filings also raise red flags with the IRS.

How to fix it:

- Wait until mid-February before filing to ensure all documents arrive

- Create a checklist of expected tax forms based on last year's return

- Cross-reference your income sources against received documents

- Contact employers or financial institutions if forms are missing by February 15

Deadline reminder: Most employers and financial institutions must mail tax forms by January 31, 2026. Allow 7-10 business days for delivery.

Mistake #2: Entering Incorrect Social Security Numbers!

The problem: A single wrong digit in a Social Security number (SSN) causes immediate rejection of your return. This error commonly occurs when claiming dependents, especially children. The IRS computer system automatically rejects returns with mismatched SSN information.

Rejected returns delay refunds by weeks. If you're claiming the Child Tax Credit or Earned Income Tax Credit (EITC), incorrect SSNs may disqualify you from receiving these valuable credits.

How to fix it:

- Compare every SSN on your return against official Social Security cards

- Never enter SSNs from memory

- Double-check dependent information against birth certificates and Social Security cards

- Review prior-year returns to verify consistency

Warning: Intentionally using incorrect SSNs may constitute fraud and can result in penalties up to $5,000 per occurrence.

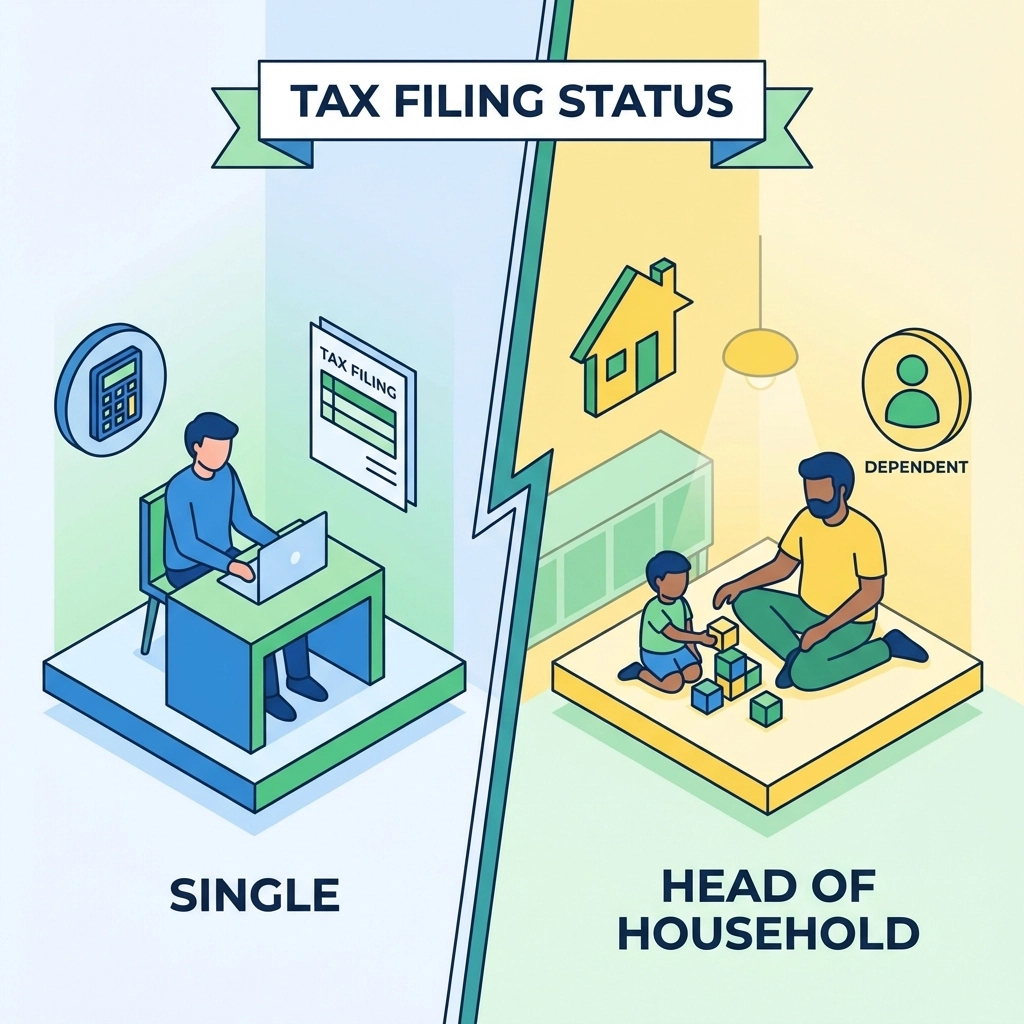

Mistake #3: Selecting the Wrong Filing Status!

The problem: Your filing status determines your tax bracket, standard deduction amount, and eligibility for certain credits. The IRS offers five filing status options:

- Single

- Married Filing Jointly (MFJ)

- Married Filing Separately (MFS)

- Head of Household (HOH)

- Qualifying Surviving Spouse

Many taxpayers who qualify for Head of Household status incorrectly file as Single. This mistake can cost thousands of dollars. Head of Household status provides a larger standard deduction ($21,900 for 2026 versus $14,600 for Single filers) and more favorable tax brackets.

How to fix it:

- Review IRS Publication 501 for filing status requirements

- Determine if you qualify for Head of Household by meeting these criteria:

- You are unmarried or considered unmarried on the last day of the year

- You paid more than half the cost of keeping up a home for the year

- A qualifying person lived with you for more than half the year

- Consult a tax professional if your marital or family situation changed during 2026

Mistake #4: Making Basic Math Errors!

The problem: The IRS identified nearly 2.5 million math errors on returns filed in recent tax years. These range from simple addition mistakes to selecting incorrect values from tax tables. Math errors delay processing and may result in penalties if they cause underpayment.

How to fix it:

- Use tax preparation software that automatically performs calculations

- If filing manually, verify each calculation with a calculator

- Double-check all transferred amounts between forms and schedules

- Review your final return before submission

Important: The IRS corrects obvious math errors but does not notify you of the correction. You may receive a different refund amount than expected without explanation.

Mistake #5: Entering Wrong Bank Account Information!

The problem: Direct deposit errors are among the most frustrating tax mistakes. A single typo in your routing number or account number can send your refund to the wrong account. Recovery may take months and require coordination between the IRS and multiple financial institutions.

If your refund is deposited into someone else's account, you must work with their bank to recover the funds. This process can take 6-12 weeks.

How to fix it:

- Locate your routing and account numbers on a check or bank statement

- Verify numbers directly with your bank or credit union before filing

- Enter numbers three times and compare each entry

- Consider paper check delivery if you're uncertain about account information

Tip: The routing number is typically nine digits. Account numbers vary in length by institution. Do not confuse your debit card number with your account number.

Mistake #6: Missing Credits and Deductions You Qualify For!

The problem: The IRS does not correct your return if you fail to claim eligible deductions and credits. You must identify and claim these tax benefits yourself. Many taxpayers leave significant money on the table by overlooking available credits.

Commonly missed credits and deductions for 2026 include:

- Child and Dependent Care Credit : Up to $3,000 for one qualifying individual or $6,000 for two or more

- Lifetime Learning Credit : Up to $2,000 per return for qualified education expenses

- Saver's Credit : Up to $1,000 ($2,000 if married filing jointly) for retirement contributions

- Home Office Deduction : Available for self-employed individuals with dedicated workspace

- Student Loan Interest Deduction : Up to $2,500 for qualified interest payments

- Energy Efficient Home Improvement Credit : Up to 30% of costs for qualifying improvements

How to fix it:

- Answer all questions in your tax software completely and accurately

- Review life changes from the past year (new job, new baby, home purchase, education expenses)

- Research credits related to your specific situation

- Work with a qualified tax professional to identify all eligible deductions

2026 Update: Income limits and credit amounts have been adjusted for inflation. Credits you didn't qualify for in previous years may now be available.

Mistake #7: Underreporting or Failing to Report All Income!

The problem: The IRS receives copies of every W-2, 1099, and K-1 form issued in your name. Their computer systems automatically compare reported income against these documents. Discrepancies trigger notices, audits, and penalties.

Many taxpayers incorrectly believe small amounts of side income don't need to be reported. This is false. All income must be reported, including:

- Freelance and gig economy earnings

- Cash payments for services

- Online marketplace sales (if exceeding $600)

- Rental income

- Cryptocurrency transactions

- Investment gains and dividends

- Gambling winnings

How to fix it:

- Report all income regardless of whether you received a tax form

- Track side income throughout the year using a spreadsheet or accounting app

- Report cryptocurrency sales on Form 8949 and Schedule D

- Include income from all states if you worked remotely or traveled for work

Warning: Underreporting income may result in accuracy-related penalties of 20% of the underpaid tax, plus interest. Intentional underreporting can result in fraud penalties up to 75%.

Take Action Before Filing!

Tax law changes frequently. The 2026 tax year includes updated standard deductions, adjusted income thresholds, and modified credit amounts. What worked on your 2025 return may not apply this year.

Before you file:

- Gather all tax documents and verify completeness

- Review filing status options carefully

- Identify all credits and deductions you may qualify for

- Double-check all personal information and bank details

- Report all income sources accurately

Need professional assistance? The tax professionals at Jose's Tax Service can review your return for errors, identify missed deductions, and ensure accurate filing. Don't leave money on the table or risk costly mistakes.

Filing deadline reminder: Individual tax returns for 2026 are due April 15, 2027. Extensions may be requested using Form 4868, but this extends filing time only( not payment deadlines.)

Tags: Business taxes, Joses Tax service, New Haven Tax Preparation, New Haven tax preparer, Refund, Self-employed, Smart vault, Tax advisor, Tax Audit, Tax help, Tax planning, Year-End Tax Planning

Leave a Reply

You must be logged in to post a comment.