Do You Really Need Year-Round Tax Planning? Here's What Small Business Owners Should Know

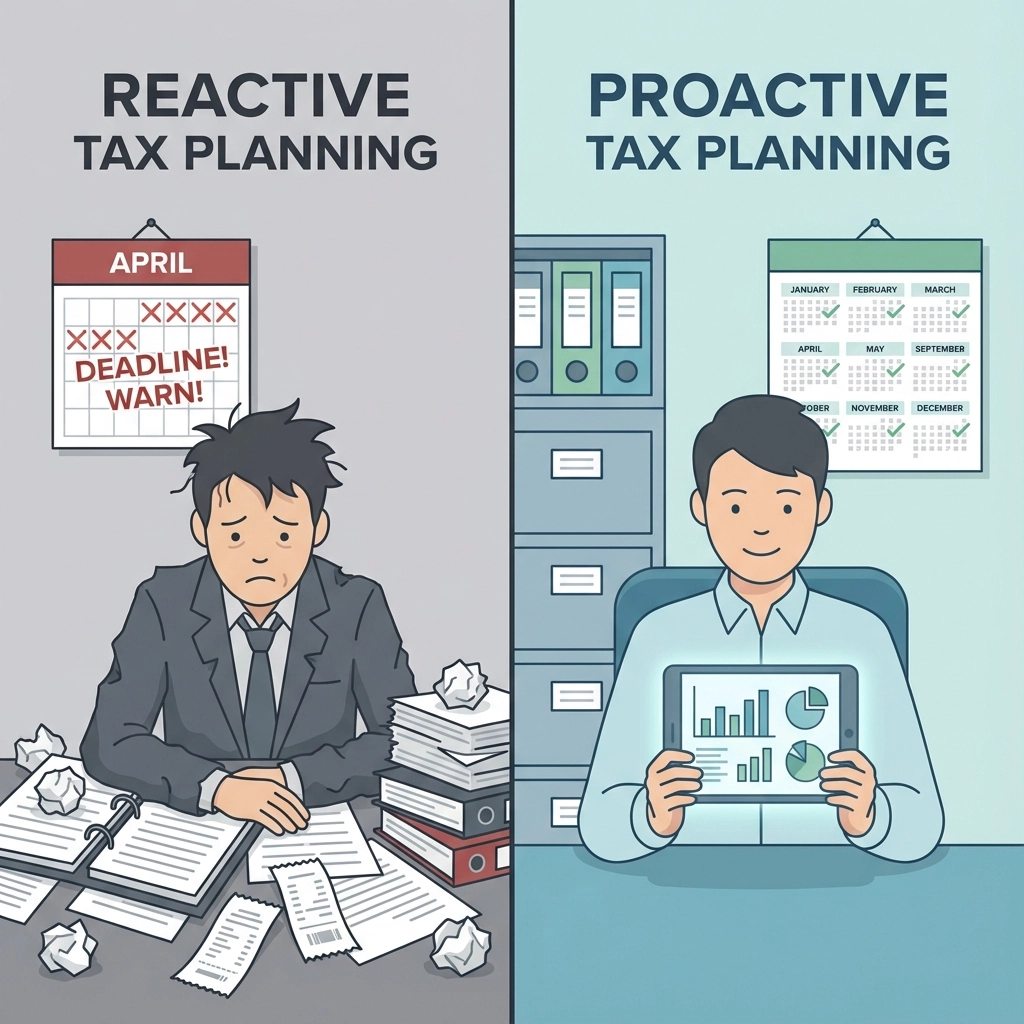

Year-round tax planning isn't just recommended for small business owners, it's absolutely essential. Most businesses treat taxes as an annual chore, scrambling through receipts and documents each April. This reactive approach costs money, creates stress, and leaves significant opportunities on the table.

Smart business owners understand that taxes impact every financial decision throughout the year. From equipment purchases to retirement contributions, each choice carries tax implications that can either boost or drain your bottom line.

The Financial Impact: Numbers Don't Lie!

Year-round tax planning delivers measurable results that directly impact your business's profitability. Consider these facts:

- Only 5-7% of top business managers rely solely on year-end tax strategies

- Businesses using quarterly planning reduce tax liability by an average of 15-25%

- Proactive planning eliminates surprise tax bills that disrupt cash flow

- Organized records reduce tax preparation costs by 30-40%

The difference between reactive and proactive tax management often determines whether small businesses thrive or merely survive. Strategic planning transforms tax obligations from annual burdens into competitive advantages.

Critical Benefits You Cannot Ignore!

Minimize Tax Liability Through Strategic Actions

Year-round planning provides multiple opportunities to reduce your tax burden legally and effectively. Regular financial reviews reveal deductions and credits that disappear if not claimed before year-end.

Key strategies include:

- Contributing to retirement plans to reduce taxable income

- Timing equipment purchases for maximum deduction benefits

- Claiming energy-efficient equipment tax credits

- Strategically planning business expenses throughout the year

Eliminate Devastating Financial Surprises

Quarterly tax projections prevent unexpected bills that can cripple small businesses. Regular monitoring provides advance notice of tax obligations, allowing proper budgeting and cash flow management.

Without year-round planning, businesses face:

- Unexpected tax bills disrupting operations

- Last-minute scrambling for payment funds

- Missed opportunities for tax-advantaged investments

- Penalties and interest on underpayment

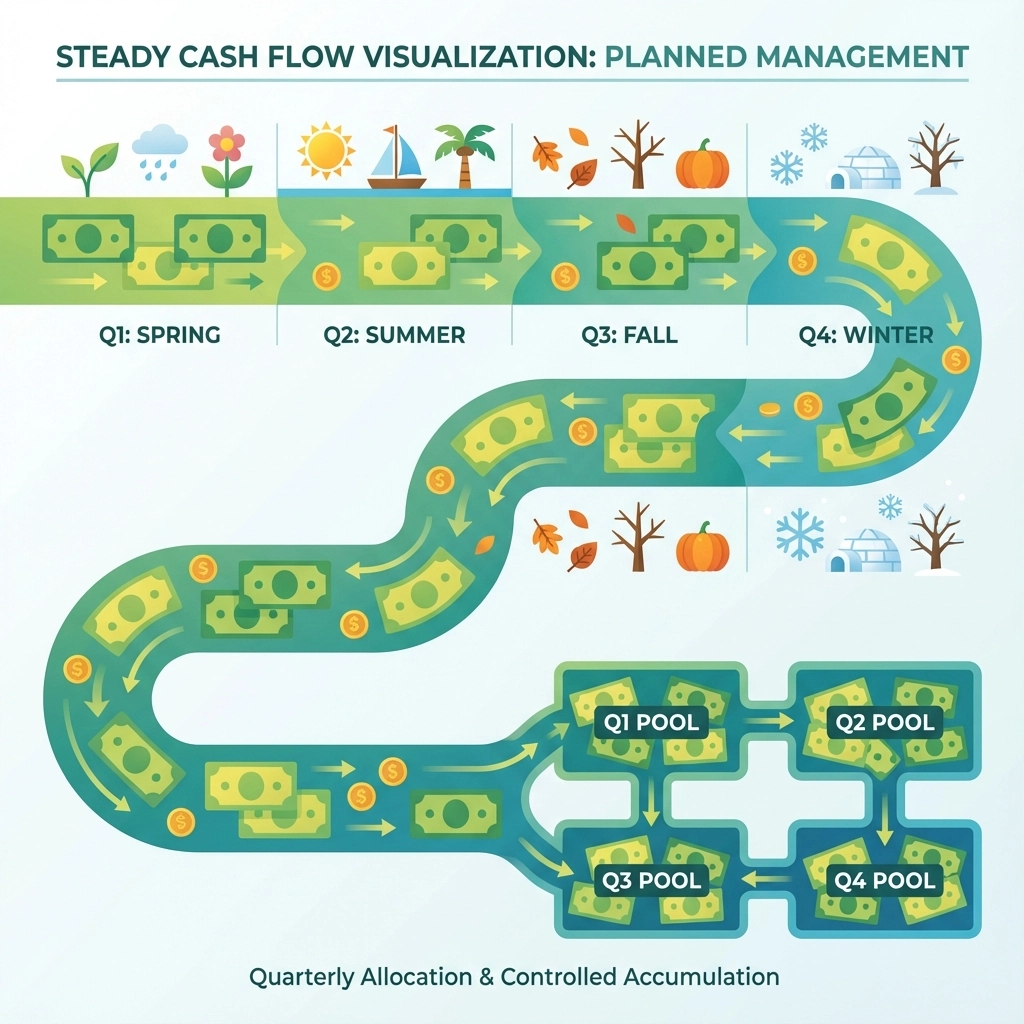

Optimize Cash Flow Management

Strategic tax planning improves cash flow by spreading tax obligations throughout the year. Instead of facing large lump-sum payments, businesses can:

- Create dedicated tax reserve accounts

- Allocate revenue portions specifically for tax obligations

- Make quarterly estimated payments to avoid penalties

- Plan major expenses around tax implications

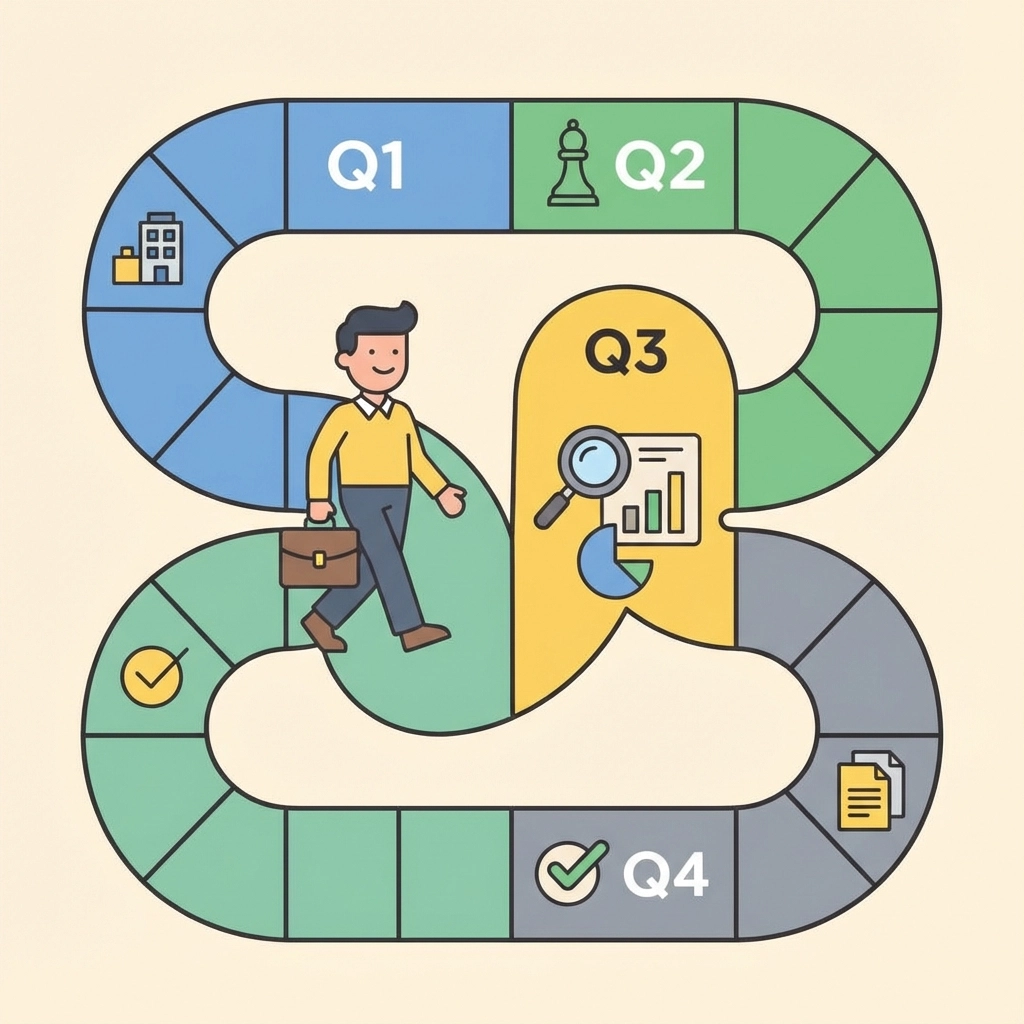

Implementation Strategy: Your Quarterly Action Plan!

Quarter 1: Foundation and Review

January-March Actions:

- Review previous year's tax return with your CPA

- Identify missed deductions and planning opportunities

- Confirm business entity structure meets current needs

- Implement expense tracking systems

- Set up organized record-keeping procedures

Critical Tasks:

- Install accounting software with expense categorization

- Create digital filing systems for receipts and documents

- Schedule quarterly CPA meetings for the entire year

- Establish automatic transfers to tax reserve accounts

Quarter 2: Strategic Planning and Adjustments

April-June Focus:

- Analyze first-quarter financial performance

- Project annual income and tax liability

- Review estimated tax payment requirements

- Plan major purchases for optimal tax timing

Key Decisions:

- Equipment purchases and depreciation strategies

- Business expansion plans and tax implications

- Employee benefit programs and tax advantages

- Retirement plan contributions and timing

Quarter 3: Mid-Year Strategy Assessment

July-September Priorities:

- Conduct comprehensive tax projection analysis

- Adjust quarterly estimated payments if necessary

- Review benefit package tax efficiency

- Plan year-end transactions and purchases

Strategic Reviews:

- Compare actual versus projected income

- Assess deduction opportunities still available

- Evaluate business structure effectiveness

- Plan fourth-quarter tax-saving activities

Quarter 4: Execution and Preparation

October-December Actions:

- Execute planned tax-saving strategies

- Make final equipment purchases before year-end

- Maximize retirement plan contributions

- Organize documents for tax preparation

Record-Keeping Requirements: Stay Organized!

Effective year-round tax planning requires systematic record-keeping. Implement these organizational systems:

Digital Documentation:

- Scan and categorize all business receipts

- Maintain separate folders for different expense categories

- Back up financial data regularly

- Use cloud storage for accessibility

Monthly Reconciliation:

- Review bank statements and credit card transactions

- Categorize expenses accurately

- Track mileage and travel expenses

- Document business meals and entertainment

Quarterly Reviews:

- Calculate estimated tax payments

- Review profit and loss statements

- Assess cash flow projections

- Update financial forecasts

Common Mistakes That Cost Money!

Avoid these costly errors that drain profits:

- Waiting Until Year-End: Last-minute planning limits available strategies

- Poor Record-Keeping: Disorganized records result in missed deductions

- Ignoring Quarterly Payments: Underpayment penalties add unnecessary costs

- DIY Complex Planning: Professional guidance prevents expensive mistakes

- Mixing Personal and Business Expenses: Complicates deductions and audits

Professional Support: When to Call the Experts!

Year-round tax planning requires professional expertise in these situations:

Business Structure Changes:

- Converting from sole proprietorship to corporation

- Adding partners or investors

- Expanding to multiple states

- Selling or acquiring business assets

Complex Transactions:

- Major equipment purchases

- Real estate investments

- Employee stock option plans

- International business activities

Compliance Requirements:

- Payroll tax obligations

- Sales tax in multiple jurisdictions

- Industry-specific regulations

- Audit representation needs

Technology Tools for Success!

Modern tax planning requires efficient technology solutions:

Accounting Software:

- QuickBooks for comprehensive financial management

- FreshBooks for time tracking and invoicing

- Wave for basic bookkeeping needs

- Xero for advanced reporting capabilities

Expense Tracking:

- Receipt scanning applications

- Mileage tracking software

- Credit card integration tools

- Bank account synchronization

Tax Preparation:

- Professional tax software integration

- Document management systems

- Electronic filing capabilities

- Audit trail maintenance

The Cost of Inaction: What You're Losing!

Small businesses that avoid year-round tax planning face significant financial consequences:

- Overpayment of taxes due to missed deductions

- Cash flow problems from unexpected tax bills

- Penalties and interest on underpaid estimates

- Audit risks from poor documentation

- Lost opportunities for tax-advantaged investments

The average small business overpays taxes by 15-20% annually through inadequate planning. For a business earning $200,000, this represents $30,000-$40,000 in unnecessary tax payments each year.

Take Action Now!

Year-round tax planning isn't optional: it's essential for small business success. The question isn't whether you need ongoing tax management, but whether you can afford to operate without it.

Start implementing quarterly planning procedures immediately. Schedule regular meetings with your tax professional. Create organized record-keeping systems. Establish tax reserve accounts for smooth cash flow management.

Your business deserves every legal advantage available. Year-round tax planning provides the strategic framework necessary for sustained growth and financial success. The time to begin is now: not next tax season.

For professional guidance tailored to your specific business needs, contact Jose's Tax Service today. Our experienced team provides year-round support to maximize your tax savings and minimize compliance risks.

Tags: Business taxes, Joses Tax service, New Haven Tax Preparation, New Haven tax preparer, Refund, Self-employed, Tax advisor, Tax Audit, Tax help, Tax planning, Year-End Tax Planning

Leave a Reply

You must be logged in to post a comment.