Are You Making These 5 Tax Planning Mistakes? New Haven Business Owners Share What They Learned

NEW HAVEN, CT – January 8, 2026 – Local business owners across New Haven County are sharing hard-learned lessons from their tax planning experiences, revealing five critical mistakes that cost them thousands of dollars in penalties, missed deductions, and audit complications.

After analyzing dozens of cases from the 2025 tax season, these recurring errors continue to plague small business operations throughout Connecticut. Each mistake carries significant financial consequences that can be avoided with proper planning and implementation.

Mistake #1: Mixing Personal and Business Expenses

The Problem: Sarah Mitchell, owner of a New Haven marketing consultancy, learned this lesson the hard way when the IRS questioned $12,000 in business deductions during a 2024 audit.

"I was using my personal credit card for everything," Mitchell explains. "Business lunches, office supplies, even client entertainment – it was all mixed together. When the auditor asked for documentation, I couldn't clearly separate what was legitimate business expense versus personal spending."

Financial Impact: Mixing personal and business expenses creates several costly problems:

- Increased audit risk due to unclear expense categorization

- Lost deductions when documentation cannot support business purpose

- Potential penalties for incorrect reporting

- Additional accounting costs to reconstruct proper records

Action Steps to Avoid This Mistake:

- Open separate business bank accounts immediately – Use dedicated checking and savings accounts exclusively for business transactions

- Obtain business credit cards – Apply for cards specifically designated for business use only

- Implement expense tracking systems – Use accounting software like QuickBooks or similar platforms to categorize expenses automatically

- Establish reimbursement procedures – If personal funds must cover business expenses, document and reimburse through proper business channels

- Review statements monthly – Conduct regular reviews to ensure proper separation is maintained

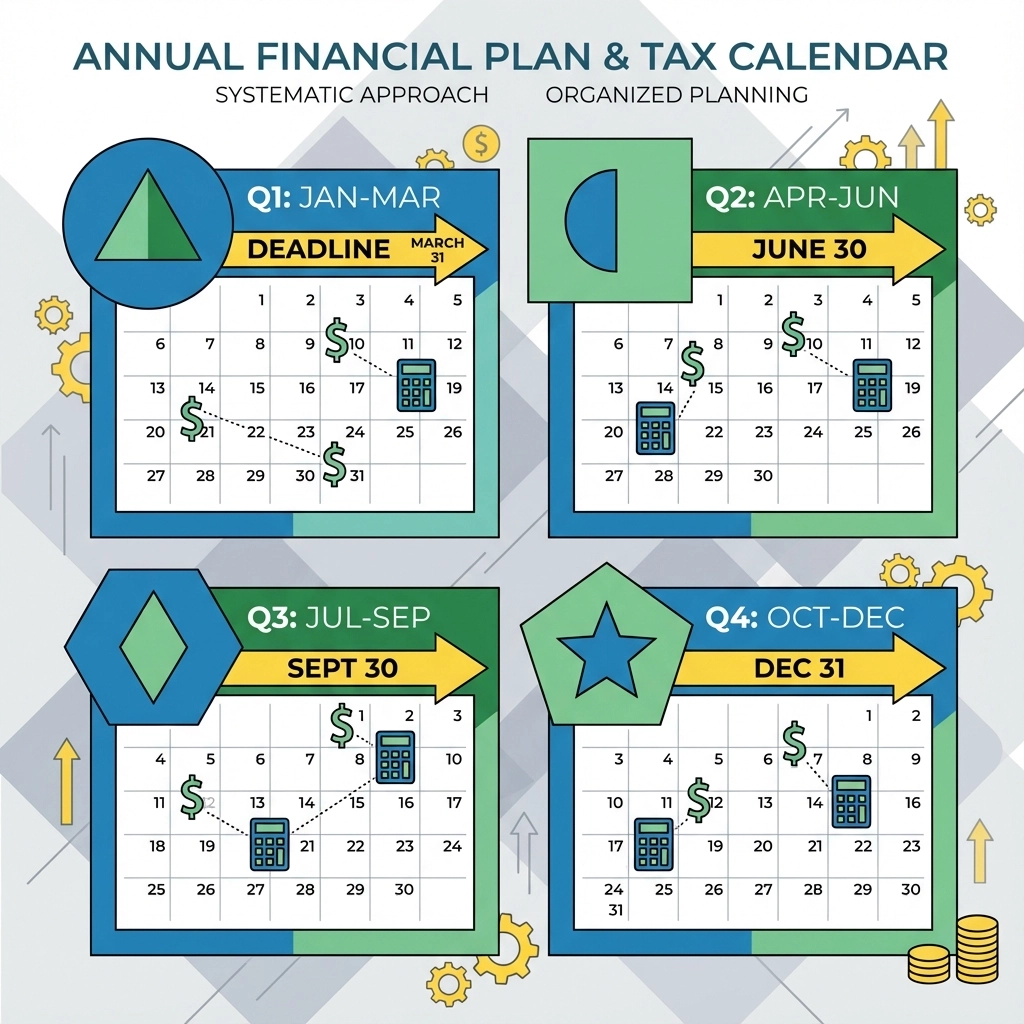

Mistake #2: Missing Estimated Quarterly Tax Payments

The Lesson Learned: Restaurant owner Carlos Rodriguez from East Haven discovered this mistake cost him $3,400 in penalties and interest during his first profitable year.

"Nobody told me about quarterly payments," Rodriguez recalls. "I thought I just paid taxes once a year like when I was an employee. When April came, I owed $18,000 plus penalties. The cash flow impact nearly shut down my restaurant."

Understanding Quarterly Payment Requirements:

Business owners who expect to owe $1,000 or more in taxes must make estimated quarterly payments by these deadlines:

- Quarter 1: January 15, 2026

- Quarter 2: April 15, 2026

- Quarter 3: June 15, 2026

- Quarter 4: September 15, 2026

Calculate Your Required Payments:

The IRS requires estimated payments equal to:

- 100% of last year's tax liability, OR

- 90% of current year's expected tax liability

Implementation Strategy:

- Set up automatic transfers – Calculate quarterly amounts and schedule automatic bank transfers to a tax savings account

- Use Form 1040ES – Download current year estimated tax forms from IRS.gov

- Track income fluctuations – Adjust quarterly payments if business income changes significantly

- Consider safe harbor rules – Pay 110% of prior year taxes if adjusted gross income exceeded $150,000

- Work with tax professionals – Consult Jose's Tax Service for accurate quarterly payment calculations

Mistake #3: Poor Record-Keeping and Bookkeeping Practices

The Reality Check: Manufacturing business owner Jennifer Kim from Hamden spent $8,000 reconstructing three years of financial records when faced with an IRS audit.

"I kept everything in shoe boxes and used basic Excel spreadsheets," Kim admits. "When the auditor requested documentation for specific deductions, I couldn't locate half the receipts. Some had faded completely. It was a nightmare that took months to resolve."

Consequences of Inadequate Record-Keeping:

- Lost deductions due to missing documentation

- Increased audit duration and associated costs

- Potential penalties for insufficient records

- Difficulty accessing business loans or credit

- Problems with accurate tax return preparation

Essential Record-Keeping Requirements:

The IRS requires businesses to maintain records supporting:

- Income sources and amounts

- Business expense deductions

- Asset purchases and depreciation

- Employment tax information

- Previous tax returns and supporting documents

Build a Proper Record-Keeping System:

- Implement accounting software – Choose cloud-based solutions like QuickBooks Online, Xero, or FreshBooks

- Digitize all receipts – Use mobile apps to photograph and store receipts immediately

- Maintain separate filing systems – Create organized physical and digital filing structures

- Schedule regular data entry – Process financial information weekly rather than annually

- Backup all records – Store copies in multiple locations including cloud storage services

Mistake #4: Overlooking Available Tax Deductions and Credits

The Missed Opportunity: Architect David Park from West Haven discovered he overlooked $7,200 in legitimate deductions over two tax years.

"I was only claiming obvious expenses like office rent and utilities," Park explains. "I had no idea about home office deductions, professional development costs, or equipment depreciation. My tax preparer found deductions I'd been missing for years."

Commonly Missed Business Deductions:

- Home office expenses – Dedicated workspace percentage of home costs

- Vehicle expenses – Business mileage or actual expense method

- Professional development – Training, conferences, and certification costs

- Business insurance premiums – Professional liability, general liability coverage

- Start-up costs – Business formation and initial operational expenses

- Equipment depreciation – Computer, machinery, and technology purchases

- Professional services – Legal, accounting, and consulting fees

Tax Credits vs. Deductions:

Understanding the difference saves money:

- Deductions reduce taxable income dollar-for-dollar

- Credits reduce tax liability dollar-for-dollar (more valuable)

Maximize Your Deductions:

- Track all business-related expenses – Document every expenditure with business purpose

- Review IRS Publication 535 – Study current business expense guidelines annually

- Calculate home office deductions – Measure dedicated workspace and calculate allowable percentage

- Document business meals – Record date, amount, business purpose, and attendees for all business dining

- Consult tax professionals – Schedule annual reviews to identify missed opportunities

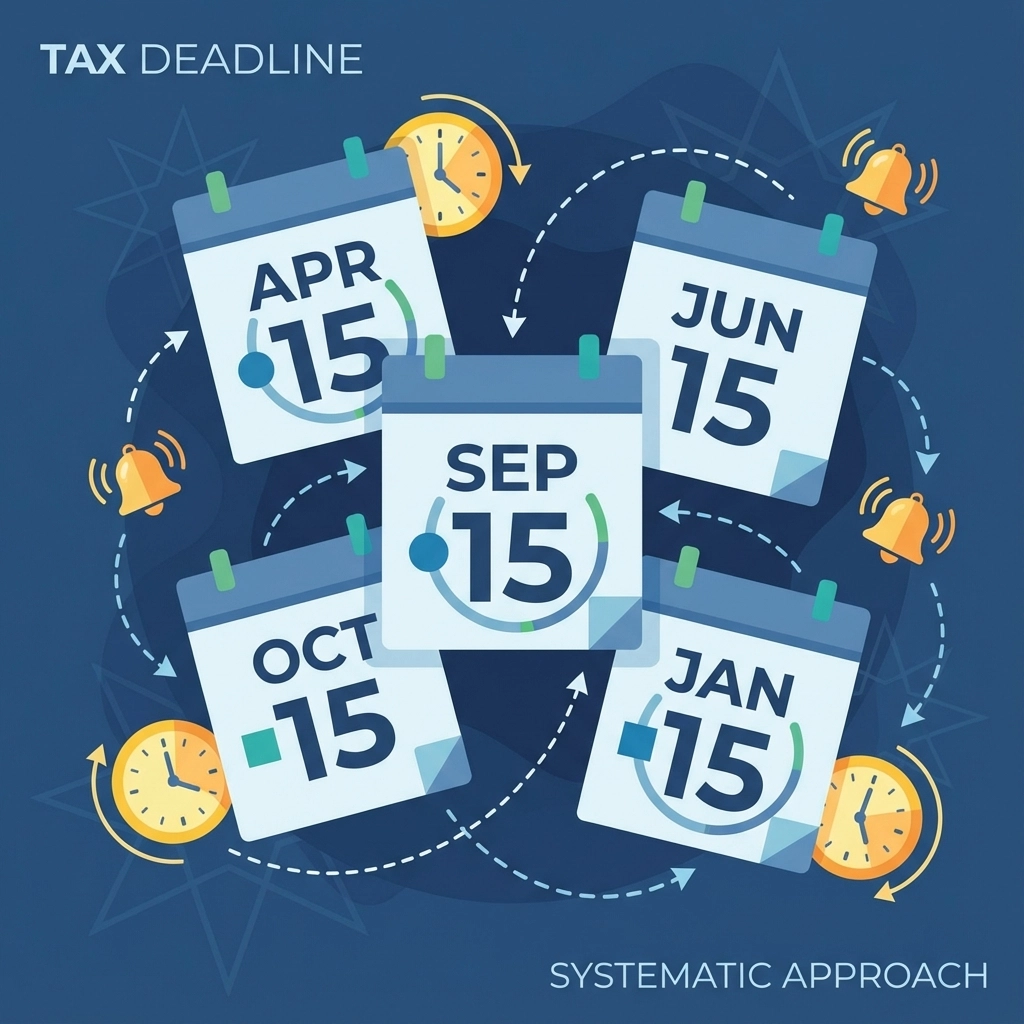

Mistake #5: Missing Critical Tax Deadlines

The Costly Oversight: Retail store owner Maria Santos from New Haven paid $2,100 in late filing penalties because she missed key business tax deadlines.

"I focused only on the April 15th personal deadline," Santos explains. "I didn't realize my S-Corp return was due March 15th, and I completely forgot about employment tax quarterly filings. The penalties added up quickly."

Critical Business Tax Deadlines for 2026:

Quarterly Employment Tax Returns (Form 941):

- Quarter 1: April 30, 2026

- Quarter 2: July 31, 2026

- Quarter 3: October 31, 2026

- Quarter 4: January 31, 2027

Annual Business Returns:

- Partnerships and S-Corps: March 15, 2026

- C-Corporations: April 15, 2026

- Sole Proprietorships: April 15, 2026 (with personal returns)

Extension Deadlines:

- Partnerships and S-Corps: September 15, 2026

- C-Corporations: October 15, 2026

Create a Deadline Management System:

- Use digital calendars – Set up automated reminders 30, 14, and 7 days before deadlines

- Prepare documents early – Gather required information at least 60 days before due dates

- File extensions when necessary – Submit extension requests before original deadlines

- Maintain deadline checklists – Create annual checklists covering all business tax obligations

- Schedule professional consultations – Meet with tax preparers quarterly to review upcoming requirements

Taking Action: Your Next Steps

These five mistakes cost New Haven business owners thousands of dollars annually, but each can be prevented with proper planning and implementation. The key is establishing systematic approaches rather than relying on last-minute preparations.

Immediate Action Items:

- Review your current practices – Evaluate which mistakes currently affect your business

- Implement separation procedures – Establish dedicated business financial accounts immediately

- Calculate quarterly payments – Determine 2026 estimated tax requirements

- Upgrade record-keeping systems – Choose and implement professional accounting software

- Schedule professional consultation – Contact Jose's Tax Service for comprehensive tax planning review

Professional Support Available:

Jose's Tax Service provides comprehensive tax planning services for New Haven area businesses, including quarterly payment calculations, deduction optimization, and deadline management systems. Our experienced team helps business owners avoid these costly mistakes while maximizing tax savings opportunities.

Contact our office today to schedule your 2026 tax planning consultation and ensure your business avoids these common pitfalls that have cost other New Haven entrepreneurs thousands in unnecessary penalties and missed deductions.

Tags: Business taxes, Joses Tax service, New Haven Tax Preparation, New Haven tax preparer, Refund, Self-employed, Smart vault, Tax advisor, Tax Audit, Tax help, Tax planning, Year-End Tax Planning

Leave a Reply

You must be logged in to post a comment.