Virtual Tax Prep vs. In-Person Service: Which Is Better For Your New Haven Business?

New Haven business owners face a critical decision each tax season: choose virtual tax preparation services or stick with traditional in-person consultations. This choice directly impacts your filing accuracy, costs, and valuable time during your busiest operational periods.

The tax preparation landscape in New Haven has evolved dramatically. Local providers now offer both virtual and in-person services, creating options that didn't exist five years ago. Your decision affects not only this year's filing but establishes your long-term tax strategy approach.

Virtual Tax Preparation: The Digital Advantage

Virtual tax preparation transforms how New Haven businesses handle their annual obligations. Services like TurboTax Expert and H&R Block now provide comprehensive online consultations where certified professionals manage your entire filing process remotely.

Core Benefits for Business Operations:

- Schedule Control: File from your office during off-peak hours without disrupting daily operations

- Document Security: Upload sensitive financial records through encrypted portals rather than transporting physical files

- Year-Round Access: Most virtual providers offer ongoing consultation access at no additional cost

- Time Efficiency: Complete complex business returns in as little as one hour through streamlined digital processes

Technology Requirements You Must Meet:

Your business needs reliable high-speed internet and updated computer systems. Ensure your devices support current browser versions and maintain active antivirus protection. Establish secure file storage for digital document uploads before your appointment.

Cost Considerations:

Virtual services often match or undercut in-person pricing. New Haven businesses with annual revenues under $67,000 may qualify for free virtual preparation through programs like SimplifyCT and VITA services. These programs provide IRS-certified volunteers who handle your filing electronically.

Potential Limitations:

Virtual consultations require strong communication skills from both parties. Complex partnership agreements, multi-state operations, or significant asset transactions may need extensive discussion that proves challenging through video calls. Technical issues during peak filing season can delay your submission.

In-Person Tax Services: Traditional Reliability

In-person tax preparation maintains its value for New Haven businesses requiring detailed consultation and document review. Local offices like TurboTax's 157 Church Street location provide face-to-face meetings where professionals examine your complete financial picture.

Direct Consultation Advantages:

- Comprehensive Document Review: Tax professionals physically examine receipts, contracts, and financial statements for accuracy

- Immediate Clarification: Ask questions and receive instant answers about deductions, credits, and compliance requirements

- Relationship Building: Establish ongoing partnerships with local professionals who understand New Haven's business environment

- Complex Situation Handling: Navigate intricate scenarios like business structure changes, significant equipment purchases, or employee benefit modifications

Service Accessibility in New Haven:

Multiple in-person options serve local businesses. Paramount Tax Services offers both remote and office consultations at their Meriden location. H&R Block provides walk-in services during extended hours throughout filing season. VITA sites operate at community locations for qualifying small businesses.

Professional Accountability:

In-person meetings create direct accountability between you and your tax preparer. Physical signatures on documents and immediate receipt of completed forms provide tangible confirmation of service completion.

Scheduling Constraints:

In-person appointments require coordination with provider business hours. During peak season (January through April), popular time slots fill quickly. Travel time to and from appointments reduces your available business hours.

Critical Comparison Factors

Document Management:

Virtual services require organized digital record-keeping. Scan receipts, bank statements, and expense reports into searchable formats before your consultation. In-person services accommodate physical documentation but may require multiple trips if documents are incomplete.

Communication Preferences:

Evaluate your comfort level with technology-mediated discussions about sensitive financial information. Some business owners prefer face-to-face explanations of complex tax strategies, while others value the convenience of remote consultations.

Compliance Accuracy:

Both service types must meet identical IRS standards. Virtual providers use the same tax software and follow identical verification procedures as in-person offices. Your choice affects service delivery, not compliance quality.

Emergency Support:

Consider what happens if problems arise after filing. Virtual services typically provide online chat or phone support for post-filing questions. In-person providers may offer walk-in consultation for urgent issues during business hours.

Business-Specific Recommendations

Choose Virtual Tax Preparation If Your Business:

- Maintains Digital Records: Your accounting system generates electronic reports and you store receipts digitally

- Operates Flexible Hours: Your schedule allows video consultations during standard business hours

- Has Straightforward Returns: Single-entity businesses with standard deductions and credits

- Values Efficiency: Time savings outweigh personal interaction preferences

- Needs Year-Round Support: Benefit from ongoing access to tax professionals for quarterly payments and planning

Select In-Person Services If Your Business:

- Handles Complex Transactions: Multiple revenue streams, significant asset purchases, or partnership changes require detailed discussion

- Prefers Physical Documentation: Maintain paper records and receipts that are easier to review together

- Benefits from Local Knowledge: New Haven-specific regulations, local business incentives, or municipal tax considerations

- Requires Detailed Explanations: Complex deductions or credits need thorough explanation and strategy discussion

- Values Relationship Continuity: Long-term planning benefits from consistent, personal relationships with local professionals

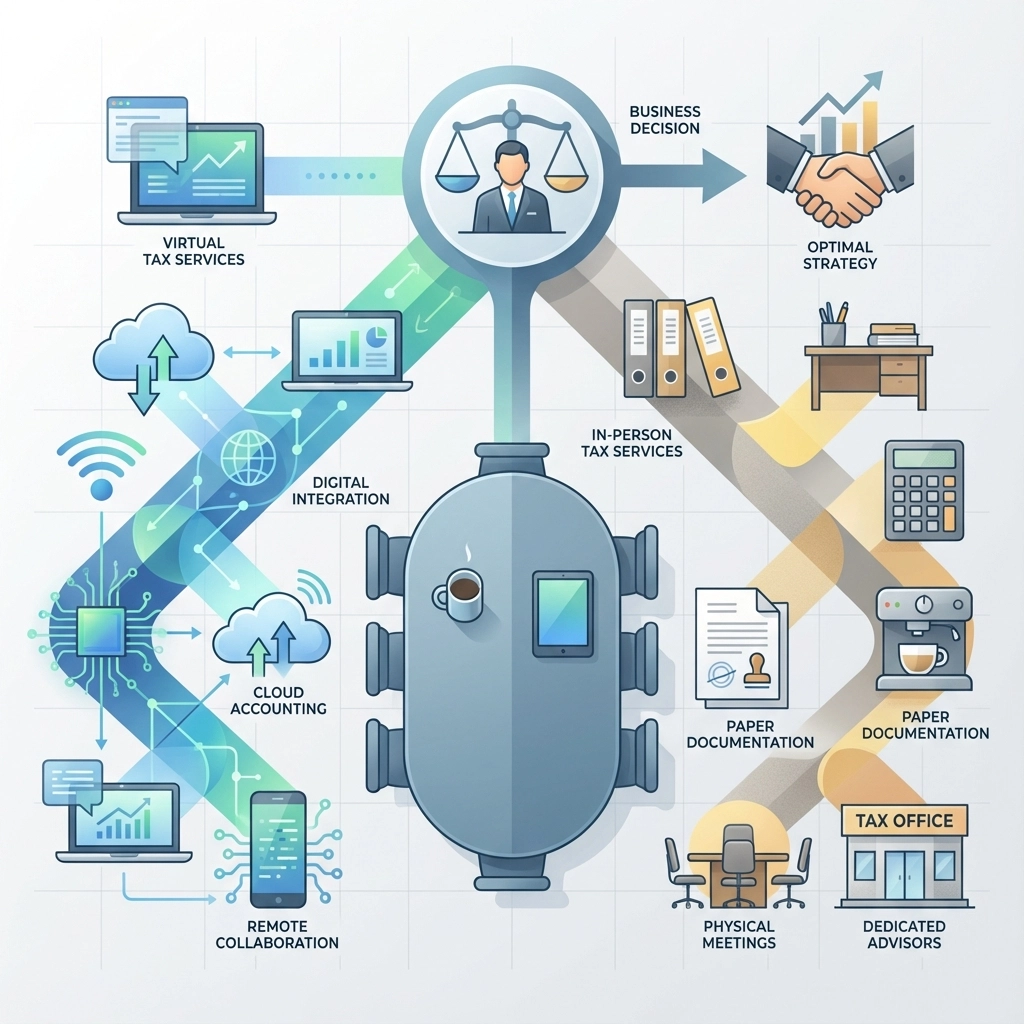

Consider Hybrid Approaches:

Many New Haven businesses successfully combine both methods. Use virtual services for routine annual filings while scheduling in-person consultations for major business changes, tax planning sessions, or when facing IRS inquiries.

Implementation Steps for Your Decision

For Virtual Tax Preparation:

- Evaluate Technology Setup: Test your internet speed, video calling capability, and document scanning equipment

- Organize Digital Files: Create secure folders for all tax-related documents before your appointment

- Research Provider Options: Compare local virtual services, reading reviews and verifying credentials

- Schedule Early: Book appointments before peak season to ensure availability

- Prepare Backup Plans: Identify in-person alternatives if technical issues arise

For In-Person Services:

- Contact Local Offices: Call New Haven providers to understand their appointment availability and requirements

- Organize Physical Documents: Gather all receipts, statements, and forms in clearly labeled folders

- Prepare Question Lists: Write down specific concerns or planning questions for your consultation

- Confirm Appointment Details: Verify location, required documents, and estimated completion time

- Plan for Multiple Visits: Complex returns may require follow-up appointments

Making Your Final Choice

Your business type, operational style, and personal preferences determine the optimal tax preparation method. New Haven's competitive market provides quality options for both approaches, ensuring professional service regardless of your choice.

Evaluate your current record-keeping systems, available time during tax season, and comfort with technology-based services. Consider starting with your preferred method this year while remaining open to switching if your business needs change.

Most importantly, choose a provider offering the service level your business requires, whether virtual or in-person. Professional competence and reliable service matter more than delivery method for successful tax preparation outcomes.

Tags: Business taxes, Joses Tax service, New Haven Tax Preparation, New Haven tax preparer, Refund, Self-employed, Tax advisor, Tax Audit, Tax help, Tax planning, Year-End Tax Planning

Leave a Reply

You must be logged in to post a comment.